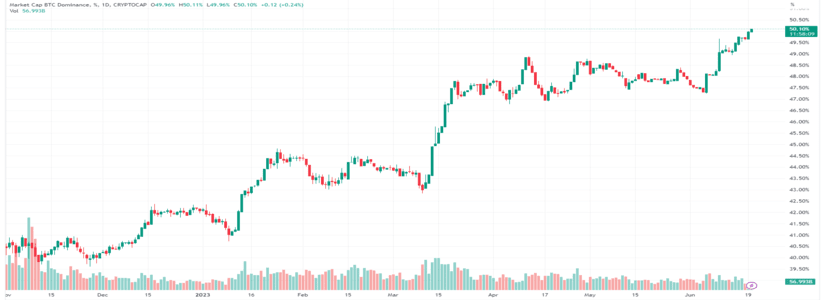

Based on the data shared by TradingView, it has come to light that the Bitcoin (BTC) Dominance has now crossed the 50% mark, yet this is not the first time the token’s dominance has crossed such an impressive mark, as a similar situation was seen in 2021, not too long after China’s ban on cryptocurrencies.

It seems like the active crackdown of the SEC against altcoins has been the major catalyst for boosting the overall share of Bitcoin (BTC) in the crypto market.

Bitcoin (BTC) accounts for almost half of the crypto market’s $1.1 trillion market cap. The total market cap of the token currently stands at the $519 billion mark. Furthermore, the market cap of the token has been on the rise since 2022 as compared to altcoins.

A chunk of investors flocked towards the digital asset after regarding it as a safe haven amid the collapse of the FTX exchange, and the increased scrutiny over other crypto assets in the US.

Despite the dominance of Bitcoin (BTC) witnessing a remarkable increase, the trading price of the token has not changed that much. At the time of writing, BTC is trading for almost $26,783 and has gone up by a mere 1.43% over the previous 24 hours.

With the current scenario in mind, a number of analysts predict that Bitcoin’s market dominance would touch 80% within the coming years as investors continue to lose faith in altcoins. However, the higher dominance would also result in increased regulatory pressure from the SEC as well.

Altcoins Continue to Decline Amid the Rising Dominance of Bitcoin

With Bitcoin (BTC) reclaiming 50% dominance, and developing a sense of positivity within the minds of the traders, altcoins are continuing to suffer. Potential signs of recovery were seen during Saturday, but have failed to keep the momentum. The market caps of a majority of altcoins are currently in the red.

One major reason for the decline of altcoins can be linked to the SEC’s crackdown against Coinbase and Binance. The regulator claims that all tokens apart from Bitcoin (BTC) are securities and must be registered.

It is necessary to note that the SEC only considers BTC to be a commodity. On the other side of the table, the BTC dominance metric has been subject to great criticism for under-representing the true market share of Bitcoin (BTC) by including altcoins in its calculations.