TL;DR

- Bitcoin broke below its 12-month moving average for the first time since 2022.

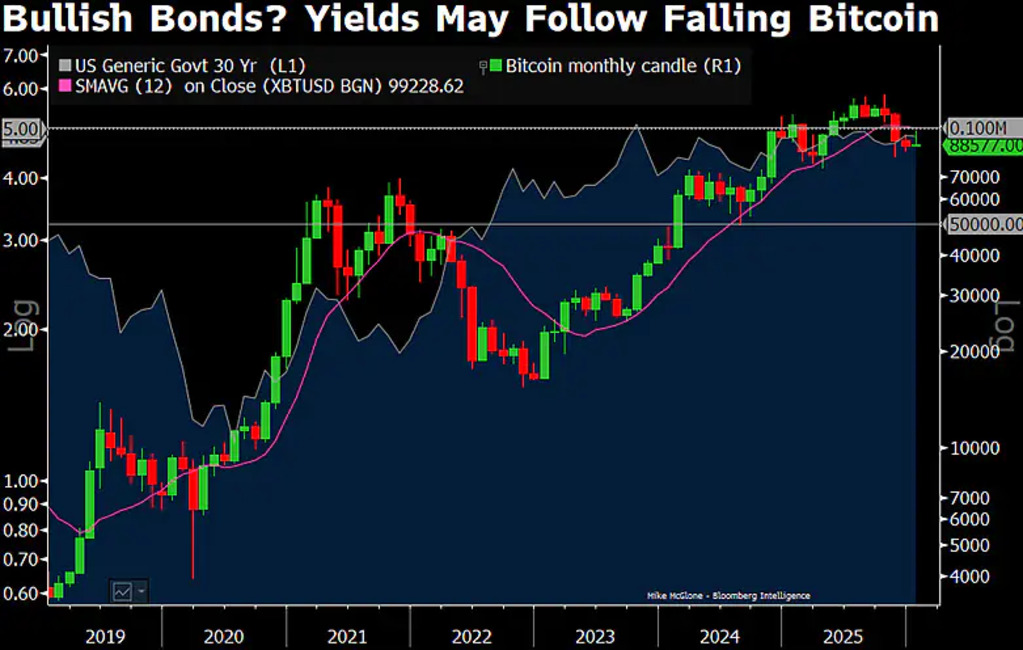

- Its $100,000 resistance mirrors the 5% yield ceiling on US 30-year Treasuries.

- Key technical support is at $87,000, with potential for a drop to $78,000.

Bitcoin shows growing signs of macroeconomic stress by trading below its 12-month moving average for the first time since 2022, a development that historically carries deflationary implications. The move occurs as the price hovers around $87,000, a level now acting as a critical line for market sentiment.

The break below the long-term trend has reopened the debate over whether the flagship cryptocurrency is entering a prolonged consolidation phase or setting the stage for a deeper correction.

Key 2026 Ceilings? $100,000 Bitcoin, 5% Treasury Bond –

For the first time since 2022, Bitcoin is below its 12-month moving average, with deflationary implications. If this leading indicator and first-born crypto keeps putting distance under $100,000, it may gain followers. Akin… pic.twitter.com/X1fkrBIHfh— Mike McGlone (@mikemcglone11) January 25, 2026

Mike McGlone of Bloomberg shared an analysis arguing that Bitcoin’s struggle to regain momentum below $100,000 mirrors stress signals emerging in traditional markets, particularly US government bonds. McGlone maintains that Bitcoin and long-dated Treasuries now tell a similar story about slowing growth and tightening financial conditions.

Bonds and Bitcoin Reflect the Same Macroeconomic Pressure

One of the most striking parallels highlighted in the analysis is the behavior of the US 30-year Treasury yield. Despite repeated attempts, long-term yields have failed to remain sustainably above the 5% level. The inability to hold higher yields suggests waning confidence in aggressive growth and inflation scenarios.

In McGlone’s framework, Bitcoin’s $100,000 level functions much like the 5% threshold for 30-year Treasuries: a psychological ceiling that markets have struggled to break decisively. Both assets peaked in 2025, with Bitcoin reaching approximately $126,000 while the 30-year yield topped out near 5.15%.

As of late January 2026, the figures retreated to around $88,600 for Bitcoin and approximately 4.83% for bond yields, reinforcing the idea that broader macroeconomic forces are pulling risk assets lower.

From a market structure perspective, Bitcoin is sitting directly on a major support zone around $87,000. Data from onchain analysis models show the area has repeatedly acted as a stabilizing point during previous pullbacks.

The broader implication of the signals is that Bitcoin increasingly behaves like a macro asset, responding to the same forces influencing bonds, liquidity conditions, and growth expectations.

As long as long-term yields struggle to rise and financial conditions remain tight, Bitcoin may find it difficult to reclaim higher levels quickly. The market searches for direction amid global economic uncertainty and mixed signals from central banks about future monetary policy.

The correlation between Bitcoin and traditional financial instruments has strengthened over recent months. Investors now watch Treasury yields, Federal Reserve policy statements, and macroeconomic data releases as closely as on-chain metrics when positioning for crypto trades.

McGlone’s analysis suggests the $100,000 resistance for Bitcoin and the 5% ceiling for 30-year Treasuries represent more than technical barriers. Both levels embody market skepticism about whether current economic conditions can support sustained risk-taking at elevated valuations.