TL;DR

- Binance’s announcement about listing RESOLV triggered a 617% price surge on decentralized exchanges within a few hours.

- Resolv Labs raised $10 million and is developing a delta-neutral stablecoin protocol, backed by Coinbase as an investor.

- Binance will delist five spot pairs and disable associated bots starting June 6.

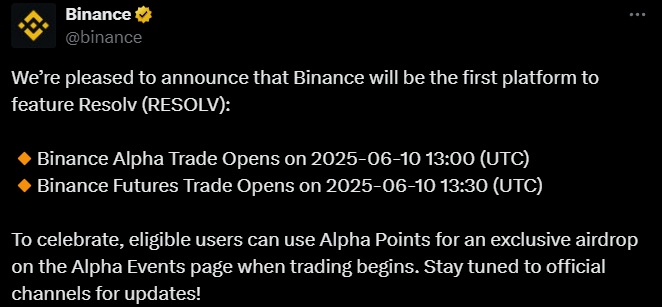

Binance confirmed it will add the Resolv (RESOLV) token to its Alpha and Futures platforms on June 10. The announcement immediately sent the token’s price soaring on decentralized exchanges, where it climbed 617% in a matter of hours, according to data from GeckoTerminal. Such sharp market moves have become common when a cryptocurrency secures a listing on high-volume platforms like Coinbase or Upbit.

RESOLV trading will go live on Alpha at 13:00 UTC, with Futures launching at 13:30 UTC that same day. In addition, Binance will host an exclusive airdrop for selected users who hold Alpha Points. This airdrop will be available through the Alpha Events section, starting alongside trading activity.

Resolv Labs, the company behind the token, secured $10 million in a seed funding round. The firm is currently building a delta-neutral stablecoin protocol, designed to limit exposure to market volatility. Coinbase appears among the project’s investors, which has further fueled expectations surrounding RESOLV’s performance once it debuts on a centralized platform.

Binance to Remove Several Spot Trading Pairs

Alongside the listing news, Binance announced it will delist five spot trading pairs starting June 6 at 03:00 UTC. The affected pairs are ACX/FDUSD, IDEX/FDUSD, ORCA/FDUSD, THETA/FDUSD, and XAI/FDUSD. However, the tokens from those pairs will remain available for trading against other active pairs on the platform.

As an additional measure, Binance will disable spot trading bots linked to these pairs. The exchange advised users to update or cancel their bot configurations ahead of the deadline to avoid unintended trades on delisted pairs.

The market’s swift reaction to the RESOLV announcement once again highlighted how quickly certain platforms can send asset prices soaring within minutes. In recent days, similar surges followed the listings of HYPE on Binance.US and ENA on Coinbase, where prices jumped 6% and 8.6%, respectively, right after the announcements