TL;DR

- Bitcoin’s hashrate surpassed 750 EH/s, driven by increased investment in infrastructure and security.

- Active miners now exceed 4.8 million, strengthening network stability but also increasing mining difficulty.

- BTC futures open interest reached $25 billion, with a possible rise above $30 billion, which could drive the price higher.

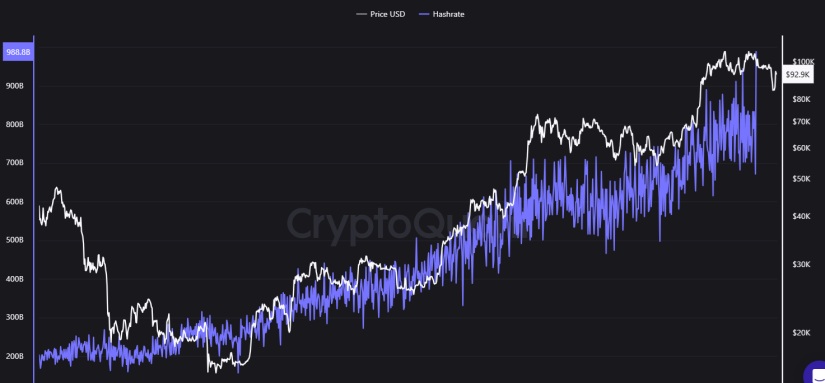

Bitcoin has reached a new record in mining power, boosting institutional interest and market stability. The network’s computational capacity surpassed 750 exahashes per second, a remarkable increase from the 100 EH/s recorded in 2020.

The highest levels are approaching 1,000 EH/s, indicating continuous investment in infrastructure and greater security in transaction validation. At the same time, this increase is linked to the expansion of active miners, which now exceed 4.8 million—almost triple the number recorded in 2018.

The growth of mining activity has strengthened ecosystem stability but has also increased mining difficulty. In 2022, the drop in hashrate to 600 EH/s coincided with a Bitcoin price correction to $20,000. However, the sector’s recovery reignited activity, reinforcing a trend that has accompanied BTC’s bullish cycles. A sustained increase in the number of miners could maintain network security and price stability, though it would also require greater energy and operational resources.

A New Bullish Cycle for Bitcoin?

Institutional interest has followed a similar pattern to mining. Open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) reached $25 billion, surpassing $20 billion in 2021 and $15 billion in 2023. The relationship between contract volume and market behavior has been evident in past cycles, where increases in institutional investment preceded price surges and adjustments during uncertain periods. If open interest continues growing and exceeds $30 billion, BTC’s price could maintain its upward trajectory.

With the current price at $93,000, the market’s evolution will depend on factors such as hardware availability, energy costs, and regulation. If hashrate remains stable and the number of miners continues to grow, Bitcoin could reach new highs. In contrast, a decline in mining investment or a drop in open interest could trigger a correction to previous levels