TL;DR

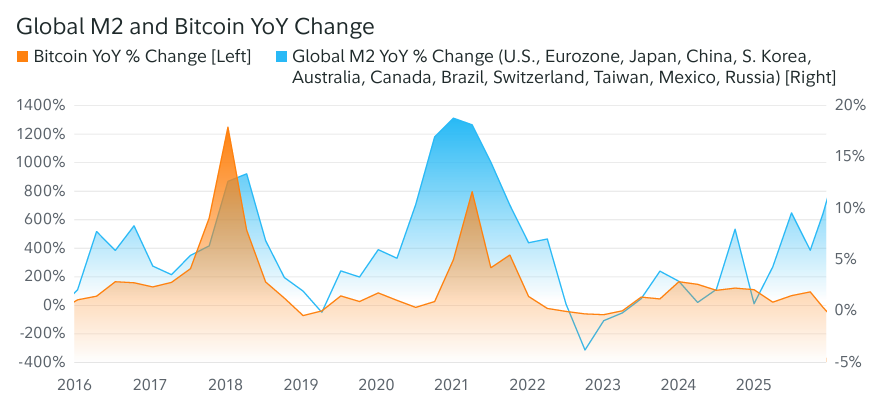

- Bitcoin’s price growth diverges from rising global M2 money supply.

- Fidelity views the decoupling as temporary amid renewed monetary easing.

- Some analysts interpret the divergence as a potential bear market signal.

Bitcoin continues to drift away from the global M2 money supply at the start of 2026, deepening a divergence that began in mid-2025 and challenging long-held macro frameworks used to explain price behavior.

For years, the expansion of global liquidity served as a core reference for bullish Bitcoin models. Historically, periods of accelerating M2 growth aligned with Bitcoin bull cycles, reinforcing the idea that scarce digital assets absorb excess capital during monetary easing. Recent data, however, shows a growing gap between both variables.

Data cited by Fidelity Digital Assets shows Bitcoin year-over-year growth turning negative, while global M2 year-over-year growth exceeds 10%. The correlation visible in prior cycles weakens further as 2026 begins. Bitcoin no longer tracks liquidity expansion in a linear way, raising questions about whether macro liquidity remains the dominant driver.

Fidelity maintains a constructive view

In its January report, the firm argues that Bitcoin bull phases typically coincide with accelerating M2 and points to the end of the Federal Reserve’s quantitative tightening and renewed global monetary easing as supportive conditions. According to Fidelity, Bitcoin’s fixed supply allows it to absorb excess capital more directly than other assets once liquidity flows normalize.

Other analysts offer contrasting interpretations

Market commentator MartyParty compares Bitcoin price action with global M2 using a 50-day lag, suggesting recent weakness reflects delayed adjustment rather than structural change. He argues price action may rebound to align with liquidity growth if historical lag patterns reassert.

#Bitcoin vs Global Liquidity – Lagged 50 days M2 says we bounce here – Jan 12th pic.twitter.com/hPw5ObpvAk

— MartyParty (@martypartymusic) January 12, 2026

Analyst Mister Crypto observes that prior periods of M2 decoupling often appeared near major market tops, followed by multi-year bear phases. From that view, the current divergence signals exhaustion rather than accumulation.

A separate explanation comes from Charles Edwards, who attributes the disconnect to technological risk rather than liquidity cycles. Edwards argues that 2025 marked Bitcoin’s entry into a “quantum risk window,” where the theoretical probability of quantum computing challenges to cryptography becomes non-zero. He suggests capital allocation now reflects risk reassessment rather than monetary expansion alone.

What’s next: Market participants continue to watch whether Bitcoin re-aligns with liquidity trends or establishes a new pricing framework driven by technology, geopolitics, and risk perception. The split among analysts highlights a market entering 2026 with more variables than prior cycles.