Bitcoin (BTC) traded above $90,000 in early December, giving investors confidence it could end the year on a solid note. However, a wave of selling pressure has since hit the world’s largest crypto, with Bitcoin plunging below $86,000 due to fading risk appetite and other factors.

The drop has weighed on sentiment and dragged down major altcoins. The Crypto “Fear and Greed” Index has improved slightly since earlier this month but remains at 25, in “Fear” territory. Some traders watch the $90,000 level as a psychological marker, and the move below it has been cited as a sign of broader risk aversion.

Against this backdrop, some market participants have shifted attention toward projects that claim real-world utility rather than purely speculative narratives. One example is Digitap ($TAP), which describes itself as an “omni-bank” app that combines fiat and crypto features and is conducting a token sale for its native token.

Source: Digitap

Why Central Banks Now Sit at the Core of Bitcoin’s Pain

Global central bank policies are frequently cited as a factor in Bitcoin’s weakness. Uncertainty around the Federal Reserve’s 2026 interest rate plans may affect market expectations, and rate changes can influence risk appetite across assets, including crypto.

Still, recent policy decisions have not removed uncertainty for investors. The U.S. central bank has also signaled that the path of future cuts may be gradual, which some market observers interpret as a headwind for risk-on positioning.

Meanwhile, the Bank of Japan has been expected by some analysts to raise interest rates on Dec. 19. Japan has been a source of liquidity for years as the “yen carry trade” offered low borrowing costs that could be deployed elsewhere, including into assets like Bitcoin.

With yields rising in Japan, that funding source can become less attractive, adding pressure across markets.

Source: @reinventideal

Digitap’s Banking App and Reported Utility

Bitcoin’s price around $86,000 has also been described by some traders as a key area to watch, with potential downside scenarios discussed if selling pressure persists. These are market interpretations rather than guarantees of where prices will move next.

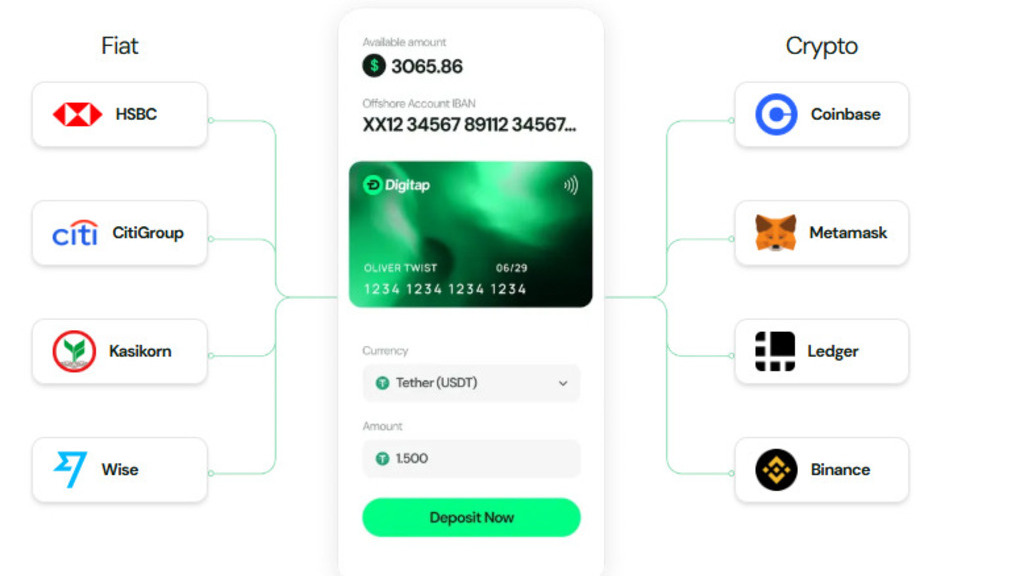

Separately, some investors have focused on crypto-related products that resemble traditional fintech services. Digitap says its product is a live banking app available on iOS and Android that combines fiat and crypto features in one platform.

According to the project, the app includes features such as international money transfers, foreign exchange, crypto swaps, savings tools, and a prepaid Visa debit card.

Digitap also states that its onboarding can be streamlined in certain cases, though identity and compliance requirements can vary by jurisdiction and user circumstances. Any claims about user growth or adoption remain speculative.

Source: Digitap

$TAP Token-Sale Structure and Buyback Description (Project-Reported)

Digitap is conducting a token sale for its native $TAP token. The project says the sale is structured in multiple rounds with scheduled price increases at the end of each round. It also states that $TAP was initially offered at $0.0125 and was later listed at $0.0371 during the period described.

Digitap says it generates fees through its app, including from currency exchange spreads, card transactions, and money transfers. Project materials also describe a profit allocation model that includes buyback-and-burn activity and funding for staking; these mechanisms and their effects are not independently verified and do not ensure any particular outcome for token holders.

The project also claims a fixed token supply of 2 billion and no inflationary issuance. As with any token model, supply design alone does not determine market price, liquidity, or risk.

Digitap has stated that it passed a $2.5 million fundraising milestone. The project has also described time-limited marketing incentives, such as bonuses or rebates, which can change and may be subject to terms and eligibility requirements.

Utility-Focused Projects in a Risk-Off Crypto Market

Bitcoin’s move below $86,000 and broader market volatility have renewed debate about how investors evaluate crypto projects in risk-off conditions. Some participants argue that products with clear use cases may be more resilient than purely narrative-driven tokens, though outcomes vary widely.

Digitap positions itself in this category by emphasizing payments and banking-related features. However, the project remains early stage, and any expectations about future adoption, revenue, or token performance are uncertain.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.