TLDR

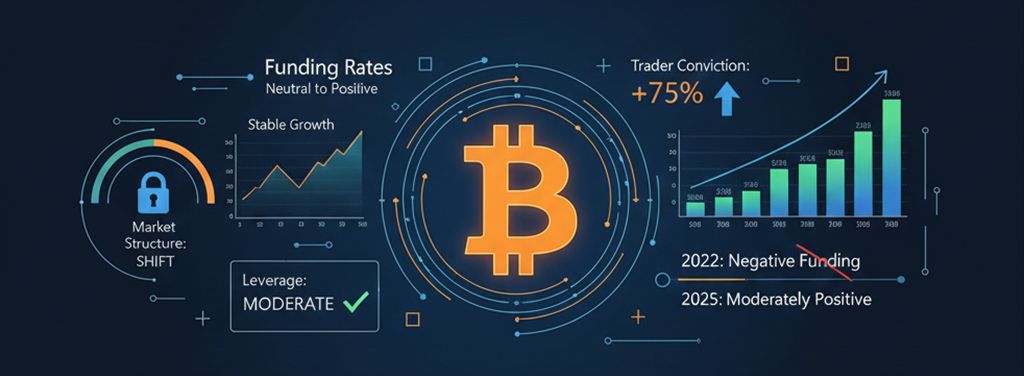

- The derivatives market shows neutral to positive behavior, unlike the bearish phases of previous years.

- CryptoQuant analysts suggest that current leverage is moderate and shows no signs of overheating.

- Persistent long positions during price consolidation reflect stronger conviction among investors.

The signals coming from the Bitcoin derivatives market differ dramatically from previous bearish cycles. Recent data from CryptoSeno ensures that Bitcoin funding rates across major exchanges have remained at neutral or slightly positive levels for an extended period. This phenomenon marks a structural shift in how traders act toward the pioneer digital asset.

🚨 $BTC Funding Rates Are Flashing a Critical Signal

— CryptoZeno (@CrypZeno) December 30, 2025

Funding rates across all exchanges have flipped decisively positive, confirming that long-side dominance is back in control.

This shift reflects renewed bullish sentiment, but also raises a red flag ⚠

Leverage builds… pic.twitter.com/lcXkRBXTta

Typically, price downturn cycles were accompanied by negative funding rates, signifying extreme pessimism and forced liquidations. However, the current cycle reflects a different kind of maturity. While sentiment is optimistic, the levels of excessive euphoria that usually precede over-leveraged collapses have not been reached.

Stability vs. Market Speculation

One of the most relevant observations of this shift is market resilience during lateralization phases. Instead of turning negative in the face of price stagnation, Bitcoin funding rates remain in constructive territory. This means that operators are willing to maintain their long positions, showing strengthened conviction rather than a simple search for quick profits through excessive risk.

This “stability over speculation” pattern is vital for the formation of a bullish trend that is sustainable over time. Previously, abrupt spikes in rates were usually precursors to instability; today, moderation seems to be reinforcing the market structure.

The transition from a deleveraging regime to one of risk reallocation suggests that the market has absorbed the traumas of 2022. With Bitcoin funding rates moving within healthy ranges, the medium-term outlook leans toward measured growth.

In summary, as long as leverage does not skyrocket uncontrollably, the current environment favors a controlled confidence, reducing the likelihood of the extreme volatilities that typically punish less-prepared investors.