TL;DR

- Analysts warn that Bitcoin’s slip near the 107,000 level could trigger a 20–30% pullback if US stock indexes cool down.

- Altcoins such as Solana may face deeper losses, although pro-crypto analysts argue the broader cycle remains bullish.

- Many traders see this weakness as a short-term reset after overheated price action, offering long-term accumulation opportunities for strategic investors.

Bitcoin hovered around 108,128 after briefly falling to 107,600, a move that caught traders off guard following recent Federal Reserve comments hinting at slower economic momentum. The sudden drop raised concerns of increased volatility across digital assets, with Solana losing roughly 7% during the session. While some investors fear a longer downturn, prominent market voices suggest the pullback should be viewed as part of a healthy cycle before renewed strength. Some market participants are also monitoring geopolitical headlines and upcoming economic data releases, which could introduce short-term swings but are unlikely to derail the broader digital asset adoption curve.

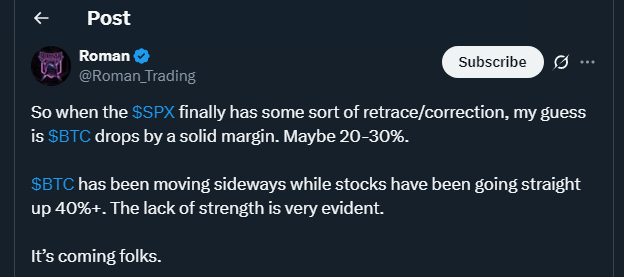

Market commentators such as Roman Trading, known for well-timed outlooks this year, reiterated that Bitcoin remains vulnerable if US equities cool. The expert on X noted that while the S&P 500 surged over 40% in recent months, Bitcoin’s lack of matching momentum could open the door to a sharper corrective move. According to this view, pressure on risk assets may briefly intensify before the market finds support again, especially if macro sentiment softens. A handful of on-chain analysts added that long-term holder supply remains near record highs, a signal often associated with resilient market floors.

Market Outlook And Analyst Views

Other analysts argue the current pricing zone offers limited downside for oversized short positions. Technical observers pointed to Bitcoin nearing its 200-day EMA and range support, levels historically linked to bullish rebounds. They emphasize that crypto has been consolidating while the stock market enjoyed stronger upside, which could reverse once capital rotation begins. Supporters of this scenario believe any pullback would be temporary rather than a trend reversal, and may offer disciplined traders a chance to strengthen positions at discounted prices.

Factors Supporting A Rebound

Ethereum near 3,800 continues to influence altcoin sentiment. Although staying below 4,000 has weighed on risk appetite, long-term observers highlight that ETH is holding key weekly support and remains above its 20-week moving average. Upcoming earnings from major tech firms and continued institutional positioning in digital assets could help restore confidence.