TL;DR

- Babylon Labs secured $15 million from a16z crypto to develop BTCVaults, an infrastructure that enables native BTC to be used as on-chain collateral.

- BTCVaults locks BTC on the base layer and makes the collateral verifiable for external applications, keeping control in the user’s hands.

- Following the announcement, the BABY token rose 13%; the a16z investment includes both capital and strategic support in blockchain infrastructure.

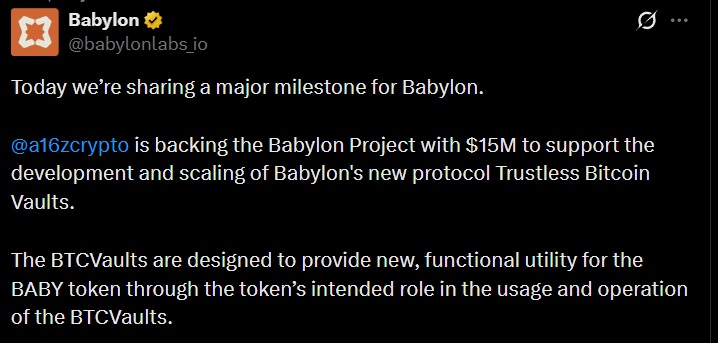

Babylon Labs raised $15 million from a16z crypto to develop and scale an infrastructure that allows native Bitcoin to be used as on-chain collateral without custodians or wrapped versions. The investment was made through a direct purchase of the BABY token and will be allocated to BTCVaults, the project’s core system.

BTCVaults allows BTC to be locked directly on the Bitcoin base layer while making that collateral verifiable for external applications. The system avoids centralized custodians and eliminates the need to convert BTC into synthetic versions. Control of the funds remains with the user, and usage conditions are enforced through cryptographic mechanisms.

Babylon’s Token Surges

After the announcement, the BABY token rose 13%. The price increase followed the a16z crypto investment, which provides both capital and strategic support based on its experience in blockchain infrastructure.

Babylon addresses a specific ecosystem challenge. Most current solutions for using Bitcoin as collateral rely on custodians or wrapped BTC. Both models require giving up control or taking on additional risks. BTCVaults offer an alternative: BTC remains locked on the base network, and external systems can verify its status without intermediaries.

Applications integrating BTCVaults can confirm that collateral remains in place and enforce predefined rules, such as unlocking or liquidation, without human intervention. The design is compatible with decentralized protocols and traditional financial systems.

Bitcoin Continues to Expand Among Institutions

The development of this infrastructure responds directly to the growing institutional use of Bitcoin as collateral. Banks, asset managers, and trading firms already use BTC in loans, derivatives, and structured products. Still, a significant portion of its supply remains inactive on-chain.

Babylon aims to close that gap. BTCVaults will enable new use cases such as lending, borrowing, and other collateralized products without moving assets off Bitcoin or breaking self-custody. The goal is for BTC to function as productive collateral without altering its base properties.

Babylon focuses on expanding the technical capabilities of the system and integrating it with applications that require verifiable collateral. The emphasis is on infrastructure, not intermediation, keeping native Bitcoin central to on-chain financial flows