The market is upbeat thanks mostly to Bitcoin’s impressive gains in January. Month-to-date, BTC price is up 30%, and this can be attributed to several reasons.

Unparalleled Liquidity

First, the coin being the most valuable and a digital asset from where several derivative products has been created from is widely traded and therefore well analyzed and traded.

Unlike most altcoins, BTC has deep liquidity and is endorsed by leading regulators amongst them the US SEC whose officials have in several occasions said its underlying network is well diversified and therefore satisfactorily decentralized, operating as designed.

Approval of a Bitcoin ETF in 2020 will be instrumental for BTC Bulls

For now what remains is the approval of a Bitcoin Exchange-Traded Fund (ETF) but worries still linger on how to best protect all cadre of investors by ensuring that prices are not manipulated.

Furthermore, there is the need of creating a true foolproof system where regulators can monitor approved exchanges and fairness exist.

If this product is approved, BTC could benefit from institutional grade investment and that will mean even higher prices and a mature market where even more products can be derived.

For now, the global uncertainty, viral outbreaks, and a fragile global economy is probably shoring prices as risk-averseness kicks in, offering support to prices.

BTC/USD Price Analysis

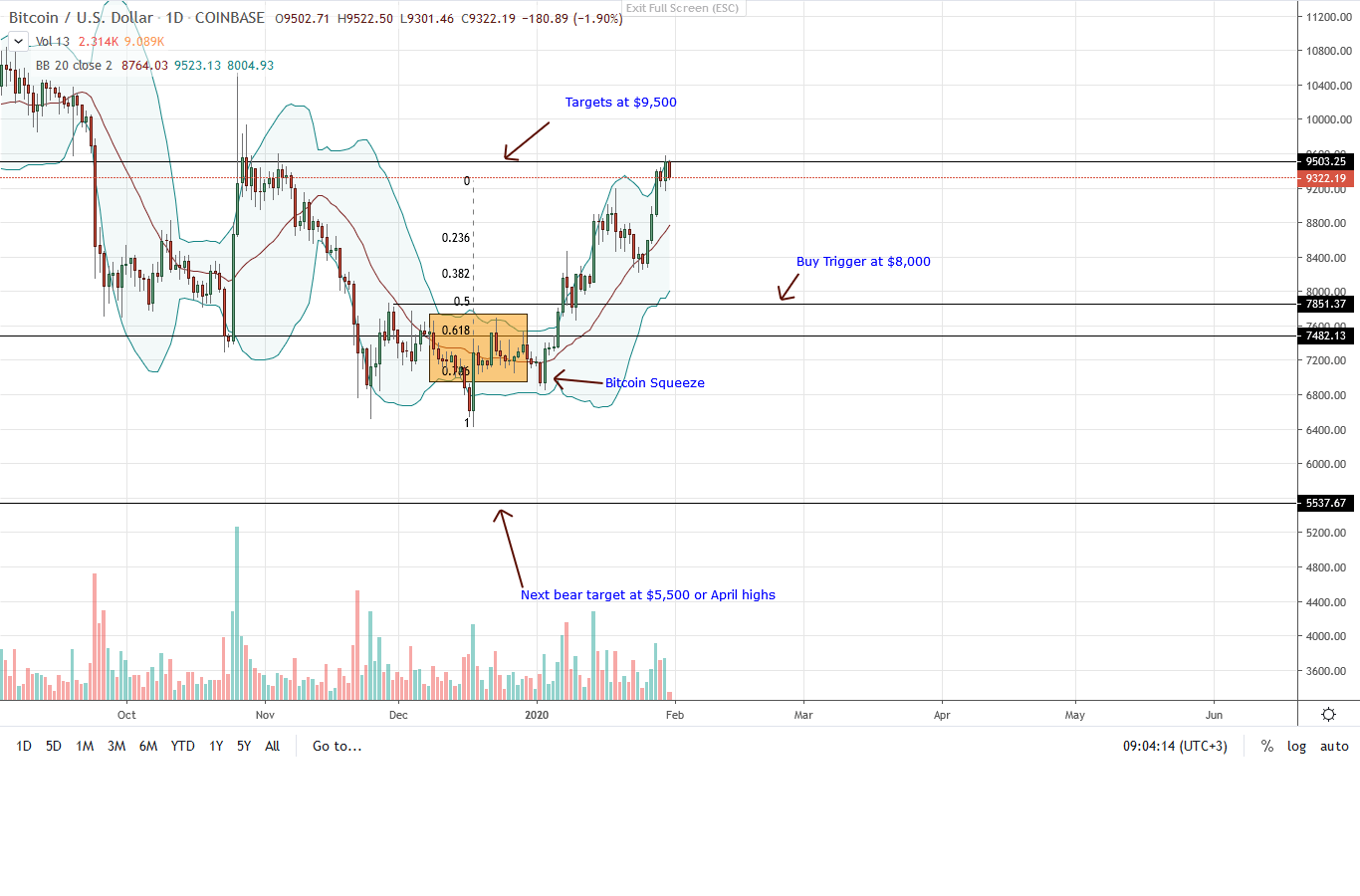

From the chart, technical candlestick arrangement is hinting of buyers. In the daily chart, bulls retested an important resistance line at $9,500 yesterday before dropping to spot levels.

So far, the upswing has been nothing short of impressive, playing positively to previous calls.

The best approach now is to tighten stop losses since prices are now stagnant although momentum is still high and bullish.

As bullish candlesticks band along the upper BB, aggressive traders can still search for entries in lower time frames. However, risk-averse traders can wait for a complete break and close above the $9,500 resistance level preferably at the back of high trading volumes.

If this prints out, buyers will nullify the bear breakout of Sep 23, 2019 and usher in another wave of higher highs that could see BTC soar to June 2019 highs of $13,800.

That’s why patience is key and even if bulls are in control, closing above the 20-week moving average in the weekly chart, a confirmation is nonetheless required in the daily chart.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.