Bitcoin (BTC) prices are under pressure as bears double down.

As it is, the immediate trend is southwards, and BTC is distributing.

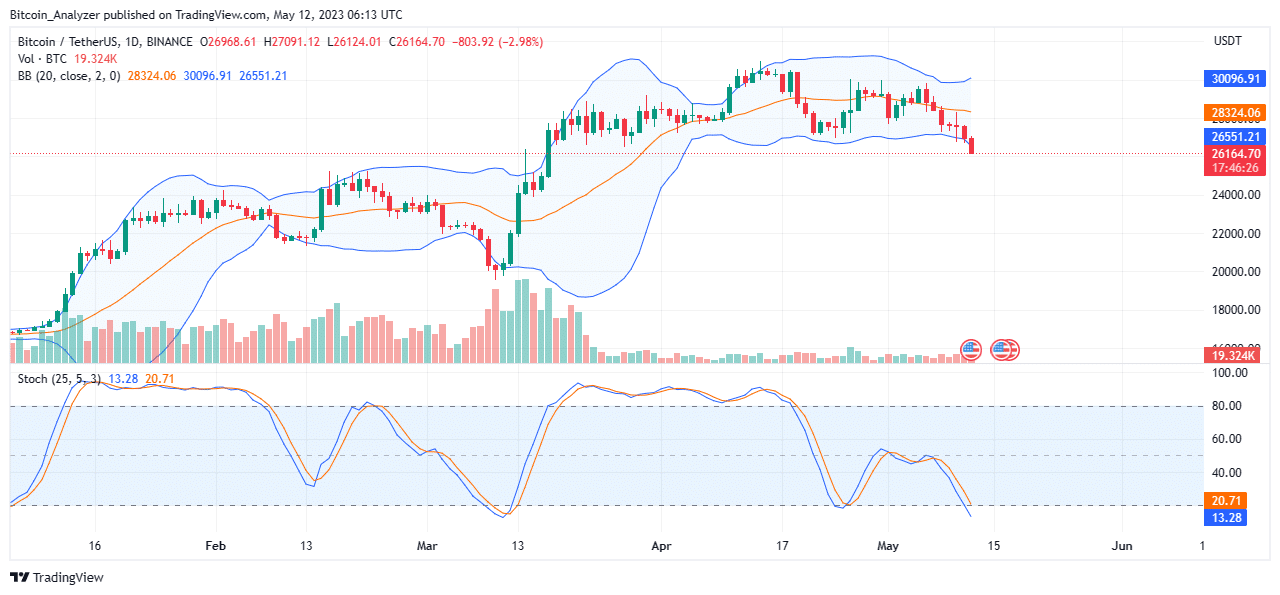

With bears down below $27k, there are indicators that sellers are back. Any confirmation of May 11 losses may initiate more dumps, forcing BTC towards $25k or lower in the sessions ahead.

This preview is valid if prices are below $28.3k and $31k, marking April 2023 peaks.

Open Interest Falling, Marathon Digital Holdings Summoned

This development is amid news that Bitcoin’s open interest across derivatives exchanges like Binance, ByBit, OKX, and others, are at a one-month low.

The contraction could suggest that traders are steering clear of the coin, avoiding trading with leverage in the current choppy conditions.

Ultimately, this may push trading volumes lower, affecting general liquidity.

Still, it is yet to be seen how this will pan out in the days ahead, especially as a new bearish trend is emerging, reading from the current price action.

Whether BTC will track lower, breaking out from the recent consolidation may push open interest higher.

Meanwhile, Marathon Digital Holdings has been subpoenaed by the United States Securities and Exchange Commission (SEC) for the second time.

The Bitcoin miner was summoned because of the farm’s transaction with third parties.

It also emerged that the miner doesn’t plan to increase their BTC holdings from the open markets.

Bitcoin (BTC) Price Analysis

Bitcoin is brittle when writing, slumping under the weight of sellers, reading from the candlestick in the daily chart.

Prices are below the $27k level, under pressure, and likely to continue dumping this weekend. Whether prices will recover depends on the engagement volumes; an indicator of participation.

Presently, the immediate resistance is at $28.3k. As long as prices are trending below this mark, traders can look to short, riding the breakout formation emerging following the crack below $27k, or April 2023 lows.

Further supporting the bearish preview is the banding of bear bars along the lower BB. This suggests sellers are building up their selling pressure, a net negative for BTC holders, optimistic of a recovery.

The short-term target for bears will be $25k and $21.5k.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Bitcoin News.