TL;DR

- Binance remains the leading exchange, but in 2025 the competition among centralized platforms is bringing new stars into the spotlight.

- Gate cements its role as the breakout exchange with $923B in futures, over $600B in spot, 300 Launchpool campaigns, and the launch of its GUSD stablecoin.

- The battle is shifting toward tokenization, regulatory licenses, and bridges with traditional finance, where Binance, OKX, and Gate pursue distinct strategies.

Binance continues to dominate global crypto trading, but competition among centralized exchanges is starting to show clear changes in 2025.

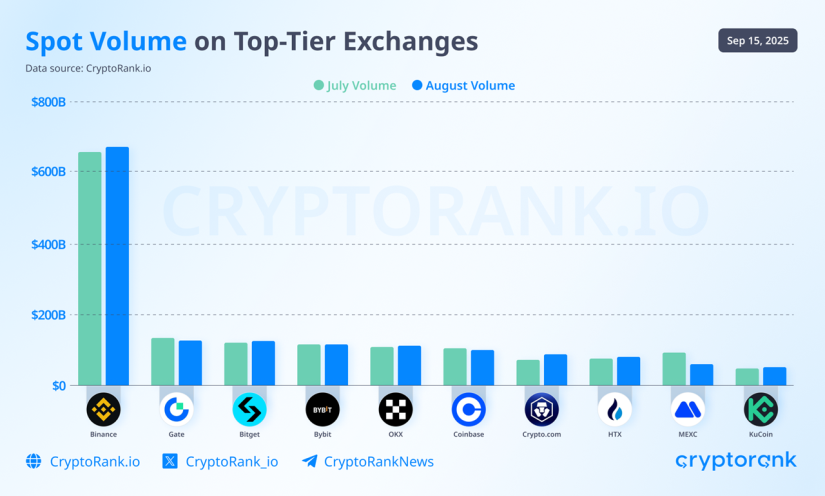

In August, Binance surpassed $600B in spot trading and reached $3.25T in futures, keeping more than one-third of the market. OKX followed with $1.26T in derivatives, while Gate emerged as the big surprise: posting over $600B in spot and $923B in futures, climbing to the second spot globally in spot volumes.

Gate, The Industry’s Breakout Player

The quarter marked a rebound compared to the second, when volumes had dropped to $3.63T in spot and $20.2T in derivatives. By the third quarter, growth is already 19% higher than 2024 in spot and 25% in futures, fueled by Bitcoin trading above $100K, the arrival of ETFs, and expectations of Federal Reserve rate cuts. Still, geopolitical tensions and unclear regulations continue to limit activity.

The strategy of top exchanges is moving beyond reliance solely on spot and derivatives. Binance is pushing asset tokenization through YZi Labs, closed a custody deal with BBVA in Spain, and partnered with Franklin Templeton to launch tokenized products. OKX is expanding with X Layer, its own blockchain, and rolled out an exchange and a wallet in the United States, integrating USDG and CCTP while securing major partnerships like PayPal for purchases in Europe.

Exchanges Focus on Tokenization and Ties With Traditional Finance

Gate, meanwhile, has strengthened its position as a hybrid platform between retail innovation and institutional infrastructure. It was the only top exchange to conduct sales in July and August, with IKA and PUMP raising $15M. It surpassed 300 Launchpool campaigns with over $95M distributed in airdrops, $38.6B in funds mobilized, and 6M users. In new token listings, it increased its share to 10%, and launched GUSD, a token backed by US Treasuries that has already issued $171M, while partnering with BitGo for institutional settlement.

Reserve reports show Binance holding 608K BTC and $31.25B in USDT, OKX with $33.7B in audited assets, Gate with $12B and a 124% ratio, and Bitget at 188%. The competition is now shifting toward regulatory licenses and building bridges with traditional finance. In this landscape, Binance keeps the top spot, OKX expands its own infrastructure, and Gate establishes itself as the fastest-rising exchange