TL;DR

- BaFin has prohibited the public sales of Ethena GmbH’s USDe token, claiming it violates the European Union’s MiCAR regulations and markets unregistered securities.

- The protocol has been ordered to freeze the reserve assets and shut down its website, but secondary sales of USDe will not be affected.

- Despite the denial of its MiCA approval request, the protocol continues to attract institutional investment, raising over $100 million.

The German financial regulator, BaFin, has prohibited the public sales of Ethena GmbH’s USDe token, stating that the asset violates the European Union’s MiCAR regulations.

According to BaFin, the company is marketing unregistered securities in the region, which has led to the freezing of the reserve assets backing the token and the shutdown of its website. Additionally, the company has been ordered to stop accepting new customers.

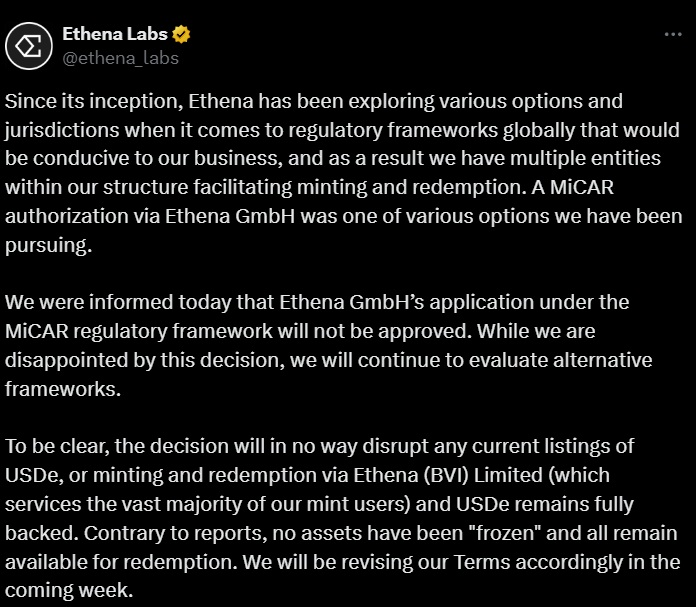

Ethena has responded to BaFin’s decision by stating that, since its inception, it has been exploring various options and regulatory frameworks globally that would benefit its business. Although its application under the MiCAR regulatory framework was not approved, the company continues to evaluate alternative regulatory options.

Additionally, they clarified that this decision will not affect the current listings of the USDe token or its minting and redemption capabilities through Ethena (BVI) Limited, which manages the majority of minting users. The company also denied reports about the “freezing” of assets, stating that all assets remain available for redemption and that terms will be updated in the coming days

On the other hand, the German regulator also expressed concerns about the potential sale of unregistered securities through the sUSDe tokens, which are interconnected with the USDe. Investors can exchange these tokens, reinforcing the accusations that Ethena is operating without the required prospectus.

Despite the ban on the primary issuance and sales of USDe, BaFin clarified that secondary sales of the token will not be affected. On the other hand, Ethena has committed to maintaining the stability of the USDe backing and assured that users will still be able to redeem the token via Ethena BVI Limited.

Ethena Had Requested MiCA Approval

Ethena’s compliance issues don’t stop there. The company had applied for MiCA approval in July 2024 in hopes of being integrated into the European regulatory framework. However, BaFin denied the request in March 2025, citing serious deficiencies in business organization and non-compliance with MiCA requirements.

Regarding token circulation, there are currently around 5.4 billion tokens in circulation, although many of them were issued outside the German jurisdiction before MiCA came into effect.

Despite these regulatory conflicts, Ethena continues to attract institutional investments. In February 2024, the company raised over $100 million to launch a new token, the iUSDe, targeted at institutional investors. Additionally, that same month, the MEXC exchange announced a $20 million investment in USDe, attempting to promote the use of stablecoins