TL;DR

- The price of Bitcoin has reached $106,000 after the release of US GDP data, which came in below expectations, favoring cryptocurrencies.

- Bond yields and the US dollar weakened, driving a rebound in the crypto market.

- Analysts expect BTC to stay above $106,000, which could lead to a sustained bullish movement and benefit other cryptocurrencies.

Bitcoin’s price touched $106,000 after the release of the US Gross Domestic Product (GDP) data, which surprised by coming in below market expectations. The Q4 2024 GDP figure showed a growth of 2.3%, while a 2.5% increase had been forecast. This variation triggered a series of reactions in the financial markets, favoring Bitcoin and other cryptocurrencies.

As a result of this news, bond yields dropped, and the US dollar weakened, leading to a rebound in the crypto market, which had been experiencing sideways movements in recent weeks. The market has now started to recover and is poised for a potential breakout to higher levels.

In technical terms, Bitcoin’s price is in a key zone, with many analysts expecting it to surpass $106,000. A breakout above this level could generate a more sustained bullish movement, with positive implications for the crypto market in general. As shown by Coinmarketcap’s chart, BTC is trading above $106,000 and has recorded a daily increase of 4.25%. The expectation is that if BTC manages to consolidate above these values, the bullish momentum will extend to other cryptocurrencies.

Bitcoin Brings Relief to the Crypto Market

Bitcoin’s recovery has already extended to the rest of the crypto market, which has seen a 4.5% rise and a 27% increase in volume. Ethereum (ETH) gained 5.1%, reaching $3,260. XRP (XRP) recovered 2% of its value and is priced at $3.13 per unit. Solana (SOL) is approaching $242 after a 5.85% increase. BNB (BNB) surpassed $680 after climbing 2.5%. Dogecoin (DOGE) reached $0.337 following a 4% rise. Cardano (ADA) is priced at $0.98 after a 6.2% increase. Finally, Chainlink (LINK) reached $25 per unit after an 11% climb.

Macroeconomic Scenario

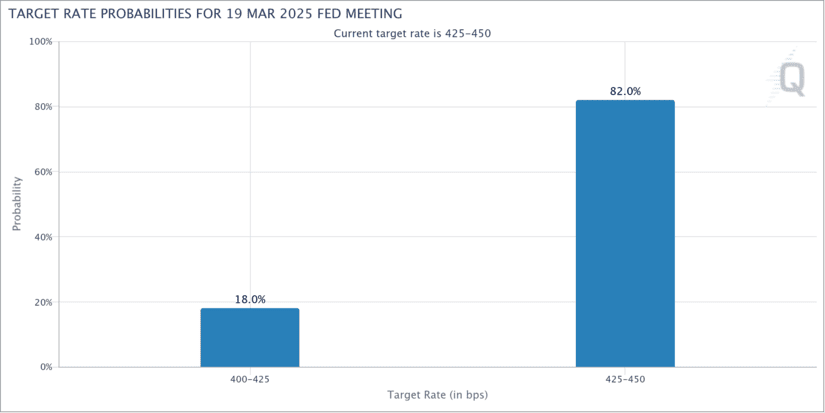

At the same time, the US dollar index (DXY) experienced a significant drop, while stock indices like the S&P 500 and Nasdaq opened with gains of around 0.5%. This signals the beginning of a search for alternative assets amid the dollar’s weakness and expectations that the Federal Reserve (Fed) will keep interest rates high for longer. In fact, the chances of a rate cut at the Fed’s next meeting in March are only 18%.

This macroeconomic scenario has led analysts to reaffirm their optimism regarding cryptocurrencies. According to experts, a strong performance from Bitcoin could reactivate the market, particularly benefiting altcoins with solid fundamentals. Attention is focused on the upcoming data from the Personal Consumption Expenditures (PCE) Index, which will be released on January 31. This index is crucial for assessing inflationary pressures and the Fed’s future monetary policy.