Bitcoin (BTC) has embarked on a bullish momentum pumping more than 8% in the last 24 hours. This comes after the Biden administration assured that no losses would be borne by the United States taxpayers, following the collapse of Silicon Valley Bank (SVB) and Signature Bank.

Despite the slump after the collapse of the two traditional banks, the cryptocurrency market has continued trading higher following a report of the US government’s plans to safeguard all depositors at Silicon Valley Bank and Signature Bank. To further bolster investor confidence, Joe Biden took to Twitter on March 13, to assure that no American taxpayer would feel the burn as the federal government takes action to protect the affected depositors.

Although the federal government’s proactive approach to minimizing damage was appreciated, many pointed out that it’s the taxpayers that would ultimately suffer the depositors’ bailout. However, Biden addressed those concerns through the tweet adding,

“Thanks to actions we’ve taken over the past few days to protect depositors from Silicon Valley and Signature Banks, Americans can have confidence that our system is safe. People’s deposits will be there when they need them – at no cost to the taxpayer.”

Thanks to actions we've taken over the past few days to protect depositors from Silicon Valley and Signature Banks, Americans can have confidence that our system is safe.

People’s deposits will be there when they need them – at no cost to the taxpayer.

— President Biden (@POTUS) March 13, 2023

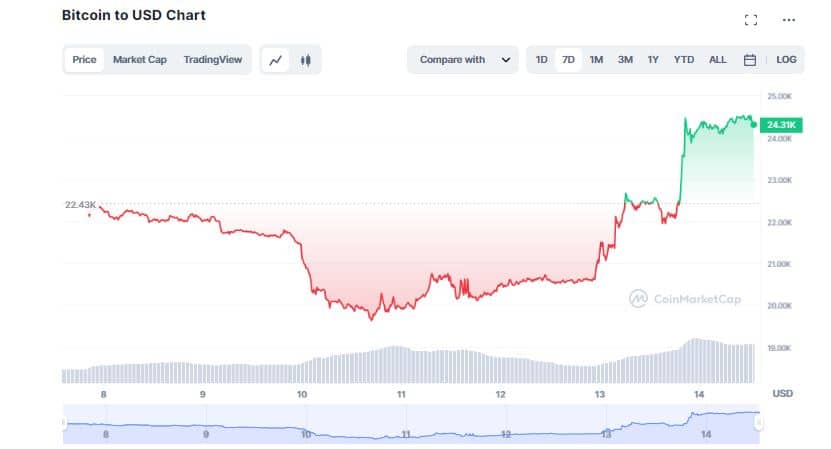

Bitcoin Inches Closer to $25K

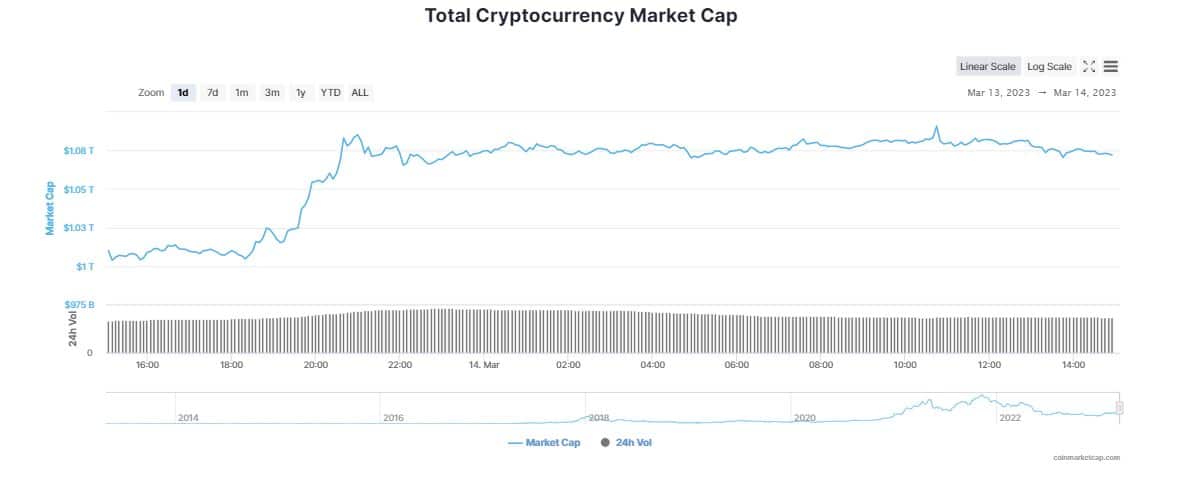

It seems the news has managed to uplift the investor sentiment with a promise of more liquidity in the market. The crypto market shared the positive view with the global crypto market cap rising 4.38% in the last 24 hours to $1.08 trillion. The total crypto market volume over the last 24 hours surged 16.75$ to $90.34 billion. In tandem with the wider financial market, Bitcoin (BTC), Ethereum (ETH) and other major altcoins also traded higher on Tuesday.

According to CoinMarketCap, BTC is up 9.28% in the last 24 hours to trade at $24,367. The flagship token jumped more than 8% over the past seven days as markets awaited key economic data from the United States. At the same time, Bitcoin’s dominance increased 1.43% over the day to 43.72%.

Moreover, on March 14, popular crypto analyst, Michael van de Poppe took to Twitter to reveal that all eyes are temporarily on the Consumer Price Index (CPI) print for February which will direct the course for further movement in the short-term BTC price action. Poppe tweeted,

“Bitcoin sweeping the highs here as it’s testing range high at $25K. You’d preferably want to see some period of consolidation (CPI day today) before continuation.”

#Bitcoin sweeping the highs here as it's testing range high at $25K.

You'd preferably want to see some period of consolidation (CPI day today) before continuation.

If markets sweep range high at $25.2K, make a bear. div and fall back, I'd be looking for shorts to $23K. pic.twitter.com/bs4HFbxBMT

— Michaël van de Poppe (@CryptoMichNL) March 14, 2023

Altcoins Grow Stronger Despite Volatility

Meanwhile, Ethereum (ETH) climbed nearly 5% over the last 24 hours to hover at $1,671. The second largest cryptocurrency soared more than 6% in the past one week even after regulators on Sunday announced the closure of Signature Bank, the last major crypto bank in the U.S.

Other major tokens also traded with gains in the same time frame. XRP, Cardano (ADA) and Solana (SOL) rose in the range between 0.11% and 3%. Whereas, Polkadot (DOT) and Polygon (MATIC) leaped 2.94% and 4.38%, respectively. Popular memecoins such as Dogecoin (DOGE and Shiba Inu (SHIB) surged nearly 3% over the past 24 hours.

As per reports, investors have also started betting that the Fed will be less aggressive in raising interest rates now that authorities have stepped in to limit the fallout from SVB and Signature. In a statement, Shivam Thakral, CEO at BuyUcoin said,

“The crypto market cap is back above the $1 trillion mark and BTC has surged by over 8% in the last 24 hours. The positive mood of the market is mainly due to the federal regulators hinting towards recovering Silicon Valley Bank’s customer deposits.”