TL;DR

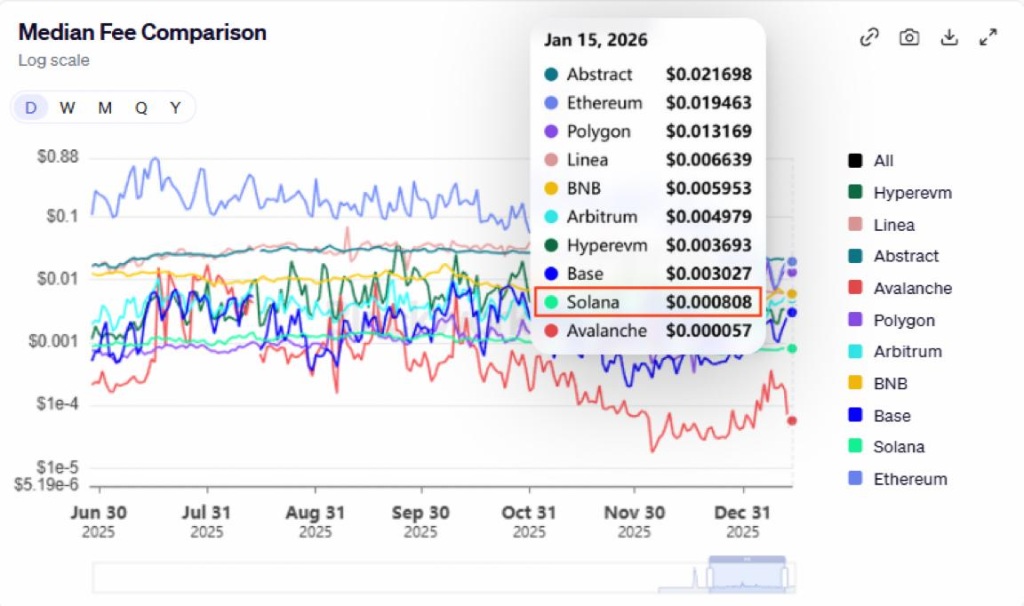

- Solana records the second-lowest median fee among major blockchains, at $0.0008 per transaction, only behind Avalanche.

- Ethereum maintains the highest median fees, around $0.019, while Polygon, Linea, BNB, Arbitrum, and Base are positioned above SOL.

- Solana’s cost structure remains stable thanks to high throughput and parallelized execution, allowing it to handle activity spikes efficiently.

Solana ranks among the most used blockchains with the lowest transaction costs according to comparative fee data recorded in mid-January 2026. The network shows the second-lowest median fee among actively used chains, only behind Avalanche, and maintains a clear gap compared to several Ethereum-associated networks.

Solana’s median fee stands at approximately $0.0008. This places it more than three times lower than Base, whose median fee is around $0.0030. The difference is notable because Base is positioned as a low-cost Ethereum Layer-2 solution. This highlights the direct impact of execution-layer design on the effective costs users bear.

Across the analyzed networks, Ethereum records the highest median fees. Its value is around $0.019 and reflects a combination of sustained demand and recurring congestion at the base layer. Polygon and Linea fall within a mid-range of fees. BNB, Arbitrum, and Base have lower fees than Ethereum but consistently remain above Solana.

WHY SOLANA REMAINS SO LOW-COST

Solana’s fee evolution has remained stable at the bottom of the chart, without abrupt spikes or pronounced fluctuations. This indicates a structurally low-cost model rather than isolated episodes of cheap transactions. The network maintains this profile through high throughput and a parallelized execution model, allowing activity increases without passing demand pressure onto per-transaction costs.

Using the median fee as a metric reflects what a typical user actually pays. Unlike peak values during congestion, the median shows the real cost under normal usage conditions. Networks built on rollup architectures retain some sensitivity to the settlement layer, especially during periods of higher calldata demand.

Applications that rely on frequent interactions, such as payments, gaming, or on-chain trading, operate under schemes where cost predictability is central. In this context, Solana maintains a low and stable fee profile compared to other networks. Other blockchains accept higher fees in exchange for tighter integration with Ethereum’s tooling and liquidity.

In pure transaction cost terms, the data position Solana among the most competitive networks in today’s market.