TL;DR

- Binance experienced a 21% decline in derivatives trading volume in September, reaching $1.25 trillion, the lowest level since October 2023.

- Spot trading volume also decreased by 22.9%, totaling $344 billion, the lowest figure since November 2023.

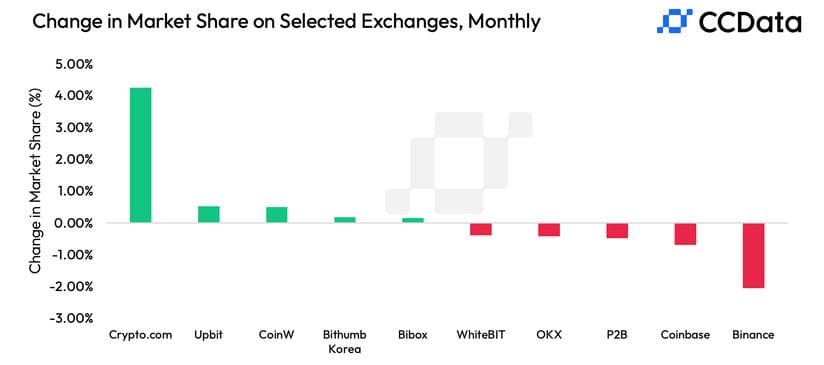

- Crypto.com, its competitor, grew by 40.2% in spot trading and 42.8% in derivatives, reaching a market share of 11%.

The derivatives market of Binance, one of the largest cryptocurrency exchanges in the world, has suffered a notable decline in trading activity during the month of September.

According to a CCData report, the derivatives trading volume on Binance fell by 21%, reaching $1.25 trillion, marking the lowest level since October 2023. The decline has also affected its market share in derivatives, which stood at 40.7%, the lowest percentage since September 2020.

Poor Numbers for the Exchange

The decrease in derivatives trading has been accompanied by a sharp drop in spot trading volume, which experienced a decline of 22.9%, totaling $344 billion. This figure represents the lowest monthly volume in spot trading since November 2023 and has reduced Binance’s market share in this segment to 27%, the lowest percentage since January 2021. When considering both spot and derivatives trading, the combined market share of the exchange fell to 36.6%, a figure that also marks a low since September 2020.

A Challenge to Binance’s Dominance?

However, Binance continues to lead the spot trading market among centralized exchanges, maintaining its dominant position in the market. Nevertheless, the growth of its competitor Crypto.com has been notable.

This exchange experienced a 40.2% increase in its spot trading volume, reaching $134 billion, and a 42.8% increase in derivatives, totaling $149 billion. As a result, Crypto.com has achieved a combined market share of 11%, positioning itself as the fourth largest exchange by volume in the market.

A Possible Upsurge

Overall trading activity on centralized exchanges has reflected the decline in Binance, with a total drop of 17% in the combined trading volume of spot and derivatives, reaching $4.34 trillion, which constitutes the lowest monthly volume since June. This trend aligns with historical seasonal patterns that typically show a reduction in trading activity toward the end of summer.

Analysts anticipate a resurgence in trading activity in the coming months, especially if the U.S. Federal Reserve begins to cut interest rates, which could lead to an increase in liquidity and attract capital into riskier assets, including cryptocurrencies