As of Feb 13, 2026, Bitcoin price movement is navigating a cautious phase as recent statistics indicate a persistent pattern of institutional outflows and shifting on-chain activity. This data is leading to new analytical discussions regarding the stability of the market in the near-term.

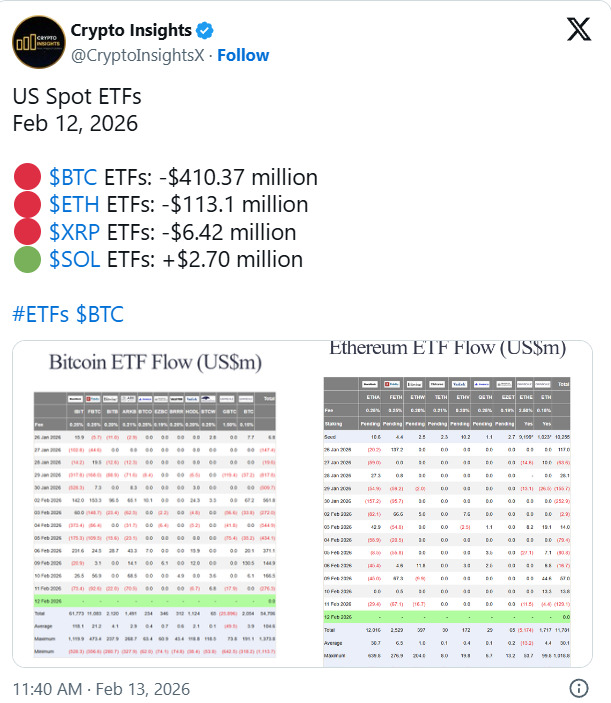

Source: @CryptoInsightsX Post

A recent report by Crypto Insights indicated that U.S. spot Bitcoin ETFs recorded net outflows of $410.37 million. This price action represents the continuation of a larger trend of risk reduction among major digital asset funds. Similarly, Ethereum ETFs registered outflows of $113.1 million, while XRP experienced smaller outflows of $6.42 million. Solana was a notable exception to this trend, registering a small inflow of $2.7 million, diverging from the overall market sentiment.

These figures come only a day after the combined Bitcoin and Ethereum ETF withdrawals reached approximately $404 million. These metrics suggest that institutional caution remains a factor, despite the optimism witnessed at the beginning of 2026.

Bitcoin Price Performance Aligns With ETF Pressure

This secondary wave of ETF redemptions has coincided with Bitcoin testing levels below the $66,000 mark, a move that has recalibrated market sentiment. The current price action indicates a de-risking environment, with participants re-evaluating exposure in the face of macro uncertainty and tightening liquidity conditions.

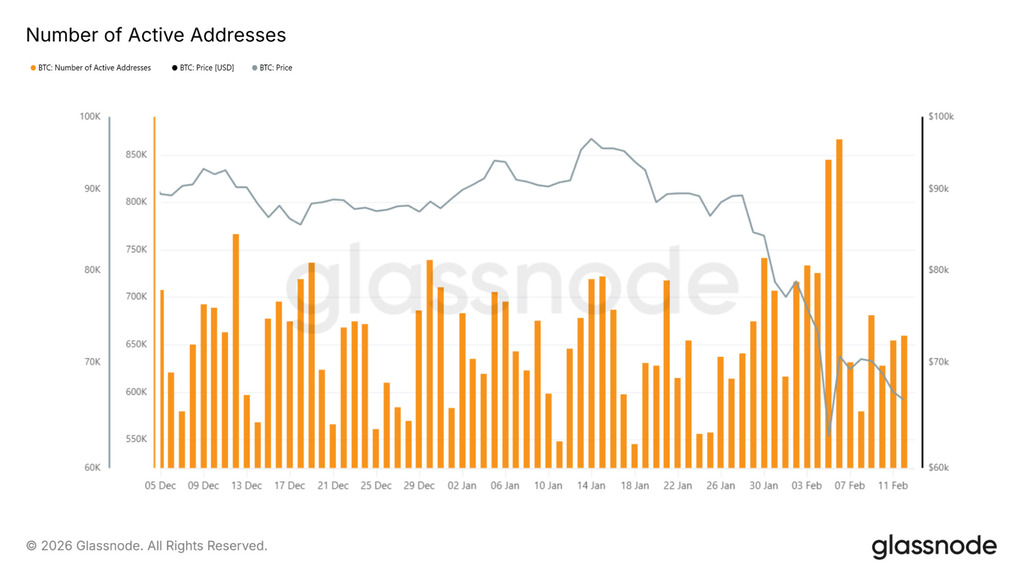

Source: Bitcoin Price Chart, Glassnode

ETF flows have become a key sentiment indicator for Bitcoin market observers. Sustained outflows of this magnitude are typically an indication of hesitancy among larger market participants, as opposed to standard retail-related volatility.

On-Chain Data Signals Cooling Network Demand

Adding to the analytical view, Glassnode on-chain data highlights a specific change in the activity of the Bitcoin network. Active addresses have surged in recent sessions even as prices faced downward pressure.

In past cycles, active address spikes during price declines have often served as evidence of distribution phases. In these scenarios, transaction activity increases due to selling pressure rather than organic demand growth. This divergence between network usage and price performance suggests that the market is currently searching for a sustainable support level.

As the Glassnode metrics illustrate, an imbalance is apparent: the number of active addresses is increasing while the BTC price remains in the mid-$60,000 range.

Market Rotation and Emerging Utility Narratives

While Bitcoin and Ethereum ETFs continue to see capital redemptions, the minor but significant inflow into Solana suggests that a form of capital rotation is taking place, rather than a total exit from the digital asset market.

Historically, BTC consolidation phases stimulate participants to consider other segments, especially those with an explicit utility narrative or lower correlation to Bitcoin’s price swings.

In this context, some market participants have begun to monitor utility-related tokens like Minotaurus (MTAUR) as an extension of their diversification strategies. In contrast to purely speculative assets, MTAUR is tied to a blockchain-based gaming ecosystem where the token is utilized for in-game features, upgrades, and access to digital items. The project has attracted technical interest due to its systematic distribution, third-party auditing, and community development. While in an early stage, such utility-driven models are increasingly discussed during phases when Bitcoin dominance fluctuates and capital seeks asymmetric exposure.

Key Indicators to Watch Next

For Bitcoin, the primary question is whether the price can maintain its current support levels or if additional ETF outflows will drive BTC toward lower technical support areas. On-chain activity, ETF flow direction, and overall risk sentiment will continue to be the most important indicators in the coming days.

Unless institutional flows reverse, the narrative for Bitcoin will likely be characterized by volatility and defensive positioning, establishing the conditions for further consolidation and selective rotation within the crypto market. In this environment, utility-focused projects like Minotaurus (MTAUR) remain part of the broader discussion on portfolio diversification.

For now, market participants appear focused on capital preservation, positioning selectively and waiting for a clearer confirmation of a positive market shift.

The information presented in this article is for informational purposes only and should not be construed as investment advice. Crypto Economy is not affiliated with the project. The cryptocurrency market is highly volatile and can involve significant risks. We recommend that you conduct your own analysis.