TL;DR

- Brian Armstrong went viral for reading live prediction market bets during Coinbase’s Q3 earnings call, an unusual display of transparency.

- Coinbase reported strong results with 25% revenue growth and the acquisition of 2,772 Bitcoin, bringing its total holdings to 14,548 BTC.

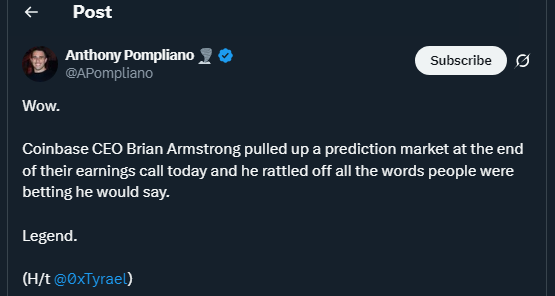

- Anthony Pompliano praised Armstrong as a “legend,” highlighting his influence on corporate authenticity and crypto engagement.

Brian Armstrong, CEO of Coinbase Global Inc., captured the crypto world’s attention when he closed the company’s third-quarter earnings call in a highly unconventional manner. Instead of a standard wrap-up, Armstrong read aloud a prediction market tracking what he might say during the broadcast. His live commentary drew laughter and applause from viewers on X, turning an otherwise routine call into a moment celebrated across social media. Investor and podcast host Anthony Pompliano called Armstrong a “legend,” describing the episode as one of the most authentic moments ever witnessed on a corporate earnings call.

Revenue Growth And Bitcoin Accumulation Highlight Coinbase’s Strength

Coinbase reported revenue of $1.9 billion for Q3 2025, marking a 25% increase from the previous quarter. The growth was fueled by strong institutional trading volumes, favorable market conditions, and the expansion of derivatives offerings. In addition, Coinbase purchased 2,772 Bitcoin during the quarter, raising its total holdings to 14,548 BTC, approximately $1.6 billion at current prices. This positions Coinbase as the ninth-largest corporate Bitcoin holder globally, surpassing companies such as Tesla and Block. Armstrong reaffirmed Coinbase’s commitment to digital assets, noting that the company plans to continue accumulating Bitcoin. Analysts noted that these acquisitions not only strengthen the company’s balance sheet but also reflect its long-term confidence in the crypto ecosystem, reinforcing Coinbase’s image as a pioneer among institutional-grade crypto platforms.

Analyst Insights And Technical Signals For Investors

Analysts from Morningstar highlighted Coinbase’s early advantage in the U.S., though competition from Gemini and Bullish is intensifying. Strategists at J.P. Morgan Chase emphasized Coinbase’s regulatory clarity and scale, which could support potential acquisitions. Armstrong acknowledged the influx of new competitors but stressed that effective execution remains key. On the charts, Coinbase shares dropped nearly 6% to $328 after failing to hold above $344.

Technical indicators suggest a descending triangle pattern, with Fibonacci support near $329 and the 200-day EMA at $296. A rebound above $344 could pave the way for a retest of $380. Traders are watching closely for follow-through buying, as sentiment remains cautiously optimistic following a period of consolidation.