TL;DR

- Aster has introduced daily buybacks starting October 29, using its existing buyback wallet to support the upcoming S3 airdrop without expanding supply.

- This move aims to keep the circulating token amount steady while boosting holder confidence.

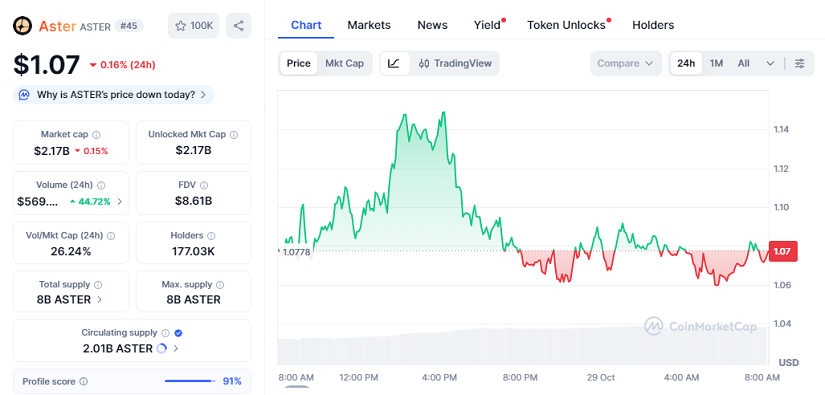

- Current market data shows Aster trading at $1.07, with a slight -0.16% move in the last 24 hours, a market cap of $2.17B, and daily volume above $569M (+44%).

Aster is moving forward with a new phase in its token strategy. The project confirmed that daily buybacks began on October 29, and the S3 airdrop will be backed by tokens already stored in the buyback wallet instead of issuing new supply. For investors focused on sustainability, this signals a controlled approach that gives the asset room to grow without inflationary pressure.

This adjustment is viewed positively across pro-crypto circles, as it shows a commitment to long-term value. With no new tokens entering the market for the airdrop, current supply conditions could help reduce selling pressure while strengthening confidence. The fact that buybacks are supported by real revenue from trading activity on the platform reflects an efficient model that rewards participation rather than speculation.

Market data adds weight to this strategy. Aster stands at $1.07, marking a mild -0.16% decrease in the last day. Its market cap remains strong at $2.17B, and 24-hour trading volume has surpassed $569M (+44%), showing renewed interest among traders.

Growing Support From Trading Metrics

Trading volume across the ecosystem continues to show strength, placing Aster among the most active tokens in its category. The increase in volume points to rising engagement, which could help sustain the buyback mechanism over time. If activity remains elevated, Aster may reinforce its position as a competitive option within decentralized trading platforms.

Daily buybacks often serve as a confidence builder, especially when combined with transparent distribution plans. With the S3 airdrop funded internally, holders can view the allocation as fairer and better aligned with long-term stability.

Market Structure Points To Constructive Trend

Technical observers note that Aster recently moved out of a prolonged accumulation pattern, transitioning into a more optimistic structure. Price stabilization and increasing volume suggest buyer interest is returning. As long as the price maintains levels above previous consolidation zones, the outlook remains favorable.

Short-term pullbacks may occur, but they could be interpreted as opportunities for entry rather than signals of weakness. Steady buybacks, sustained platform revenue, and anticipation for the S3 airdrop collectively set the stage for gradual progress.