TL;DR

- Bitcoin’s value has dropped significantly after hitting an all-time high in late March, largely due to the influence of the “Fear and Greed Index” and a significant withdrawal from a principal investment vehicle.

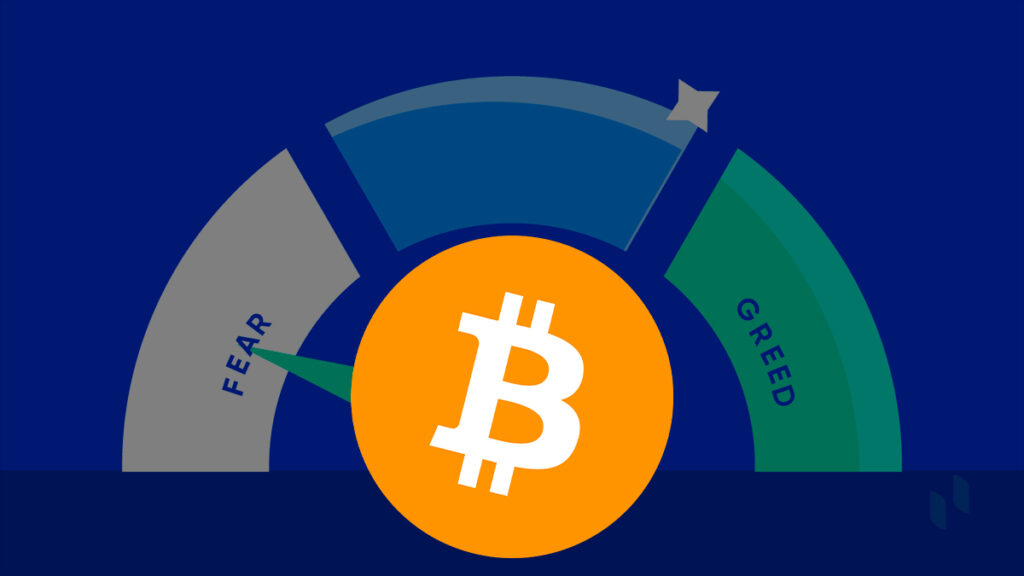

- The Crypto Fear and Greed Index, which measures the collective emotional state of the cryptocurrency market, has fallen to 43, indicating “Fear”. This has led to a sell-off frenzy among investors, further driving down Bitcoin’s price.

- Despite the current market instability, some analysts view this as a necessary adjustment after the rapid increase leading up to the halving event. However, a record departure from spot Bitcoin ETFs and the ongoing market volatility suggest that the path to stabilization may be challenging.

The once dazzling shine of Bitcoin seems to be dimming. Following a remarkable surge that saw the cryptocurrency hit an all-time high in late March, Bitcoin has since undergone a stark correction. The investor mood has plummeted, casting a shadow over the future of the digital currency.

This downturn is largely due to a mix of factors, with the “Fear and Greed Index” playing a pivotal role in this tumultuous journey, accompanied by a significant withdrawal from a principal investment vehicle.

The Crypto Fear and Greed Index, a sentiment gauge, aims to measure the collective emotional state of the cryptocurrency market. It ranges from 0, indicating “Extreme Fear,” to 100, denoting “Extreme Greed.” This index has unexpectedly become a key influencer in Bitcoin’s valuation.

During its climb to the summit, the index was firmly in the “Greed” territory, fostering an atmosphere of investor optimism and a “buy the dip” strategy. Minor price dips were perceived as opportunities, propelling Bitcoin’s value even higher.

The Impact of the Halving on Bitcoin’s Fear & Greed Chart

However, the recent downturn has seen the index fall to 43, squarely placing it within the “Fear” category. This shift towards negativity has sparked a sell-off frenzy, with investors eager to cut their losses.

The index, while insightful, can often lead to a self-perpetuating cycle in the volatile Bitcoin market. As the index falls, investor anxiety mounts, leading to a sell-off of Bitcoin assets. This, in turn, drives the price down further, validating the initial fear and causing more sell-offs. This feedback loop can intensify corrections and lead to greater market instability.

Despite the current pessimism, some market analysts view this as a necessary adjustment after the rapid increase leading up to the halving event. The halving, which slashes the number of new Bitcoins created with each block, had previously sparked a speculative frenzy. Now that the event has passed, the market is recalibrating.

Adding to Bitcoin’s challenges is a record departure from spot Bitcoin ETFs. On May 1st, these funds saw a net outflow of $560 million, indicating a waning confidence among some institutional investors, which could also unsettle retail investors.

Yet, despite the ongoing turmoil, staunch Bitcoin advocates maintain a positive outlook. They cite the cryptocurrency’s decentralized nature and finite supply as reasons for its enduring value. Nonetheless, the path to stabilization may be fraught with volatility, and investors are advised to brace for potential fluctuations in the days ahead.

![Is Dogecoin [DOGE] Security? Mad Money's Jim Cramer believe so](https://crypto-economy.com//wp-content/uploads/2022/01/Capture-2-300x184.jpg)