TL;DR

- Economist Alex Krüger remains unconcerned about Bitcoin’s recent price decline, noting that temporary underperformance is normal for the crypto market.

- He highlights Bitcoin’s historical volatility and the occasional large upward moves that offset slow periods.

- Krüger also warns traders about the proliferation of fake crypto accounts on X, emphasizing that much of the content comes from automated accounts, AI-generated posts, and coordinated efforts promoting questionable tokens.

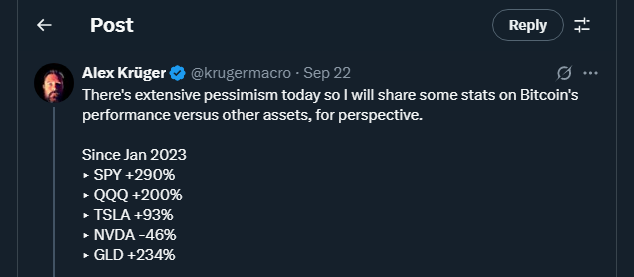

Economist Alex Krüger is maintaining a calm stance despite Bitcoin’s (BTC) dip over the past six weeks. In a recent post to his 214,900 followers on X, Krüger compared Bitcoin’s performance with other major assets over the past few years, illustrating how even high-profile equities and commodities experience periods of mixed returns and occasional surprises.

“Since Jan 2023, SPY +290%, QQQ +200%, TSLA +93%, NVDA -46%, GLD +234%. Since Election Day 2024, SPY +42%, QQQ +34%, TSLA -7%, NVDA +23%, GLD +20%. Since Jan 2025, SPY +5.2%, QQQ +1.6%, TSLA +11.3%, NVDA -12.5%, GLD -15%,” Krüger wrote.

He suggests that investors often see Bitcoin experience a few large upward moves that can balance longer periods of muted performance.

“Investors should consider whether the recent underperformance since August has reasons to persist. Personally, I am not worried. Giving back profits happens, but I am not concerned. I hold an equities portfolio and avoid heavy exposure to mid and small-cap altcoins, which sometimes fluctuate unpredictably,” Krüger added.

Bitcoin is currently trading around $111,025 reflecting a 1,85% loss over the past 24 hours but remaining more than 10% below its all-time high of $124,128 recorded on August 14th.

Traders Face Increasing Risks From Fake Accounts On X

Krüger also highlighted growing risks in the social media crypto space.

“95% of crypto content now comes from KOL farms — companies operating fleets of fake accounts, bot-driven engagement, AI-generated replies, and mass-produced threads promoting specific tokens,” he warned.

This observation aligns with broader trends in online finance, where automated systems and AI tools amplify marketing campaigns, sometimes misleading inexperienced investors subtly. Krüger encourages traders to critically evaluate information and focus on established sources rather than relying on trending posts.

Crypto Volatility Remains A Factor Investors Must Accept

While some investors may react nervously to dips, Krüger frames Bitcoin’s recent movements as part of a normal market cycle. Long-term holders may find opportunities in volatility, especially when supported by informed strategies and careful risk management. His analysis underscores that, despite temporary setbacks, Bitcoin remains a resilient asset in diversified portfolios.