Latest Bitcoin [BTC] News

Somehow, the Bitcoin-and indeed the blockchain community, is ecstatic about Facebook’s entry. Armed with a stablecoin weighted and pegged to different world currencies, Libra is shaping. However, that is not to mean that it is everything to do with Bitcoin’s success. More than doubling since hitting rock bottom in mid-Dec 2018, BTC recovery has been stellar.

Thus far, the comparison between Libra is good and bad. Bad in that analysts reckon that the underlying infrastructure powering Libra is not a “true blockchain.” Meanwhile, it is good in that Facebook has a broad base with billions of users spread across the block.

The mentioning of a cryptocurrency will surely make them curious and the prospects of sending funds across the globe through their messenger or WhatsApp will definitely pique their interest. As such, it is likely that Bitcoin will benefit from the exposure.

From what it is and more importantly its value coupled with its upward trajectory, odds are there will be some level of conversion. Note, Libra is not an investment. Its value is stable and given the nature of humans, the appetite for profit means funneling funds to an opportunity. Bitcoin gives them just that.

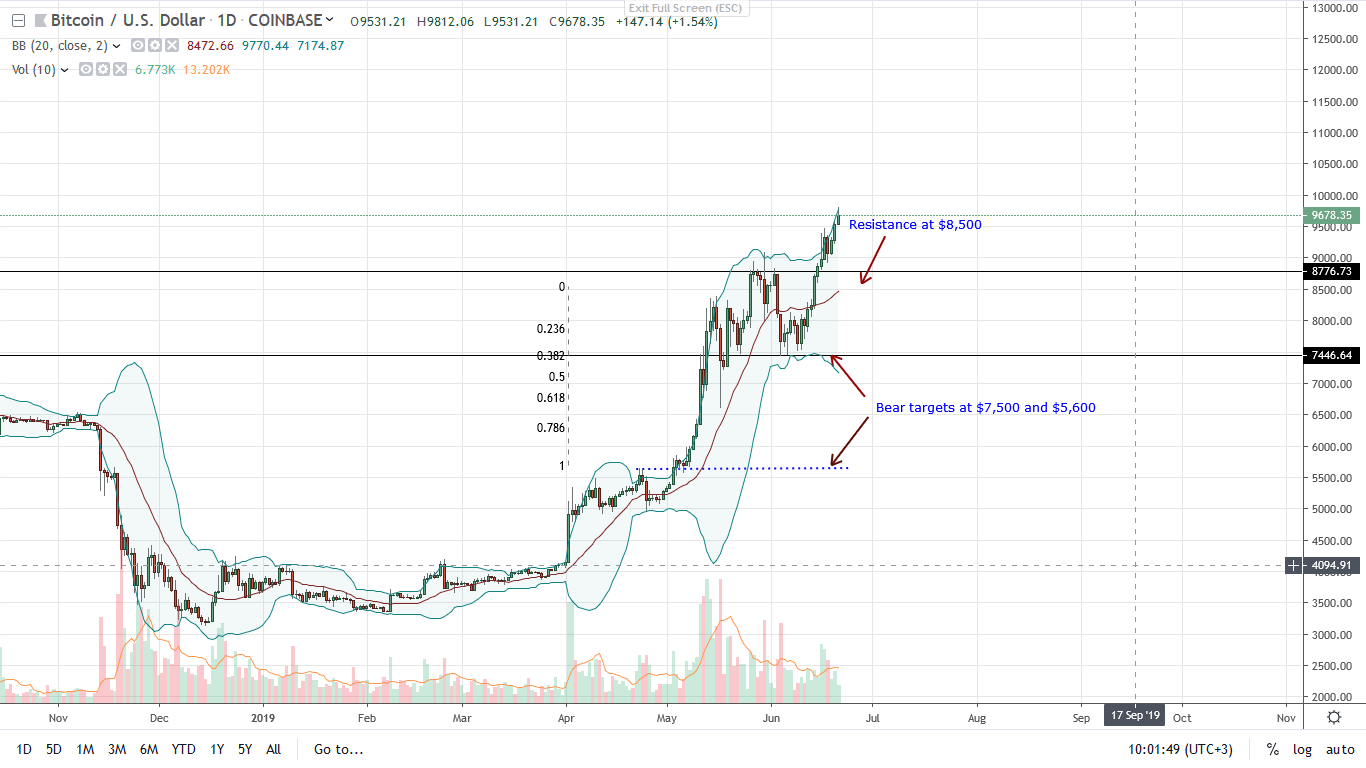

BTC/USD Price Analysis

After a temporary accumulation, BTC bulls are back. If anything, buyers are firmly in control trading within a bullish breakout pattern following swings above $9,100 or May high. Because of this, traders can buy the dips as long as prices are trading above $9,000.

Visible from the chart, daily candlesticks are banding along the upper BB meaning demand is strong and upside momentum is firm. While there is a possibility that daily ranges will drop ahead of the weekend since participation is waning, if bulls manage to maintain prices above May highs then the better.

On the flip side, support is within the $8,500-$9000 zone. Break below these levels at the back of high trading volumes exceeding 31k of May 30th could see BTC crumbling to $7,500 correcting the bearish divergence that is currently printing. That is, prices are increasing at the back of low trading volumes.

However, if bulls absorb sell pressure and prices bolt above $9,900, odds are BTC will rally to above psychological $10,000. Consequently, that will trigger a FOMO that will feed the next wave that would likely place BTC at $12,000 and even $15,000 as losses of 2018 are resoundingly reversed.

Chart courtesy of TradingView—Coinbase

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.