TL;DR

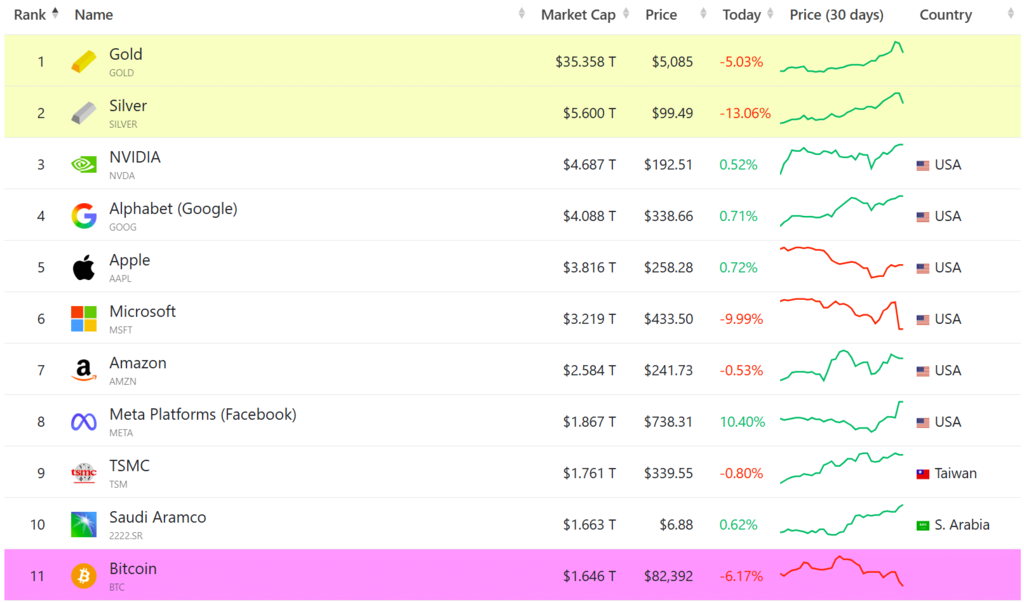

- Bitcoin exits the top 10 global assets after a correction reduced its market capitalization.

- To re-enter the top 10, it needs to gain ~$100-200B; for the top 5, exceed $2.5 trillion.

- Its volatility contrasts with gold, which leads the ranking and has historically shallower pullbacks.

Bitcoin left the top 10 global assets by market capitalization after remaining among the top ten for much of 2025. BTC currently registers a market capitalization close to 1.65-1.7 trillion dollars, with the price oscillating between 82,000 and 88,000 dollars per unit.

The drop in the ranking places Bitcoin below companies like Meta, TSMC and Saudi Aramco, whose market values move between 1.7 and 1.9 trillion dollars. A few weeks ago, some listings showed Bitcoin in eighth place with approximately 1.84 trillion dollars, but the recent correction eliminated enough value to remove it from the elite group.

The immediate trigger was a wave of liquidations exceeding 1.6 billion dollars in leveraged long positions. Traders who were betting on the rally’s continuation saw their positions forcibly closed when the price fell from zones near 90,000 dollars. The cascade of sales amplified the bearish movement within days.

Gold Dominates While Tech Companies Maintain Positions

The current ranking of global assets by market capitalization places gold in first place with an estimated value between 31 and 35 trillion dollars. It is followed by technology companies and silver, all with capitalizations exceeding 2.5 trillion dollars.

NVIDIA, Apple, Alphabet, Microsoft and Amazon occupy positions in the group of 2.5 to 4.6 trillion dollars. Silver, as a traditional commodity, also sits in the upper range of the ranking. Bitcoin now appears around 11th place, slightly below the block formed by Meta, TSMC and Saudi Aramco.

The episode reinforces the perception that Bitcoin, although already comparable in size to mega-caps and commodities, remains highly exposed to leverage cycles and global risk-off episodes. Movements of 10-15% within a few days continue to be common in the digital asset.

Despite the decline in ranking, recent surveys among institutional investors suggest that many consider Bitcoin undervalued at these levels. Several analyses catalog it as an asset with upside potential if global liquidity normalizes and regulations do not tighten drastically.

To return to the top 10, Bitcoin would need to recover approximately 100-200 billion dollars in capitalization, which would equate to a price increase to the 90,000-95,000 dollar zone per unit. Reaching the top 5 would require exceeding 2.5 trillion dollars in total value, implying prices above 120,000 dollars.

The contrast with gold is illustrative. While Bitcoin needs to gain close to 50% to enter the global top 5, gold already dominates first place with a value that almost doubles that of NVIDIA, the world’s second most valuable company.

Bitcoin’s inherent volatility keeps the possibility of rapid recovery open, but also exposes holders to risks of new drops if macroeconomic conditions deteriorate.

Bitcoin Falls to $81,000 While Gold Retreats After Reaching All-Time Highs

Bitcoin trades around 81-83 thousand dollars after registering a 6% drop on January 30. Gold, meanwhile, stood near 5,064 dollars per ounce after a daily retreat that oscillated between 8% and 13%, depending on the source consulted.

The crypto market experienced liquidations of 1.6 billion dollars in derivatives during the session. Technical analysis identifies a relevant support in the 80,500 dollar zone for Bitcoin. The loss of that level could extend the correction toward the 78-80 thousand dollar range in the short term.

Gold suffered a pronounced correction after an aggressive rally that took it from approximately 2,800 dollars per ounce a year ago to exceeding 5,000 dollars recently. The precious metal’s year-over-year gain reaches close to 80%, reflecting strong demand amid geopolitical uncertainty and inflation.

Historical Behavior Reveals Risk Differences

Data from the last five years show marked contrasts between both assets. Bitcoin accumulated returns close to 953% between 2020 and 2025, while gold registered approximately 100% in the same period. However, Bitcoin’s price faced drops of up to 80% from its highs, compared to retreats of less than 15% in gold.

At current prices, one Bitcoin equals approximately 16 ounces of gold (82,000 / 5,064). The ratio illustrates how Bitcoin functions as a high-performance asset within the store of value space, while gold maintains its role as a classic refuge.

Portfolio analysis suggests that Bitcoin captures flows when there is appetite for risk and “hard money” narratives, but suffers violent liquidations in the face of liquidity adjustments or regulatory changes. Gold responds more stably to geopolitical shocks, inflation and economic recessions.

Bitcoin’s institutional adoption advances through vehicles like spot ETFs, gaining space within the store of value market. Central banks and conservative savers continue accumulating physical gold, maintaining its structural demand.

Gold’s drop from nearby highs can be interpreted as profit-taking within an upward trend, as long as the price stays above support zones in the 4,300-4,400 dollar per ounce range. Bitcoin faces a phase of cleaning speculative excesses, with risk of bearish extension if it loses the 80,500 dollar level.

Combining both assets in a portfolio can improve the risk-return profile: Bitcoin amplifies global liquidity cycles while gold cushions adverse impacts.

![Is Dogecoin [DOGE] Security? Mad Money's Jim Cramer believe so](https://crypto-economy.com//wp-content/uploads/2022/01/Capture-2-300x184.jpg)