TL;DR

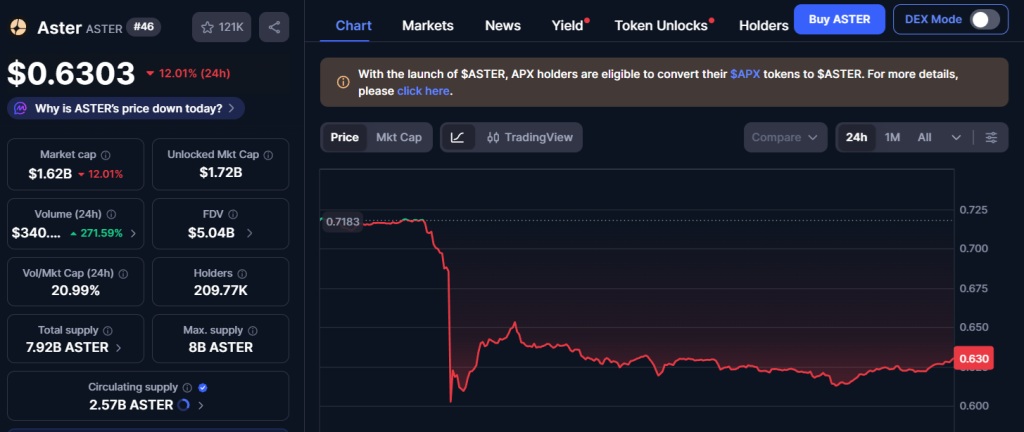

- ASTER fell to a new all-time low, trading at $0.63, down 12% in 24 hours, with a volume of $340 million, a 271% increase.

- The loss of $0.70–$0.68 support after Bitcoin dropped to $92,000 triggered rapid liquidations and moves into low-liquidity zones.

- 96 million tokens will unlock in February 2026, with additional quarterly releases through 2035.

ASTER hit a new all-time low amid high Bitcoin volatility and concentrated selling pressure. According to CoinMarketCap, the token trades at $0.63, down 12% in the last 24 hours, with a volume of $340 million, up 271% from the previous day.

Reasons Behind the Drop

The decline followed a sharp Bitcoin move from $95,400 down to near $92,000. ASTER lost its key support in the $0.70–$0.68 range, triggering a rapid sell-off with high volume. The market structure broke immediately, pushing the price into low-liquidity areas.

In February 2026, 96 million ASTER tokens will unlock, with additional quarterly releases continuing through 2035. This increase in circulating supply creates more selling flexibility. Blockchain data shows a concentration of tokens among large holders, increasing market sensitivity to coordinated sales.

Previous unlock events also affected the token. In October 2025, the token dropped 50% after a phase two airdrop released 320 million tokens. At that time, whales sold roughly 4% of the total supply.

ASTER Needs Bitcoin to Recover

The market reflects structural and supply-driven pressure. ASTER’s maximum leverage, which reaches up to 1001x on its platform, accelerates liquidation cascades during sharp moves. Correlations across altcoins have tightened, intensifying ASTER’s drop after Bitcoin’s volatility.

Competition and some fundamental metrics also contributed to the decline. ASTER’s delisting from DeFiLlama and the relative volume increase in competitors like Lighter indicate significant changes in liquidity and user activity.

Analysts note that the token’s price direction depends on Bitcoin reclaiming $93,000. Until then, selling pressure could remain high. The market continues to monitor upcoming token unlocks and the concentration of tokens among holders to assess future shifts