TL;DR

- “Based Rollups” could transform Ethereum’s economic structure by aligning incentives between layer-2 solutions and layer-1 validators.

- This approach uses layer-1 validators for transaction processing, unlike other rollups that employ their own sequencers.

- The interoperability of “Based Rollups” may enhance liquidity access and gas demand, potentially allowing for zero ETH issuance in the long term while maintaining high staking yields.

The “Based Rollups” proposal is gaining attention as an innovative solution to address incentive problems within the Ethereum network.

This approach could profoundly alter the economic structure of the ecosystem, especially concerning the usage and demand for Ethereum (ETH). The key to this proposal lies in its ability to align incentives between layer-2 (L2) solutions and layer-1 (L1) validators, which could result in an exponential increase in long-term demand for ETH, up to 100 times.

So a based rollup is a type of L2.

It still saves the data in a compressed format on the L1.

But instead of its own sequencer, it relies on L1 validators to process the transactions.

They still use rollup bundling, systems called “prconfirmation commits” and other features, to…

— Adam Cochran (adamscochran.eth) (@adamscochran) September 10, 2024

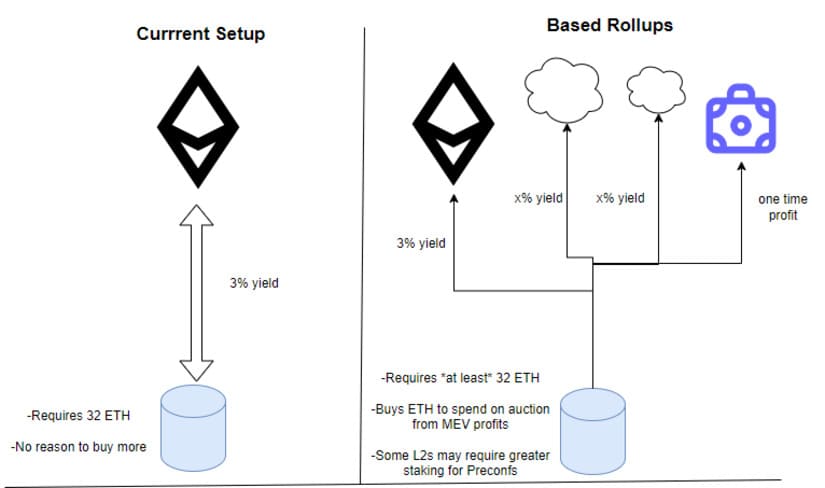

“Based Rollups” represent a layer-2 scaling solution that, unlike other solutions, uses layer-1 validators instead of their own sequencers for transaction processing.

Realigning Incentives in Ethereum

This methodology could transform ETH monetization by making fundamental changes to incentive structures. The proposal could massively increase ETH demand by providing an additional incentive for layer-1 validators who choose to participate in processing these rollups. This translates to an increase in the value of ETH staking, resulting in higher yields for investors.

The interoperability of “Based Rollups” with other rollups could also enhance liquidity access, facilitate cross-chain settlement transactions, and raise overall gas demand on the network.

The Path to Zero Issuance

This approach could enable zero ETH issuance in the long term while maintaining high staking yields. The transformation in the staking incentive structure would be driven by widespread use of the Ethereum Virtual Machine (EVM), rather than relying solely on ETH issuance rates.

We are at an ideal moment to implement such solutions. The recent Ethereum update, Dencun, resulted in higher inflation of ETH issuance due to a drastic reduction in layer-2 fees. This reduction, in turn, led to a decrease in burned fees and a drop in network revenue, exacerbating the inflation issue.

Validators participating in rollups could benefit from additional rewards beyond general network inflation rewards. These benefits include participation in Miner Extractable Value (MEV) auctions, where validators can offer ETH to become block validators, or models like pre-confirmation staking and proof of burn, which could require burning ETH to select new layer-2 validators.

More Demand, Less Increase and Greater Competitiveness

Furthermore, the ability of “Based Rollups” to operate across multiple rollups can increase the number of cross-market settlement transactions, thereby raising gas demand on the network without increasing layer-1 gas fees. This dynamic could lead to a scenario where ETH staking yields remain competitive compared to other investments, such as U.S. Treasury bonds.

“Based Rollups” could revolutionize Ethereum’s economic model by realigning incentives between layer-2 solutions and layer-1 validators. This structural change could reduce ETH issuance inflation while maintaining high staking yields, opening new opportunities for ETH monetization and enhancing its market value.