The 2010s saw Bitcoin evolve to be a duo asset that can simultaneously act as a medium of exchange–as originally envisioned by Satoshi Nakamoto, and a store of value thanks mainly to its censorship resistant status. This meaning owners in ravaged economies can seek refuge in during times of crises.

Since then, Bitcoin has experienced wild swings. From rally to $20k and slumping back to $3,200, it has been a ride for traders as well as HODLers.

Price Bitcoin in Satoshis

However, the forecasted direction that the coin will take in the next decade is a subject of debate. Maximalists and optimists expect prices to soar to new all-time highs.

According to commentators on Twitter, Bitcoin price will be accelerated more so if exchanges decide to denominate BTC in Satoshi, the smallest unit of account, and not whole units.

This way, they argue, more people will find the coin cheap and given its advantages over traditional assets, invest in the digital asset thereby pumping the coin higher.

While there are reasons to be bullish from a fundamental perspective, chartists are also positive.

On-chain Activity Point to Bulls

An analysis of on-chain data by Willy Woo reveals that Bitcoin, even though consolidating below $8,000, is in a re-accumulation phase and likely to edge higher in days ahead.

Further, the failure of sellers to build on and liquidate the asset in recent days is a mark of strength that allows traders to add to their gains.

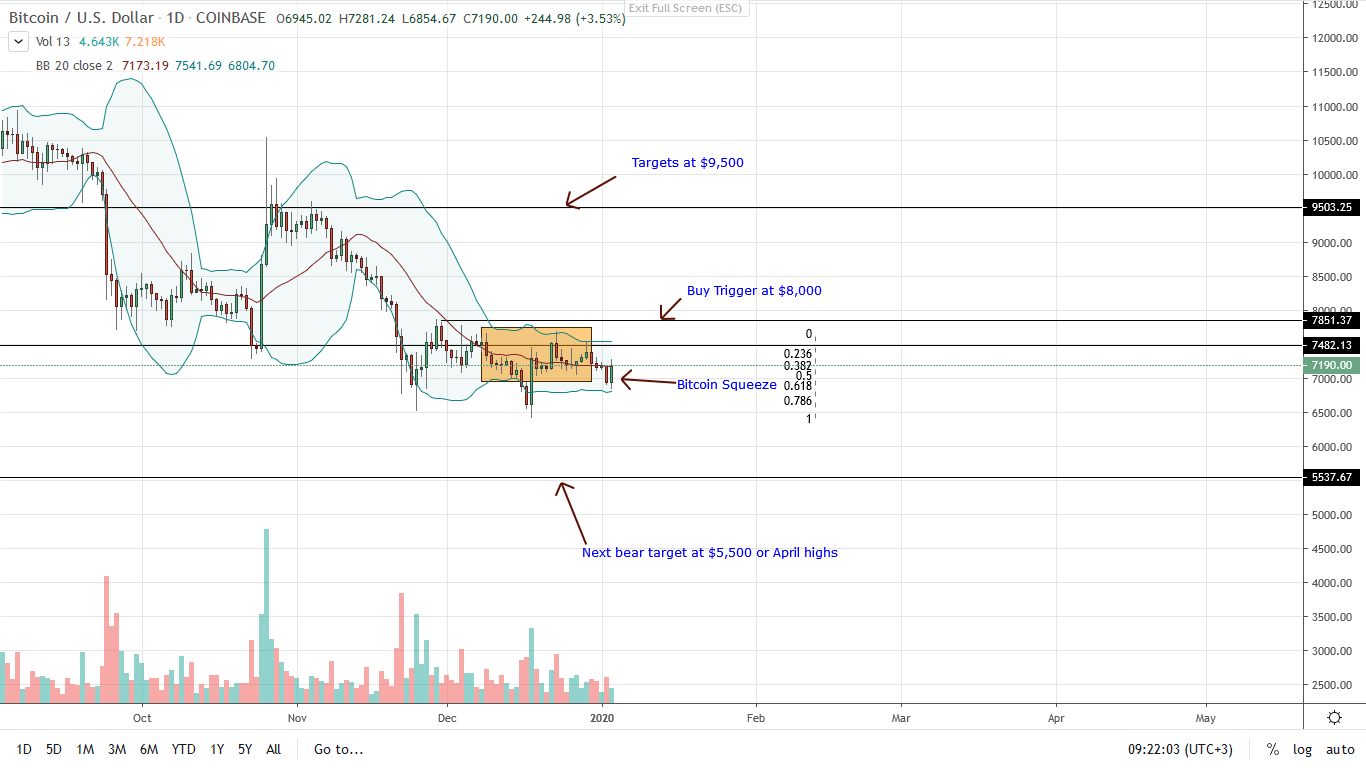

BTC/USD Price Analysis

Price wise, Bitcoin bulls are in control. Year-to-date, BTC is up 89% against the USD and in triple-digits against ETH.

However, of interest is the support of prices and the swift entry of buyers following yesterday dip below $7,000.

Presently, the uptick of trading volumes and price is a mark of strength. From candlestick arrangement, there is a double-bar bullish reversal pattern and the reversal from the 61.8% Fibonacci retracement level of the last two weeks trading range is a mark of bulls.

In an effort versus result point of view, the fact that prices are still consolidating inside Dec 19 trade range is a mark of bulls and could be the basis of further gains in days ahead.

Considering this, the most prudent approach for aggressive traders to load the dips with firm stops below Jan 2 low.

Alternatively, and this applies for risk-averse traders, a break-out above $7,500 with increasing volumes would increase the odds of a bull rally towards $8,000 or better.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.