TL;DR

- Over $3.5 billion in Bitcoin and Ethereum options are set to expire this Friday, which could trigger short-term volatility across the crypto markets.

- BTC is facing pressure toward $106,500, while ETH gravitates toward its $2,650 max pain level.

- Despite the prevailing bearish tone, Ethereum shows strong upside flows, hinting at a potential near-term rebound.

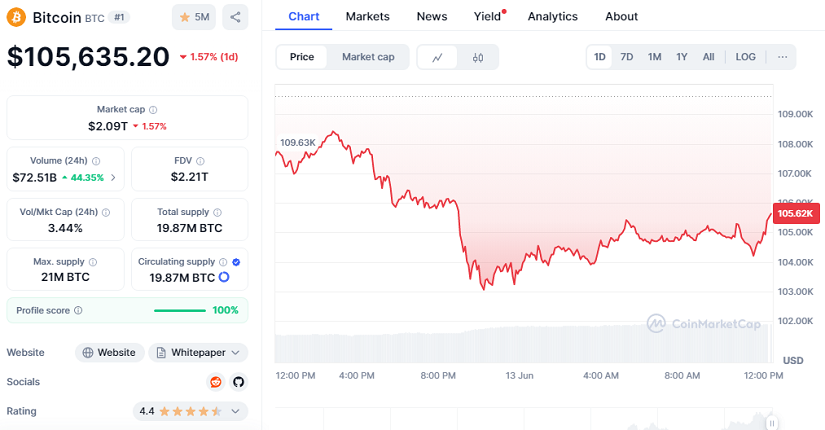

Today, Friday, marks the expiration of 27,959 Bitcoin option contracts, representing a notional value of $2.9 billion, according to Deribit data. This event arrives amid global uncertainty, with geopolitical tensions and a recent market downturn weighing on investor sentiment. Currently, Bitcoin is trading at $105,635.20, down 1.57% over the past 24 hours, while the total crypto market capitalization stands at $2.09 trillion.

The “max pain” level for BTC is $106,500, the price at which option traders would experience the largest collective losses and market makers would gain the most, as the majority of options expire worthless. BTC’s put-to-call ratio of 0.91 shows a bullish leaning among market participants, even as near-term risks persist and volatility remains high. Traders are carefully assessing liquidity levels and positioning strategies as the expiry deadline approaches.

Meanwhile, Ethereum is also seeing a significant expiration event, with 246,849 contracts valued at $617.6 million set to expire. Unlike Bitcoin, Ethereum options exhibit a higher put-to-call ratio of 1.14, indicating a stronger preference for downside protection. ETH is currently priced near $2,515, still below its $2,650 max pain point, further intensifying the tug-of-war between bulls and bears. Investors are watching closely for potential momentum shifts over the weekend.

Ethereum Upside Flows Defy Bearish Expectations

Analysts at Greeks.live emphasize that while many traders are shifting into puts as a hedge, Ethereum has shown notable upside flows in the lead-up to expiration. This behavior hints at a possible bullish move that defies the usual max pain dynamics and could catch bearish positions off guard.

Traders are deploying sophisticated strategies such as “put spreads” and “protective puts” to manage risk in this high-volatility environment. These approaches reflect a tactical rather than emotional response, suggesting that Ethereum’s technical outlook may still hold promise despite broader uncertainty.

External drivers, such as U.S. CPI inflation data, the evolving Israel-Iran conflict, and the ongoing U.S.-China trade talks, could further amplify price swings surrounding this expiry. While uncertainty is high, it also presents an opportunity for well-positioned investors to capitalize on the market’s reactions to these expiring options.