TL;DR

- Bitcoin trades at $83,151 per unit and posts a 1.4% decline over the past 24 hours. Daily volume exceeds $75 billion after jumping 44.5%.

- Ethereum hovers around $2,740 following a drop of roughly 3%. The rest of the top 10 assets remain in negative territory.

- Long-term holders sent around 370,000 BTC to exchanges.

Bitcoin trades at $83,151 per unit, down 1.4% over the past 24 hours, according to CoinMarketCap. Daily volume exceeds $75 billion after a 44.5% surge, in a session shaped by liquidations and an accelerated rotation of positions. Over the past 48 hours, BTC touched a low around $81,300 and posts a weekly decline close to 7.7%.

Ethereum follows the same pattern and trades near $2,740, with a daily drop of about 3%. On a weekly basis, ETH also records a decline close to 6%. The rest of the top 10 assets are in the red. XRP fell nearly 7% over seven days, while Solana posts a decline close to 8%. Total crypto market capitalization holds around $2.82 trillion.

Holders and Miners Sent More Than 370,000 Bitcoins to Exchanges

Onchain data shows persistent supply. Glassnode reported that long-term holders distributed more than 12,000 BTC per day on average over the past 30 days, equivalent to roughly 370,000 BTC per month. At the same time, miners continue to send BTC to exchanges on a steady basis, increasing selling pressure on the spot market.

The derivatives market deepened the correction. Over the past 24 hours, liquidations reached approximately $1.8 billion. Long positions accounted for about $1.68 billion of the total. Bitcoin led liquidations with $792.8 million, followed by Ethereum with $424.8 million.

Within the top 100, Pi Network posted the largest daily gain, rising by roughly 6%. At the opposite end, Hyperliquid fell around 11%, sharply correcting its recent rally. Even so, it maintains a weekly gain above 31%.

ETFs Record Heavy Outflows

Institutional flows played a key role in the market correction and showed significant outflows. Ethereum spot ETFs recorded outflows of about $155.6 million, reducing total assets to $16.7 billion, according to SoSoValue. In the same session, Bitcoin spot ETFs saw outflows of roughly $817.9 million.

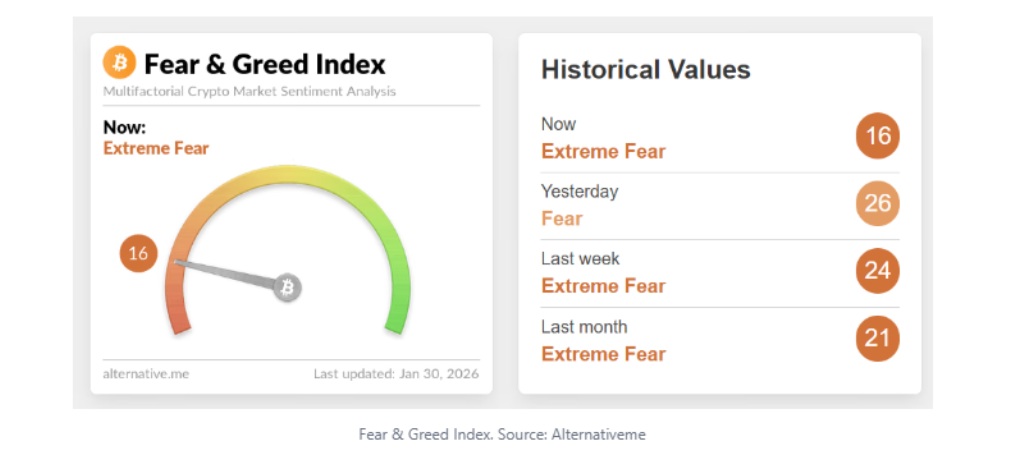

Finally, the Crypto Fear & Greed Index moved into the extreme fear zone.