TL;DR

- Bitcoin tests $100,000 again after short-term holders exit.

- Record open interest on October 31; half rebuilt in a week.

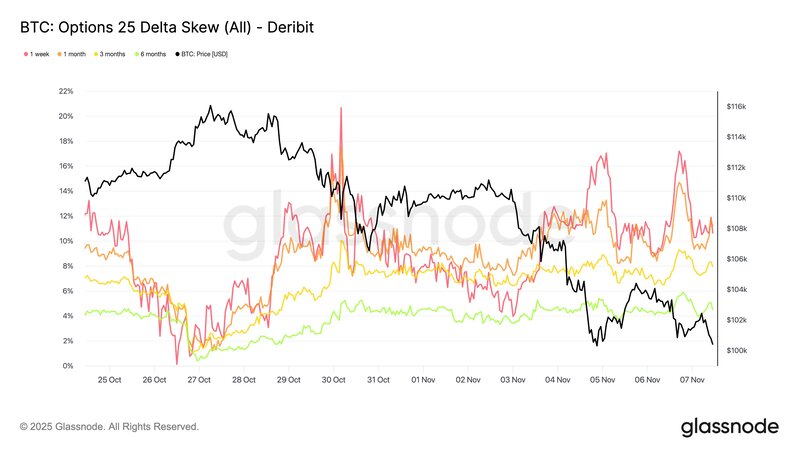

- 11-12% put skew on short maturities reflects immediate caution.

Bitcoin is once again testing the $100,000 threshold after short-term holders exited their positions, creating a shift in market sentiment. The options market, which serves as a transparent gauge of trader expectations, provides key insights into how participants are positioning themselves in the current environment.

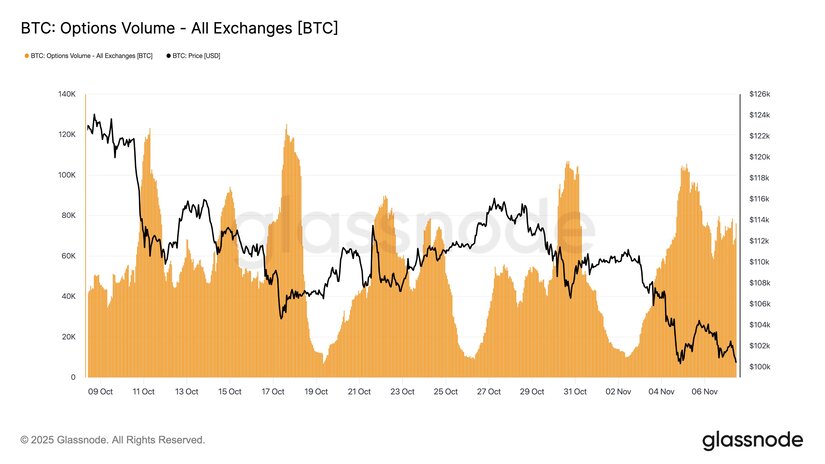

Data indicate that a new all-time high (ATH) in open interest was recorded on October 31, shortly before contract expiries cleared a portion of positions. Within a week, roughly half of that open interest has already returned, suggesting a steady rebuild. Traders remain highly active, and the options market continues to print record highs with each successive expiry.

$BTC Options Weekly

Bitcoin is retesting the 100K level after short term holders have capitulated. Options data reveal how traders feel about fear, vol and positioning, a clear read on sentiment and the driver of price action.

Here’s what the market is signaling now. 👇 pic.twitter.com/64A8uPwYnp

— glassnode (@glassnode) November 7, 2025

Options trading volume has remained elevated since the price crossed $107,000, signaling constant position adjustments and fresh hedging activity. The data reveal mixed sentiment, as participants hedge against further declines while speculating on short-term rebounds.

Market Positioning and Sentiment

The put–call volume ratio indicates a fragile confidence in the market bottom. During the recent downturn, put activity rose sharply, followed by a burst in call buying as prices rebounded near $100,000. Despite the bounce, puts have regained momentum, reflecting ongoing caution. The market appears to expect a retest of lower levels and maintains protective positioning.

Short-dated maturities, ranging from one week to one month, show a strong put skew near 11–12%, illustrating near-term anxiety among traders. Longer-dated contracts remain moderately put-biased, signaling cautious behavior rather than panic. Participants appear to be conserving capital, ready to re-enter when volatility stabilizes.

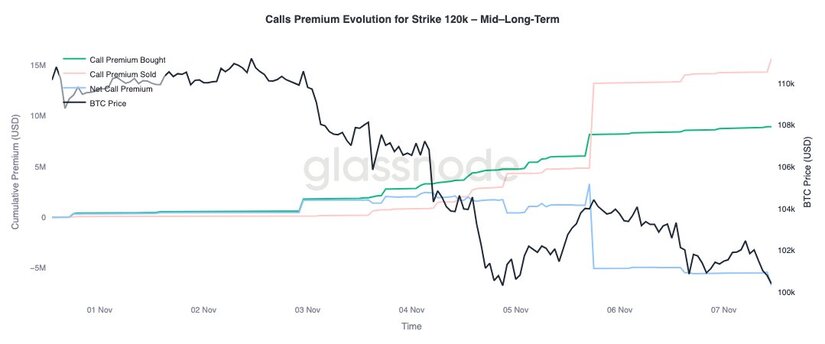

Premium data reinforce this sentiment. The 100K strike put premium for short-term maturities has grown from negative territory to roughly $7 million in three days, marking a substantial investment in downside coverage. Meanwhile, the 120K strike call for medium to long-term expiries shows little accumulation, as traders used the brief price recovery to sell calls and reduce exposure.

Overall, options metrics reveal a market still governed by fear and uncertainty. Traders are prioritizing risk control over aggressive positioning. In such conditions, experience tends to reward those who act with restraint — selling early and buying late remains the pattern favored by disciplined participants.

As of November 7, 2025, the current price of Bitcoin (BTC) is approximately $100,526 USD, according to CoinGecko live data. Over the past 24 hours, BTC has posted a modest 1.3% increase, although it remains down 9.1% over the past 7 days, signaling a moderate correction phase following the strong rally seen in October. The daily trading range sits between $99,376 and $102,380 USD, with a market capitalization of around $2.0 trillion USD and a 24-hour trading volume exceeding $86.8 billion USD.