Some market commentators describe the current crypto market as a mid-cycle period in which attention may shift toward projects they view as having traction. In that context, Cardano, Chainlink, and Remittix have been mentioned by some analysts. Remittix has reported raising more than 28.1 million dollars through the sale of more than 686 million tokens at 0.1166 dollars each.

Cardano Shows Pressure But Holds Long-Term Potential

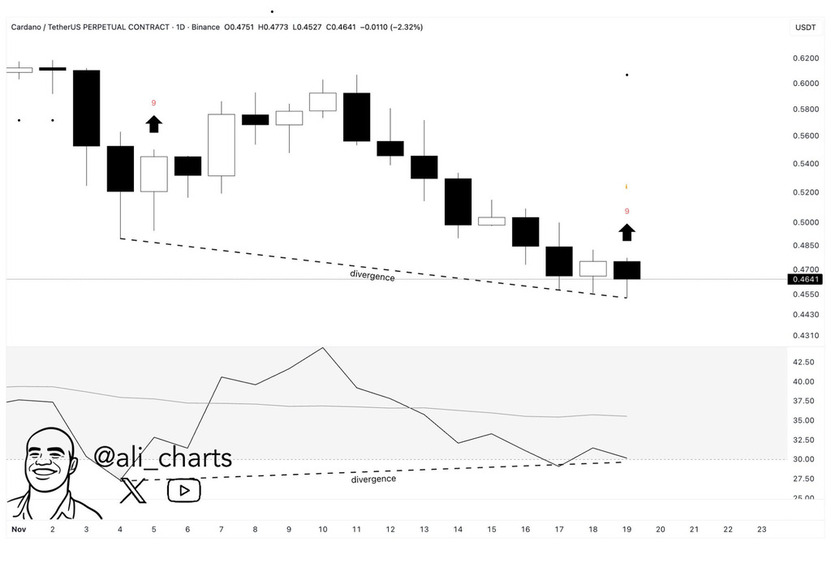

Source: Ali Martinez

Cardano has been trading amid broader market weakness. ADA recently fell to around 0.45 dollars before recovering modestly to trade at about 0.4690 dollars. The asset has declined over 16 percent this week and over 30 percent this month, highlighting volatility and shifting sentiment across altcoins.

Some analysts continue to monitor ADA. For example, DApp Analyst has suggested Cardano’s RSI is repeating a past pattern; however, such technical signals are not predictive and any price outcomes remain uncertain. Other commentators have mentioned potential resistance and support levels, which should be viewed as opinion rather than a forecast.

The December 8 release of Midnight and its native token NIGHT has been discussed as a potential development milestone for the Cardano ecosystem. Midnight is described as aiming to enhance privacy tooling, smart contracts, and cross-chain access, which could influence developer activity over time.

Chainlink Draws Attention During Market Reset

Source: Hamza

Chainlink has drawn renewed attention after weeks of downward pressure. LINK has repeatedly tried to reclaim the 14-dollar level but has struggled amid market volatility. Some observers have pointed to on-chain activity as a sign of interest from large holders, though such activity can be interpreted in different ways.

CryptoQuant reported a rise in LINK outflows from Binance, particularly among the largest ten transactions. Analysts sometimes interpret outflows as possible accumulation, but this is not conclusive. One post cited more than 3,150 LINK moving off exchanges daily.

Chainlink continues to emphasize real-world integrations. Coverage has cited a Mastercard-related initiative enabling non-custodial crypto purchases, and Chainlink Proof of Reserve as a tool designed to support transparency for certain digital-asset reserves. The practical impact of these initiatives depends on adoption and implementation.

Remittix: Project Overview and Reported Fundraising

Remittix is described in project materials as a payments-focused crypto initiative intended to connect crypto users with traditional banking rails. Supporters argue that utility-led projects may receive more attention during periods when market participants are less focused on purely speculative narratives.

According to the project, it raised over 28.1 million dollars from selling 686 million tokens at 0.1166 dollars each. The team has also discussed ongoing work on payment infrastructure and a wallet product, though timelines and outcomes are not guaranteed.

Project-reported features include:

- Support for crypto-to-bank transfers in more than 30 countries, according to the project

- Support for multiple crypto assets and fiat currencies, as described by the project

- A wallet beta that the project says is being tested and updated based on user feedback

- A focus on cross-border payments for individuals and businesses, according to project descriptions

- A public security page/assessment hosted by CertiK, which readers can review for context; this is not a guarantee of security or performance

Mid-Cycle Narratives Remain Uncertain

Commentary around Cardano, Chainlink, and Remittix reflects differing views on what may matter in a mid-cycle market environment, including developer activity, integrations, and payments use cases. As with all crypto assets and token-sale projects, outcomes can vary widely and are subject to market, execution, and regulatory risks.

Project website (for reference): https://remittix.io/

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.