TL;DR

- Cantor Fitzgerald raised IREN’s price target from $49 to $100, implying a potential upside of 56% from the previous close near $64.14.

- IREN has shifted its business focus to AI Cloud Services, leveraging its data center and energy infrastructure to provide GPU-based computing capacity.

- Analyst Brett Knoblauch notes that the company is trading at a roughly 75% discount compared with its “neocloud” peers.

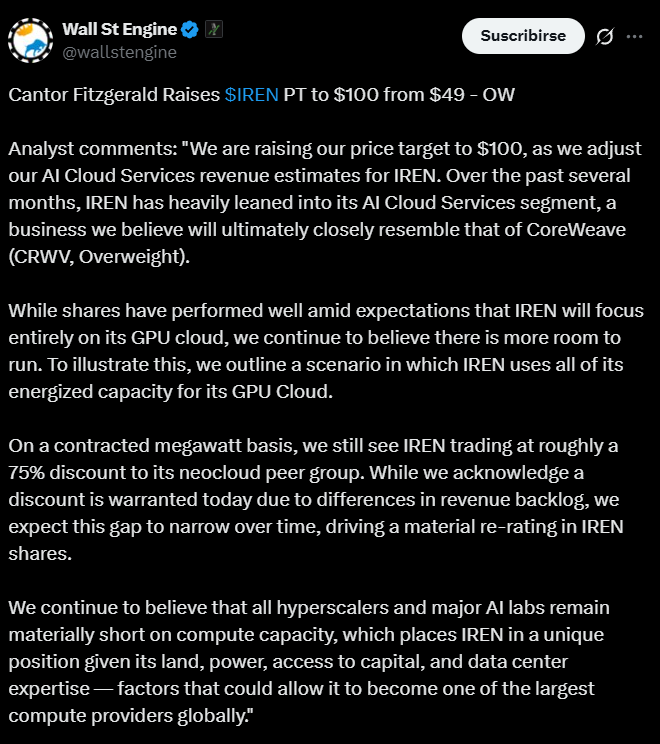

Cantor Fitzgerald raised IREN’s price target from $49 to $100, representing a potential upside of 56% from the previous close around $64.14.

The firm justifies the revision by citing the expansion of IREN’s AI Cloud Services segment, which has become the company’s main business focus. Previously centered on Bitcoin mining, now has redirected much of its energy infrastructure and data centers to provide GPU-based computing capacity.

In recent months, IREN has strengthened its AI Cloud Services division, turning it into a business line comparable to CoreWeave, one of the sector’s leading players. The analyst noted that the shares have performed exceptionally well, fueled by expectations that the company will dedicate all its energy capacity to the cloud, but he believes there is still room for further gains.

IREN Trades at a Roughly 75% Discount

Brett Knoblauch observed that, measured on a contracted megawatt basis, IREN trades at an approximate 75% discount compared with its “neocloud” peers. While he acknowledged that this discount is reasonable given differences in revenue backlog, he expects the gap to narrow over time. As that distance closes, he anticipates a significant revaluation in the market.

Knoblauch also highlighted that the company benefits from a market in which major cloud providers and AI labs face a shortage of computing capacity. According to Cantor, The company has structural advantages — access to land, energy, capital, and operational expertise — that could position it as one of the world’s leading providers of AI infrastructure.

IREN has risen more than 500% in 2025, after starting the year just above $10. In premarket trading, the shares were slightly higher at $64.50. Cantor maintains its buy rating and expects further revaluation in the medium term