TL;DR

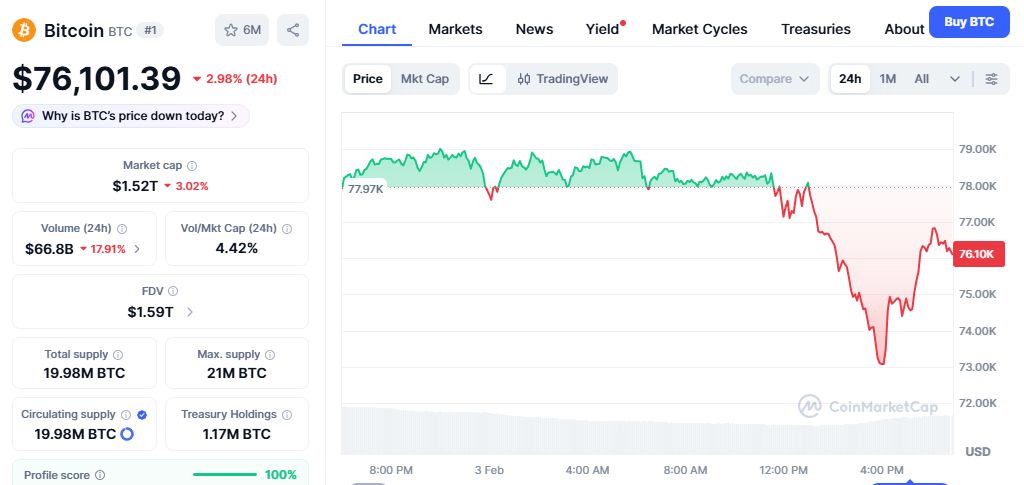

- Bitcoin trades at $76,101 after a -2.98% drop in the last 24 hours, extending a five-month corrective phase.

- Exchange data shows weak spot demand that limits the strength of rebounds and increases sensitivity to volatility.

- Analysts maintain a pro-crypto perspective, seeing the slowdown as a normal consolidation before the next growth cycle. Market observers note that long-term accumulation continues quietly despite short-term price fluctuations.

Bitcoin continues to face selling pressure as buyers struggle to regain control of the trend. Recovery attempts consistently stall near the $80,000 zone, keeping the market fragile. The recent -2.98% drop highlights the lack of follow-through from buyers during this corrective period, while trading volumes remain uneven across exchanges.

Spot Demand is Drying up: Bitcoin Enters its 5th Month of Correction

“This contraction in volumes has brought the market back to levels among the lowest observed since 2024, suggesting a clear disengagement from investors.” – By @Darkfost_Coc

Link ⤵️https://t.co/Rz0nt4hKwx pic.twitter.com/NQZhPSu3mS

— CryptoQuant.com (@cryptoquant_com) February 3, 2026

The ongoing pattern reflects caution rather than panic. Large holders have reduced activity, while retail participation has slowed, creating a selective market environment. Pro-crypto supporters point out that previous cycles included similar prolonged pauses before major advances, and that these periods often precede broader adoption surges. Observers also highlight that network activity and transaction volume continue at healthy levels.

Spot trading activity has softened. Thinner order books and reduced real buying allow derivatives flows to dominate short-term price moves. This structure increases sensitivity to headline news without changing the long-term outlook for Bitcoin. Additionally, emerging institutional products continue to build on-chain infrastructure, which supports market depth over time.

From a fundamentals perspective, adoption continues steadily. Payment companies are integrating blockchain rails, and institutional custody solutions expand, supporting the long-term growth story. Analysts point to growing on-chain transfers and stable daily active addresses as further evidence that the ecosystem is still advancing despite the price correction.

Market Structure And Price Behavior

Technical analysis shows a series of lower highs starting after the $126,219 peak, with resistance in the $78,900–$79,235 range and support near $77,500. Momentum indicators are near oversold territory, signaling a potential short-term relief bounce while the broader trend remains corrective. Traders watch key levels closely, noting that any sustained move above $80,000 could shift sentiment.

Demand Signals To Watch

Analysts highlight the return of genuine spot buying as the key to a durable recovery. Historical patterns show that sustainable rallies are backed by expanding exchange volumes and steady long-term holders. Until this occurs, the market is likely to remain sensitive to liquidations and macro factors, including dollar strength and interest rate trends.

The current correction tests patience but does not undermine Bitcoin’s trajectory. The network continues to operate securely with growing adoption, and many see the calm phase as an opportunity to accumulate.