TL;DR

- A White House official clarified that the cryptocurrencies mentioned by Trump were just examples, but the data suggests otherwise.

- After the clarification, XRP fell by 6.5%, SOL dropped by 1.65%, and ADA lost 7.7%, while trading volume increased.

- Trump signed an order to create a strategic Bitcoin reserve with seized assets, separate from any fund that might consider altcoins.

Donald Trump’s recent announcement about creating a strategic cryptocurrency reserve sparked reactions in the market and confusion about the assets involved.

A White House official clarified that the five cryptocurrencies mentioned by the former president were examples and not a definitive selection based on their market capitalization. However, the data contradicts this explanation, as the five largest cryptocurrencies, excluding stablecoins, are Bitcoin, Ether, XRP, BNB, and Solana.

After the official’s statement, Ripple (XRP) fell by 6.5%, dropping to $2.4 per token. Additionally, its trading volume increased by more than 33%.

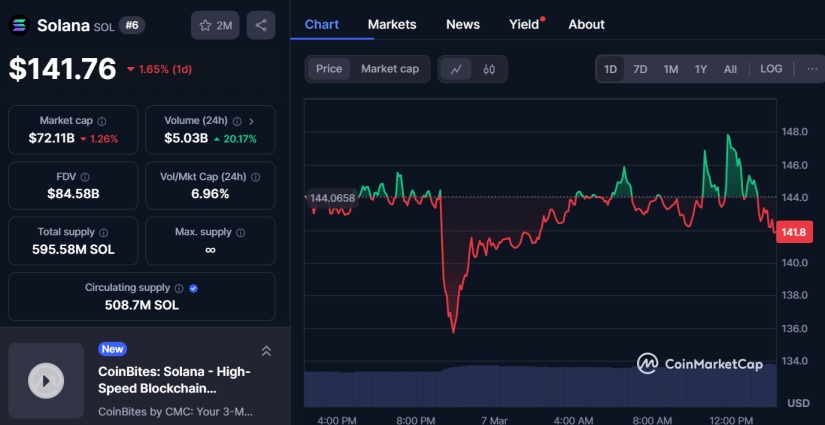

On the other hand, Solana (SOL) suffered a smaller blow. The token dropped by 1.65% and is currently trading at $141.76 per unit. The trading volume also rose by 20.17% compared to the previous day.

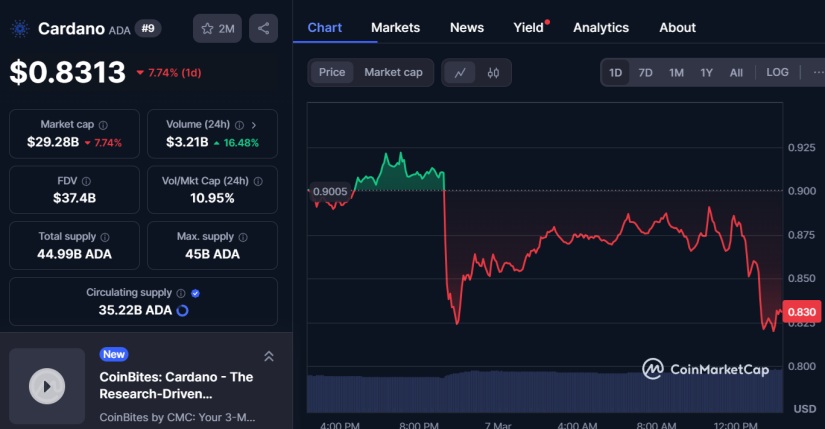

Finally, Cardano (ADA) was the most affected by the events. It recorded a drop of 7.7%, and its price fell to $0.8313 per token. As with the previous cases, the volume surged nearly 16.5%. It is worth noting that this situation coincides with a period of weakness and significant volatility in the market.

Confusing Statements Hit a Fragile Crypto Market

On March 2, Trump posted on social media that a cryptocurrency reserve in the United States would help strengthen the industry after what he called “corrupt attacks” from the Biden Administration. The initial proposal included ADA, XRP, and SOL alongside Bitcoin and Ethereum, which raised questions within the industry. Some analysts considered that including certain assets could open the door to conflicts of interest and favor specific projects over others.

On March 6, Trump signed an executive order to create a Bitcoin Strategic Reserve, funded with government-seized bitcoin holdings. The initiative will be separate from any other fund that might consider the inclusion of altcoins.

Meanwhile, Washington, D.C. gathered top executives from the crypto industry for the first White House Crypto Summit. Companies like Ripple, Gemini, and Crypto.com participated in discussions about regulation and the future of the sector. As the regulatory framework is reconfigured, markets will continue to react to political decisions and their implications for the crypto market as a whole