TL;DR

- Bitcoin ETFs in the U.S. reached $60 billion in assets under management (AUM) after strong capital inflows.

- Over $1.18 billion was injected in three days, marking the best performance since June.

- While BTC grows, Ethereum ETFs face difficulties, although ETH’s price rose 7% in the past week.

Bitcoin ETFs in the United States have reached a record figure, surpassing $60 billion in assets under management (AUM).

Their growth is due to the massive capital inflows in recent days, highlighting a change in investor perception toward these financial products. Despite recording net withdrawals for three days the previous week, Bitcoin ETFs consolidated an excellent rebound starting last Friday.

Data indicates that $253.6 million were injected into the funds on Friday, followed by $555.9 million on Monday and $371 million on Tuesday, totaling over $1.18 billion in a three-day period. This marks the best performance since June. Funds like Fidelity’s FBTC and Bitwise’s BITB saw significant contributions on Monday, while BlackRock’s IBIT led net inflows on Tuesday.

Uptober Renews Confidence in Bitcoin

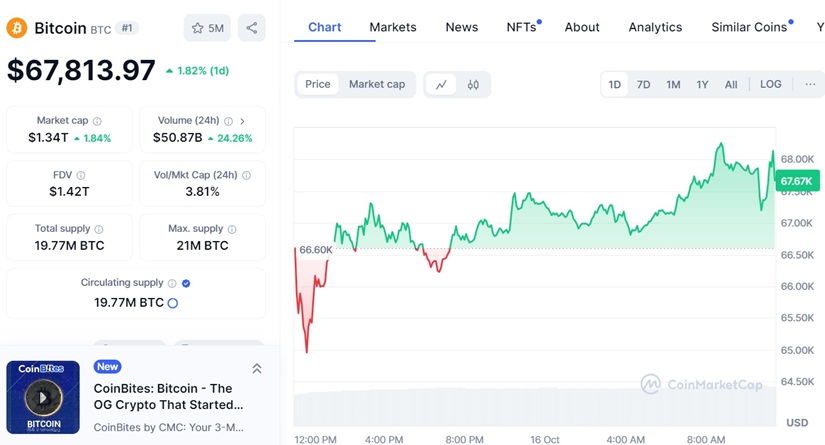

The increase in flows toward Bitcoin ETFs coincides with a rally in the cryptocurrency’s price. After dropping below $59,000 last Thursday, BTC’s value has risen 9.2% over the past week, reaching $67,800. Based on the behavior of the ETFs, it seems that investor confidence in these products is playing a key role in the recovery of Bitcoin’s price.

However, the situation is different for Ethereum ETFs. Despite being launched in July, they have not managed to capture the same attention as their Bitcoin counterparts. Ethereum has seen more outflows than inflows in recent months, affecting its overall performance. In the past few days, there were even two days of no trading activity, reflecting that, at least for now, interest in these funds remains low.

Ethereum Fails to Attract Investors

However, despite the lack of demand, Ethereum’s price has shown a similar increase to Bitcoin. Since last week, ETH has risen 7%, reaching a value above $2,600, marking a 14% growth over the past month. Although Ethereum ETFs struggle to attract investors, the asset itself has maintained steady price growth, which could influence future perceptions of these funds