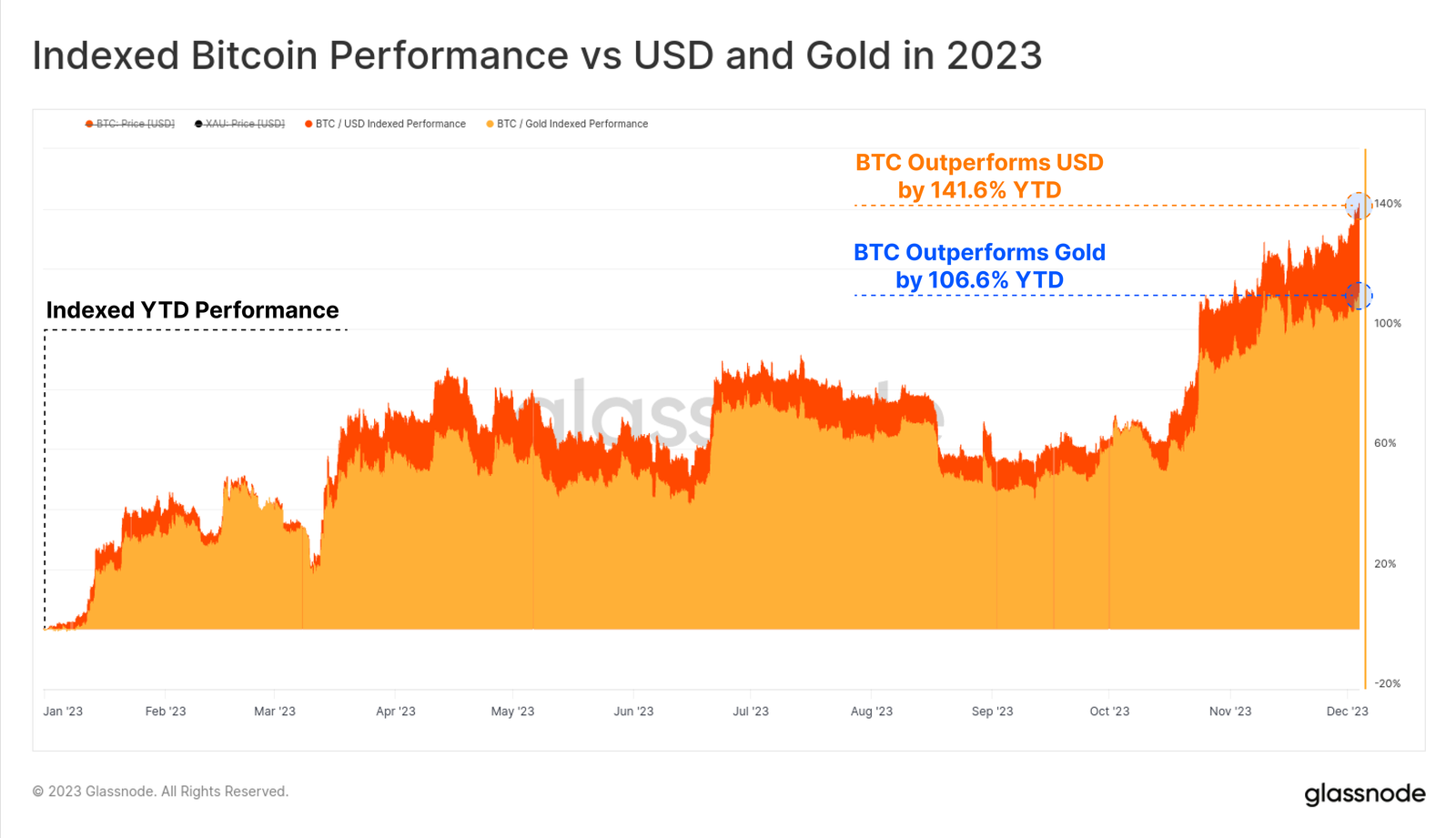

Throughout the year 2023, Bitcoin has proven to be a leading asset in terms of performance, solidifying its position as one of the best-performing assets globally. With an increase of over 140% year-to-date, BTC has consistently outperformed other asset classes, including gold, doubling its relative value.

Bitcoin’s recent breakthrough of the psychological $40,000 level marks a key point in an exceptional year for the cryptocurrency. Its outstanding performance is further highlighted when compared to the performance of other cryptocurrencies, such as Ethereum, and the overall digital asset market. While BTC achieved a growth of 140.6% in its value against the US dollar, Ethereum and other altcoins recorded more moderate growth, with increases of 79.4% and 62.3%, respectively, in their market capitalization.

Analyzing Bitcoin’s performance in previous cycles reveals a striking similarity to the 2015-17 and 2018-22 cycles in terms of recovery duration and drawdown from the historical peak. The current 37% decline from the ATH compares to similar pullbacks in previous cycles, suggesting recurrent cyclical patterns in Bitcoin’s trajectory.

The Fundamental Role of Exchanges in Bitcoin’s Success

The role of exchanges in this context is also crucial. Despite the decrease in the number of transactions depositing funds into exchanges, the total volume on these platforms has seen substantial growth, surpassing $3 billion, a 220% increase. This growth is directly associated with increasing investor interest in trading, accumulating, and speculating using exchange services.

Regarding profitability for long-term holders, BTC’s rise above key levels positioned the majority of investors in profit territory. The proportion of long-term holders’ holdings in profit increased from 56% to 84%, surpassing even the historical average of 81.6%. Historically, this situation has coincided with positive transitions towards strong bull markets.

The analysis of coin spending, evaluated through the SOPR metric, indicates that most spent coins are currently generating profits for both short and long-term holders. The persistence of this condition for 44 days, beyond the historical average, suggests strong demand and sustained backing of the bullish trend.