TL;DR

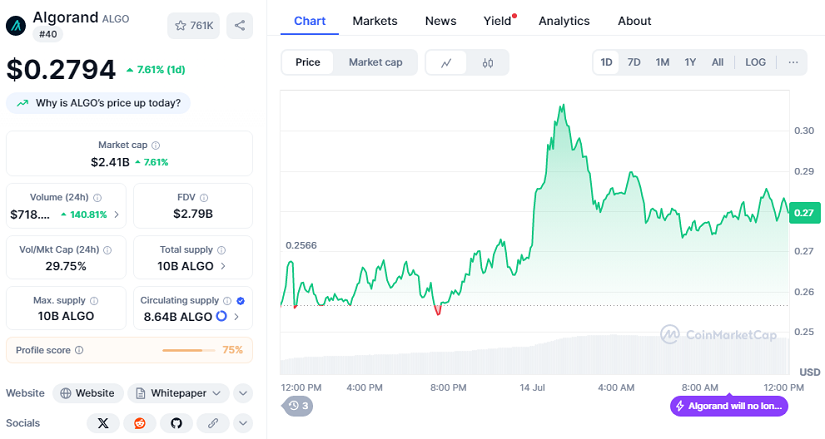

- Algorand jumps 11% to reclaim a four-month peak, now trading at $0.2794 after touching $0.31.

- Despite the surge, many traders still bet short as derivatives activity spikes.

- The market cap stands at $2.41 billion with strong on-chain signals suggesting more volatility ahead.

Algorand’s sharp move higher this week has caught many off guard, reigniting interest in the overlooked altcoin. After months in a tight range, ALGO broke out with force, touching $0.31 before retracing to $0.2794, still up 7.61% in 24 hours. Daily trading volume surged 140% to over $718 million, showing that plenty of capital is flowing back into the token.

The return of buyers has been decisive. Coinalyze data confirms two days in a row with a positive Buy Sell Delta, indicating more aggressive spot buying than selling. ALGO recorded over 111 million in Buy Volume against about 110 million in Sell Volume. A day earlier, the gap was wider, showing steady demand despite quick profit-taking by some holders.

Open Interest And Futures Traders Pile In

Meanwhile, derivatives traders are stepping up. According to CoinGlass, Algorand’s Open Interest rose 54.85% to hit $163 million, while Futures Volume jumped 575% to nearly $981 million. These numbers show traders are opening fresh positions as they bet on short-term swings. However, the Long/Short ratio at 0.9837 reveals that short sellers are still testing the strength of bulls.

Profit-Takers Eye Short-Term Wins

Profit-taking could keep prices from climbing too fast. Exchange Netflow data shows $3.14 million in inflows on July 13, later easing to $480K, proving some investors are cashing out. Positive Netflow means more tokens moving to exchanges, which often signals a readiness to sell if prices rise too fast.

Technical indicators highlight why caution remains. The Relative Strength Index sits at 83.18, deep in overbought territory, while the Stochastic RSI is maxed out at 100, suggesting a pullback could come fast if bulls lose grip. If buyers stay strong, the next target is $0.34, but any weakness could see a drop to $0.25, where past buyers stepped in to support the price.

With a market cap of $2.41 billion and a steady stream of partnerships in DeFi and CBDC experiments, Algorand continues to appeal to long-term believers. Its energy-efficient blockchain design keeps it in the conversation as a potential player in future institutional projects. As summer trading heats up, all eyes are on whether ALGO can sustain this push or if traders will lock in gains and wait for the next breakout.