TL;DR

- Bitcoin hit a record high of $111,800 driven by spot purchases, but it suffers from selling pressure as holders take profits.

- Key support holds at $103,700, with a risk of breaking if there’s not enough demand to absorb recent selling.

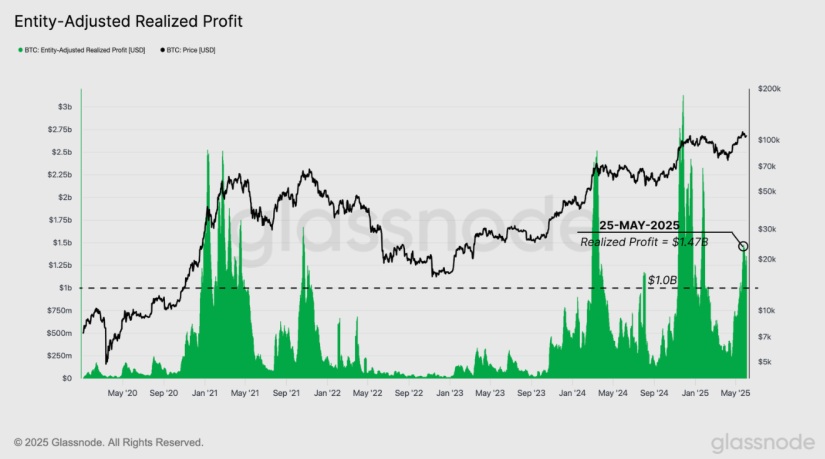

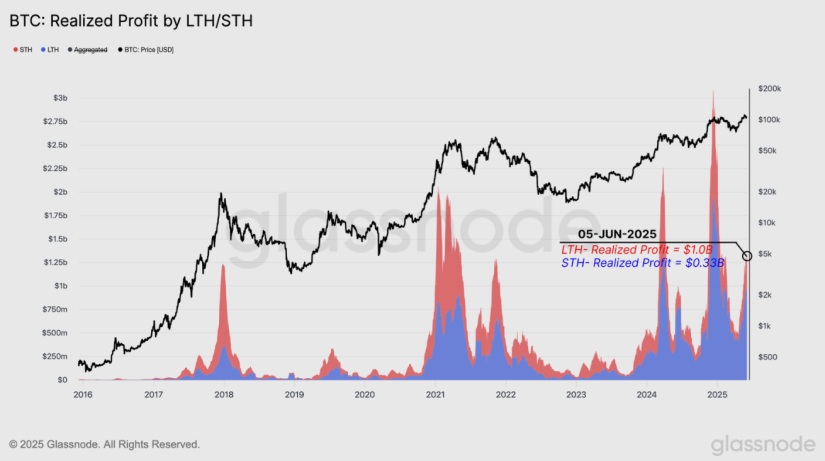

- Daily realized gains reached $1.47 billion, mainly from holders with over a year of tenure who have started to unwind their positions.

Bitcoin recently reached a new all-time high of $111,800, pushed up by a series of spot market purchases that lifted its price from accumulation zones between $81,000 and $104,000.

Bitcoin Shows Signs of Fatigue

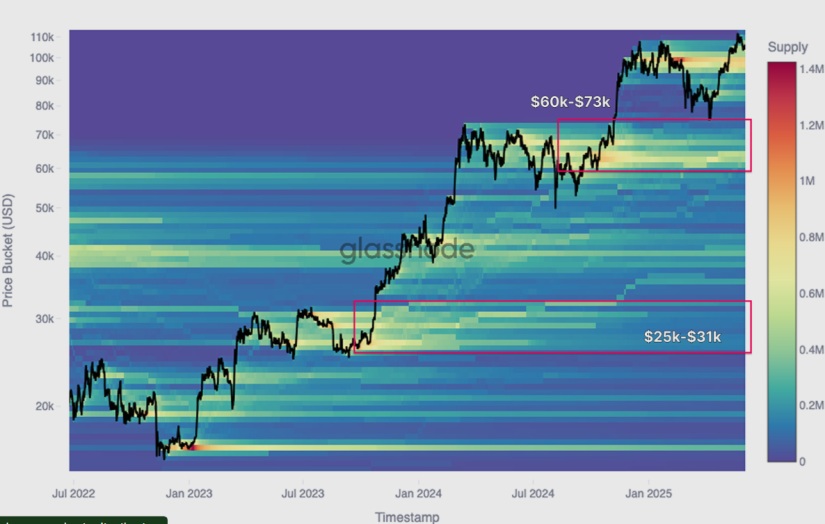

After this surge, the market began to show signs of fatigue. Selling by holders who bought between $25,000 and $73,000 triggered a correction, bringing the price down to stabilize around $104,200.

On-chain data confirms that accumulation zones from previous cycles, once strongholds against declines, have turned into active selling levels. Most of the pressure on Bitcoin comes from investors who bought early in this bull cycle and are now taking profits, which weakens the market’s ability to support further gains.

Price behavior models now identify three key technical levels. Immediate support sits at $103,700, followed by a base at $95,600. If these fail, the market could temporarily lose its bullish structure. On the upside, resistance lies near $114,800, a level that can only be broken if demand rises enough to absorb recent selling pressure.

Holders Are Taking Profits

The average acquisition cost for short-term holders remains at $97,100. This serves as a benchmark to gauge speculative appetite. Volatility levels based on this indicator show that a drop below $83,200 would trigger a higher-risk bearish environment.

Another important data point is the volume of realized gains, which reached $1.47 billion daily last week. Most of this came from investors holding for over a year, indicating that those who accumulated early in the cycle are beginning to unwind. This group accounted for more than three times the gains realized by short-term holders in the same period.

Bitcoin’s market now faces a critical phase. Maintaining current levels and absorbing supply will depend on demand strength in the coming weeks. Without a fresh wave of buyers, this scenario could set a local top and lead to a longer consolidation phase