TL;DR

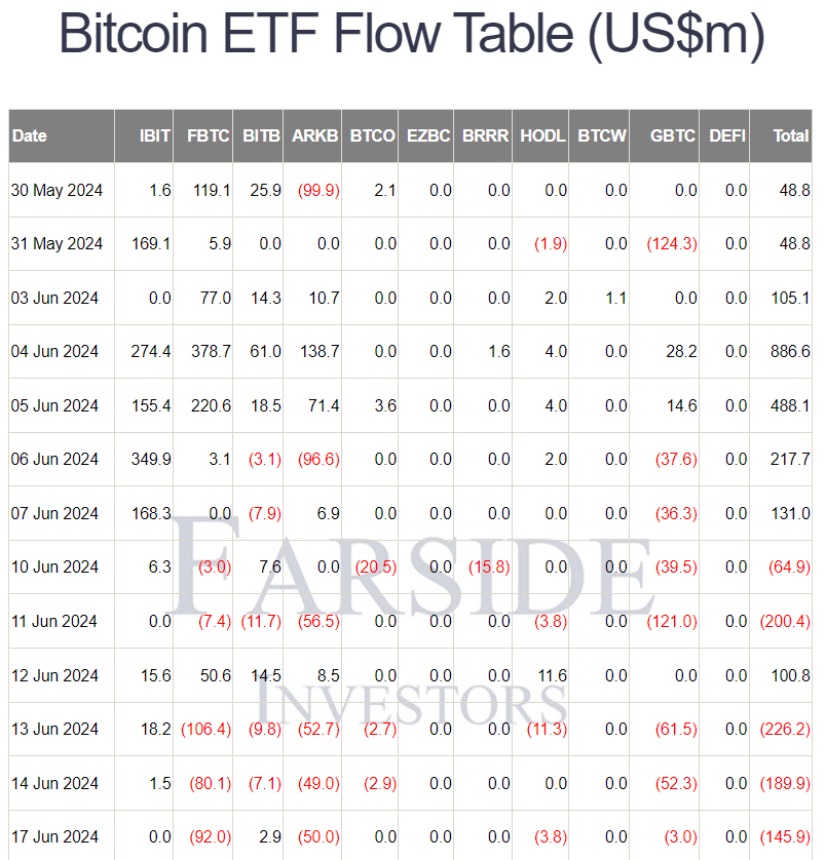

- Bitcoin ETFs experience strong outflows: $145.9 million withdrawn on 3 days, turbulence affects the crypto market.

- Fidelity’s FBTC leads outflows with a reduction of $92 million, followed by Ark’s ARKB with $50 million and Grayscale’s GBTC with $3 million.

- Despite the price drop, BTC dominance reaches 56.2%, its second highest level of the year.

In recent trading sessions, Bitcoin Exchange-Traded Funds (ETFs) have seen a concerning trend with significant outflows, causing marked volatility for the leading cryptocurrency.

Recent data from Farside Investors reveals that on June 17, the third consecutive day of outflows was recorded in BTC ETFs, totaling $145.9 million. This pattern extends to five out of the last six business days, indicating a strong wave of divestment in this financial vehicle linked to Bitcoin’s performance.

Among the hardest-hit ETFs, Fidelity’s FBTC stands out with a $92 million reduction, followed by Ark’s ARKB with $50 million and Grayscale’s GBTC with $3 million. In contrast, Blackrock’s IBIT managed to remain stable without recording net inflows or outflows during this period.

Bitcoin Strengthens Dominance Amid Market Turbulence

The adverse capital flow coincides with a decline in Bitcoin’s price, which has reached $64,800 at the time of writing, its lowest level since mid-May. The drop represents a depreciation of over 11% from its all-time high. Its market capitalization has decreased by 1.18% to approximately $1.28 trillion, while trading volume has surged by 82% and is approaching $37 billion.

However, despite the bearish trend in price, Bitcoin’s dominance has increased to 56.2%, its second highest level of the year. This metric indicates that, despite massive sales in ETFs, BTC remains the undisputed leader in terms of market capitalization and relative participation in the crypto ecosystem.

The current market perception towards Bitcoin could influence institutional investment strategies as investors assess risk and opportunities. The total cryptocurrency market capitalization has decreased by 2.38% to around $2.33 trillion, while trading volume has surpassed $96 billion in the last session, marking a 60% increase.