TL;DR

- Bitcoin ETFs have accumulated over 500,000 BTC in just 54 days since their launch in January.

- U.S. spot BTC funds, including Grayscale, now hold around 835,000 BTC, equivalent to 4% of the total Bitcoin supply.

- This week saw $845 million in inflows to BTC ETFs, reversing the previous trend of capital outflows.

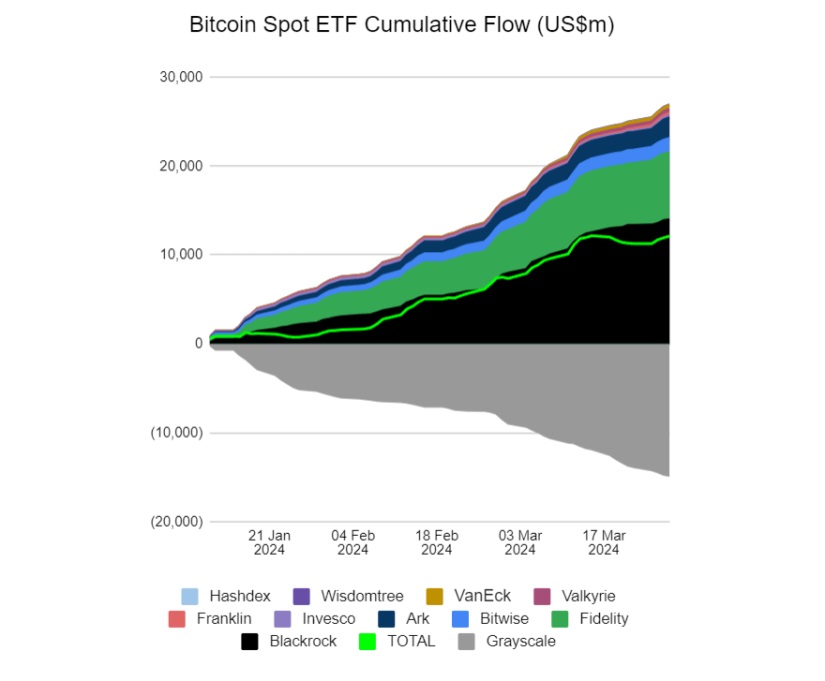

Since the launch of Bitcoin ETFs in January, the market has witnessed a steady growth in BTC accumulation by these funds. Nine out of ten newly launched products have managed to gather more than 500,000 BTC in just 54 days of operation, representing approximately 2.54% of the current circulating supply. This accumulation trend is indicative of growing institutional investor interest in the crypto market.

Recent information reflects that BTC ETFs continue to attract significant volume investments, with a total of $287.7 million in inflows in just one day. In total, U.S. spot BTC funds, including Grayscale, now hold around 835,000 BTC, nearly 4% of the total Bitcoin supply.

Additionally, this week marked a reversal in the trend of capital outflows from funds, with $845 million in inflows recorded in the past few days, suggesting renewed investor interest. Among the major players experiencing significant inflows are BlackRock, Fidelity, Bitwise, and Ark 21Shares.

Following Bitcoin ETFs, Proposals for Ethereum Emerge

Another interesting case is Grayscale’s GBTC fund, which experienced a decrease in outflows, with only $105 million in outflows, the lowest figure since mid-March. The company has reduced its BTC outflow since converting GBTC to a spot ETF in January.

Furthermore, in a surprising move, Bitwise filed an application with the Securities and Exchange Commission for an Ethereum spot ETF on March 28. However, analysts’ approval prospects for this product, whose resolution will be known in May, remain low due to the SEC’s lack of communication on the matter.

The Bitcoin market continues to expand thanks to the growth and adoption of BTC ETFs and the entry of new players into the industry. We are witnessing a wave of institutional interest in the crypto market overall. We will continue to closely monitor the evolution of Bitcoin and its financial products.