TL;DR

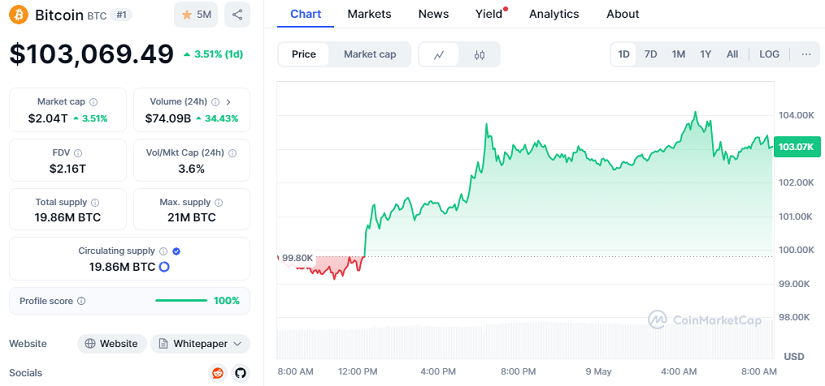

- Bitcoin has surged past $103,000, marking a 3.51% increase in the last 24 hours and pushing its individual market capitalization to $2.04 trillion.

- A trade deal between the United States and the United Kingdom, combined with strong inflows into bitcoin ETFs, has sparked massive market optimism.

- Over $800 million in short positions were liquidated, with altcoins like Ethereum, Cardano, and Dogecoin soaring between 10% and 20%.

The crypto market is experiencing one of its most exciting and dynamic moments of the year: Bitcoin (BTC) has climbed above $103,000, specifically hitting $103,069.49, representing a 3.51% gain over the past 24 hours. This surge has propelled its market capitalization to an impressive $2.04 trillion, further cementing its dominance within the digital ecosystem and showcasing its remarkable resilience amid recent macroeconomic pressures and regulatory challenges worldwide.

This jump is not happening in isolation: altcoins like Ethereum (ETH) soared 20%, while Cardano (ADA) and Dogecoin (DOGE) posted gains over 10%. The buying frenzy has triggered more than $800 million in short liquidations, marking the largest figure since 2023 and leaving bearish traders licking their wounds.

Altcoin Explosion Sparks Massive Liquidations

The catalyst behind this bullish frenzy is multi-faceted: the historic trade agreement between the U.S. and the U.K. has reignited investor confidence, while record-breaking inflows into bitcoin ETFs have shown that institutional demand is far from exhausted or slowing down. According to CoinGlass data, over 84% of the liquidations came from short positions, highlighting the strength and speed of the buying momentum. Binance and OKX, two of the world’s largest exchanges, accounted for more than $500 million in these losses combined, underscoring the global impact of the rally.

Ethereum not only led in profitability but also in volume, contributing $310 million to total liquidations. This renewed interest in ETH may be linked to its recent Pectra upgrade, which improves network efficiency and scalability while drawing in both retail and institutional attention. Solana (SOL), Binance Coin (BNB), and XRP also joined the rally, each posting gains of at least 7%.

Bullish Outlook And Renewed Optimism

Analysts emphasize that these kinds of “short squeezes” are not just fleeting moments of euphoria but signal a shift in market narrative. The appetite for risk has returned with force, making it clear that investors are ready to challenge Wall Street’s old rules.

With Bitcoin surpassing $103,000, many now see this moment as an open door to new all-time highs, fueled by an explosive combination of favorable macroeconomic factors, technological advancements, and growing institutional adoption.