TL;DR

- The Bitcoin market has reached an equilibrium, with a decrease in capital flow and in profit and loss-taking activities.

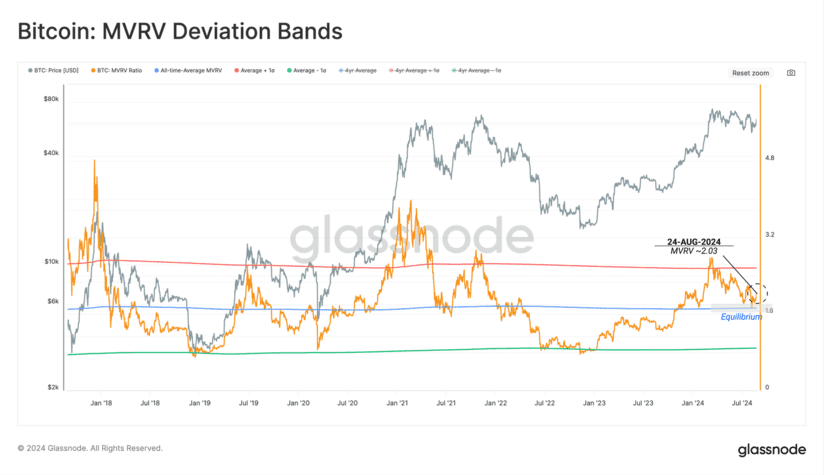

- The MVRV Ratio has returned to its historical average of 1.72, indicating an equilibrium in investor profitability.

- The Sell-Side Risk Ratio has dropped to low levels, suggesting a preparation for increased volatility.

The Bitcoin market has achieved a state of equilibrium, evidenced by a reduction in net capital flow and a decrease in profit and loss-taking activities. The calm in the market, characterized by a cooling off of speculation and a reset of volatility, might be indicating a transition phase towards increased activity in the near future.

In recent months, capital flow into Bitcoin has shown a significant slowdown. It seems that the market has found a balance between investors looking to realize gains and those accepting losses. This phenomenon is uncommon and typically precedes an increase in volatility. Historically, similar periods of inactivity have led to sharp price movements.

The MVRV Ratio (Market Value to Realized Value) has returned to its historical average of 1.72, a critical level that often marks a transition between bullish and bearish market trends. Approximately 51% of trading days have an MVRV value above the average, indicating that investor profitability has returned to an equilibrium state following the post-ETF launch enthusiasm.

Additionally, the percentage of supply in profit has returned to its historical average. This behavior is comparable to levels observed in late 2016, in 2019, and during the 2021 sell-off, as Bitcoin supply is reaching a global equilibrium in terms of profitability.

Is Bitcoin Preparing for High Volatility?

The Sell-Side Risk Ratio, which measures market equilibrium, has fallen to low levels. This indicates that most coins are being spent close to their original acquisition price, which generally precedes a new regime of higher volatility. In terms of short-term stress, the net realized profit has decreased to $15 million per day, significantly below the $3.6 billion per day observed during the $73,000 ATH in March. This adjustment is typical at market inflection points.

Moreover, Bitcoin supply in the 3 to 6-month age band represents over 12.5% of the circulating supply. This pattern is similar to the one observed during the 2021 decline and the peak of the 2018 bear market, and suggests that these BTC are close to migrating to a Long-Term Holders (LTH) category.

Finally, the perpetual swap market has shown a decline in speculative activity, with a drop in liquidation volumes and a decreased willingness to take on high risks. This is consistent with a reset in speculative interest across the entire digital asset ecosystem, with spot markets gaining predominance in the short term.