TL;DR

- Historic BBW compression below 100 signals potential parabolic Bitcoin breakout without prior weakness.

- Current BTC rally shows volatility expansion, strong liquidity inflows, and rising technical momentum indicators.

- On-chain metrics reveal sustained accumulation, higher hashrate, growing activity, and consistent institutional participation.

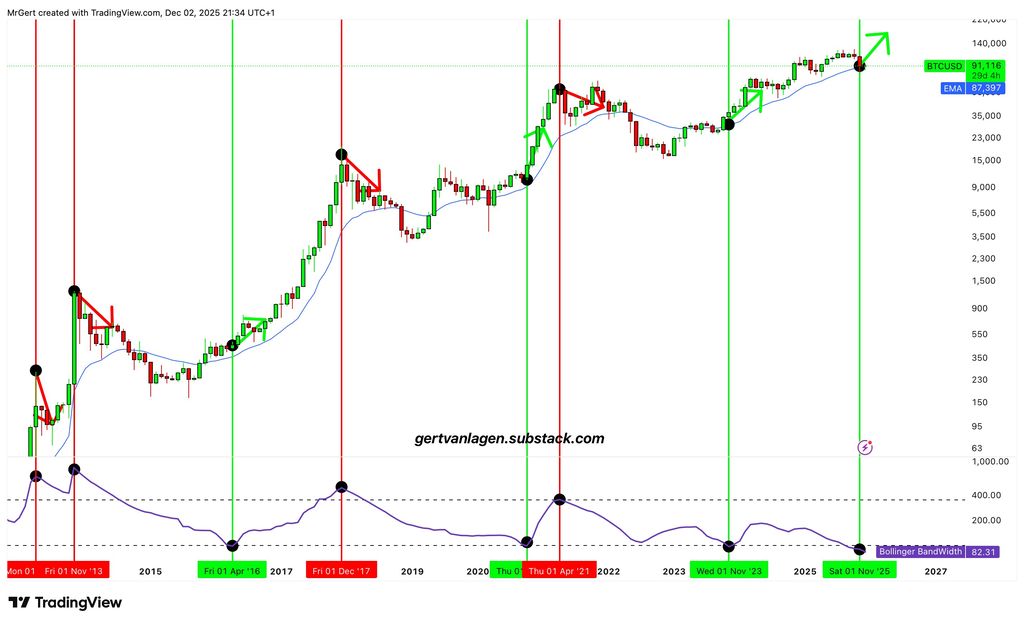

A recent tweet from @GertvanLagen has captured the attention of Bitcoin enthusiasts, highlighting a rare “green signal” triggered by the Bollinger Band Width (BBW) on the monthly chart of $BTC dropping below 100.

Historically, this indicator has foreshadowed direct parabolic bullish rallies, and the absence of a preceding “red signal” only amplifies the optimism.

$BTC [1M] – Bollinger Band Width just dipped below 100 — flashing a rare green signal.

Historically, every time this triggers, Bitcoin follows with a direct parabolic leg up.

No red signal flashed in the previous months… pic.twitter.com/PoAM9hgHfV

— Gert van Lagen (@GertvanLagen) December 2, 2025

According to macro strategist Gert van Lagen, Bitcoin’s Bollinger BandWidth indicator has reached its lowest level of all time on the monthly timeframe. This indicator measures the percentage difference between the upper and lower Bollinger bands, functioning as a leading gauge of price volatility.

“Historically, every time this indicator triggers, Bitcoin responds with a direct parabolic rise” commented Van Lagen in his most recent analysis. The data shows that BandWidth rarely falls below 100 on its scale, and each time it does, the BTC price reacts strongly.

Parallel with November 2023

The last similar “green signal” occurred in early November 2023, a period after which Bitcoin’s price doubled in just four months. Analysts point out that the current setup is identical to the one that preceded that massive bullish movement.

Van Lagen also compared this setup to Google’s (GOOGL) behavior before its final bullish wave prior to the 2008 financial crisis. “A cascade of lower highs in the Bollinger BandWidth, which breaks to fuel the subsequent long-term bearish volatility” explained the analyst.

Importance of the Psychological Level

The current price of Bitcoin (BTC) stands at $92,765 USD, reflecting a +6.13% increase over the last 24 hours, signaling a strong bullish impulse following a week of consolidation. The market capitalization now exceeds $1.85 trillion, while 24-hour trading volume has surged to $85.8 billion, up nearly 20%, indicating a significant inflow of liquidity into the market.

From a technical standpoint using Bollinger Bands, Bitcoin is showing a broad volatility expansion, a clear sign of heightened activity and positive momentum. The price currently trades slightly above the upper Bollinger Band, located around $91,800 USD, while the lower band sits near $87,200 USD and the 20-period moving average (middle band) remains around $89,500 USD. This configuration reflects strong buying pressure, though it also hints at a possible short-term correction if BTC fails to consolidate above the key resistance at $93,000 USD.

On-chain data reinforces this bullish momentum

Institutional and retail accumulation remains strong, with exchange inflows decreasing steadily, indicating a hold strategy among major investors. The Bitcoin hashrate has reached a new all-time high, underscoring network security and miner confidence. Additionally, long-term holder reserves have increased by 1.8% in the past week, while active unique addresses are up 4.2%, showing continued adoption and network expansion.

From a fundamental perspective, several key developments have driven recent market optimism:

- U.S. Bitcoin ETFs have seen over $2.1 billion in net inflows during the past seven days, signaling renewed institutional appetite.

- Both the Bank of England and the European Central Bank released reports acknowledging Bitcoin’s role as a hedge against expansionary monetary policies.

- El Salvador and Argentina announced new pro-Bitcoin regulations, promoting institutional adoption of BTC as a strategic financial asset.

- Additionally, BlackRock’s CEO stated that Bitcoin is “becoming a permanent asset class,” further fueling bullish sentiment across global markets.

The current price level holds crucial importance for the 2025 yearly candle. Bitcoin started the year at $93,500, and as analyst Rekt Capital points out: “Bitcoin has an entire month to rise 2% and close the year above the $93,500 Four-Year Cycle level, ending the year with a green candle.“

Trader Daan Crypto Trades acknowledges that “the price has now made a higher high and a higher low, so technically the market structure is back to bullish on this timeframe. But for this to really move forward, I want to see it hold above this current price zone.“

With the year coming to an end, market eyes are on whether Bitcoin will be able to capitalize on this historic technical signal to close 2025 strongly. If the historical pattern repeats, investors could be witnessing the first signs of a parabolic movement that could take Bitcoin to new highs before its next bear cycle begins.