TL;DR

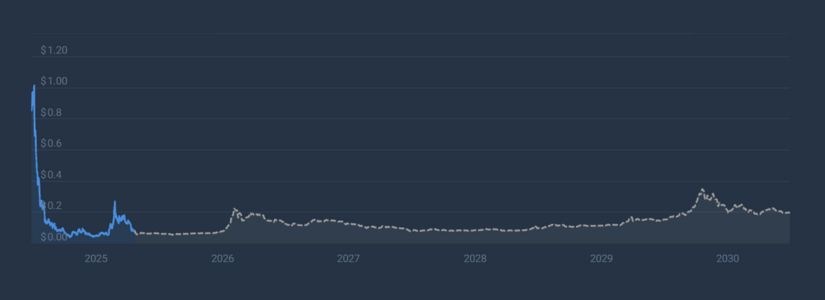

- 2025–2026 Outlook: BIO shows mixed signals, with ranges from $0.0409–$0.2118, reflecting both modest growth potential and downside risk.

- 2027–2028 Momentum: Forecasts highlight stronger upside, with prices projected between $0.25–$0.54, driven by adoption and market expansion.

- 2029–2030 Long-Term View: BIO could mature into a more stable asset, averaging $0.49–$0.65, with highs near $0.80 and firm support around $0.50.

Bio Protocol has emerged as one of the most intriguing projects within the blockchain and digital asset ecosystem. Positioned at the intersection of DeFi, decentralized technological innovation, and real-world application, it has captured the attention of both investors and industry analysts. As the cryptocurrency sector matures, projects like Bio Protocol are increasingly evaluated not only for their immediate utility but also for their long-term potential. This has led to growing interest in structured price prediction analyses, particularly for the mid- to long-term horizon spanning 2025 to 2030.

Why Long-Term Outlook Matters

For Bio Protocol, the years between 2025 and 2030 represent a critical window in which its ecosystem could either consolidate its position or face challenges from emerging competitors. Long-term outlooks allow stakeholders to assess how external factors may influence the trajectory of the project.

Factors Shaping the Discussion

When considering the future of Bio Protocol, analysts often highlight several recurring themes. These include the project’s ability to maintain developer engagement, expand its partnerships, and adapt to evolving regulatory frameworks. Additionally, the role of community governance and the integration of sustainable practices are increasingly relevant in shaping perceptions of long-term viability. While no specific forecasts are provided here, these factors form the foundation upon which future projections are built.

Setting the Stage for 2025–2030

This article will explore the broader context surrounding Bio Protocol’s potential over the next decade. By examining technological, economic, and social dimensions, readers will gain a structured framework for understanding how the project may evolve. The following sections will delve deeper into these aspects, setting the stage for detailed price prediction discussions covering 2025 through 2030.

Bio Protocol (BIO) Price Prediction 2025 to 2030

Bio Protocol Price Prediction for the rest of 2025

In 2025, CoinCodex projects that BIO could trade within a relatively narrow channel, fluctuating between $0.0593 and $0.0848. This range suggests an average annualized price of approximately $0.0672, representing a potential return on investment of -25.68%. Such an outlook highlights the possibility of downward pressure on the asset.

On the other hand, alternative technical analysis presents a more optimistic scenario for BIO in 2025. According to this forecast, BIO could reach a peak price of $0.2030, with the average price for the year projected at $0.1692. Even in a more conservative view, the lowest expected price point is estimated at $0.1353, which still positions the token significantly higher than the bearish outlook.

Bio Protocol Price Forecast 2026: Key Factors to Watch

According to CoinDataFlow’s latest experimental simulation, Bio Protocol could experience modest growth in 2026 under favorable conditions. The model suggests a potential rise of 4.59%, bringing the token’s value to approximately $0.1182. Throughout the year, the price is projected to fluctuate within a channel ranging from $0.1182 to $0.0409, reflecting both the opportunities and risks inherent in emerging crypto assets.

In contrast, another forecast envisions a more expansive trading channel for Bio Protocol in 2026, ranging between $0.1122 and $0.2118. Within this scenario, Bio Protocol is expected to average around $0.1508 for the year, suggesting stronger momentum compared to the more conservative projection.

Bio Protocol Price Prediction 2027: Growth Potential and Risks

Analysts from DigitalCoinPrice predict that Bio Protocol could experience a notable upswing by 2027. Their outlook suggests BIO may open the year near $0.33 and trade around $0.41 as the months progress. Compared with the previous year’s levels, this represents a substantial increase, signaling stronger momentum and growing investor confidence.

Another forecast envisions Bio Protocol stabilizing within a wider accumulation range above $0.25, with buyers maintaining control of the market. Under this scenario, the token could advance toward $0.50, while the average trading price for the year may hover near $0.36. Support is expected to remain firm around $0.25 during potential pullbacks, suggesting resilience despite volatility.

How Bio Protocol Could Navigate Industry Shifts in 2028

For 2028, projections suggest that Bio Protocol could trade within a relatively modest channel, ranging between $0.0828 and $0.1199. This movement would result in an average annualized price of approximately $0.0888, representing a potential return on investment of 9.00% compared to current benchmarks.

In contrast, a more ambitious forecast envisions a scenario driven by the widespread adoption of Bio Protocol on a global scale. Under this perspective, the token could reach a potential ceiling of $0.5415 in 2028, with an average price projected at $0.5076 and a minimum level near $0.4738. These figures, derived from technical analysis of adoption patterns and broader market trends.

Bio Protocol 2029: Assessing Resilience Before the Next Cycle

Experimental simulations for Bio Protocol suggest that 2029 could mark a year of substantial growth. Under the most favorable conditions, BIO’s value is projected to rise by 371.74%, potentially reaching $0.5335. Throughout the year, the token is expected to fluctuate within a trading range between $0.5335 and $0.1716, reflecting both the opportunities and risks associated with high-volatility assets.

Building on the bullish momentum of the previous year, 2029 is anticipated to remain strong in comparison. Forecasts indicate that Bio Protocol could average around $0.4913 during the year, with notable fluctuations between a low of $0.2858 in February and a high of $0.6661 in December.

Can BIO Sustain Momentum Into 2030 and Beyond?

Market projections for 2030 suggest that Bio Protocol could cross a significant threshold, with estimates placing its value above $0.57. Analysts anticipate that the token may fluctuate between a minimum of $0.54 and a maximum of $0.61 during the year. This range reflects a relatively stable outlook compared to earlier years, pointing to a maturing phase in BIO’s market behavior.

Looking further into 2030, some forecasts highlight the possibility of Bio Protocol approaching a key valuation zone near $0.80. This scenario is supported by expectations of expanding ecosystem use cases and broader adoption, which could sustain an average price around $0.65. At the same time, $0.50 is projected to serve as a strong multi-year support level.

Conclusion

The trajectory of Bio Protocol between 2025 and 2030 illustrates both the promise and the uncertainty inherent in emerging blockchain projects. Across the forecasts reviewed, BIO demonstrates a wide spectrum of possibilities, from modest, incremental gains to substantial growth fueled by adoption and ecosystem expansion. This divergence underscores the dual nature of crypto assets.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.