Aave announced the launch of a new stablecoin called GHO in a tweet that contains complete details about the project and its plans.

The tweet says:

1/ Calling all GHOsts 👻

We have created an ARC for a new decentralized, collateral-backed stablecoin, native to the Aave ecosystem, known as GHO.

Read more below and discuss your thoughts for the snapshot (coming soon)!👇https://t.co/P7tHl9LbBe

— Aave (@AaveAave) July 7, 2022

In Aave’s forum, AaveCompanies has published the full proposal about the new stablecoin that they plan to launch soon. As a stablecoin backed by USD, the currency goes by the name GHO.

It is possible to launch GHO on the Aave Protocol with the support of the community, allowing users to mint GHO against collaterals that they have provided. Those who borrow GHO can continue to earn interest on their underlying collateral by investing in an array of crypto-assets selected by them at their discretion while they remain backed by a diverse set of crypto-assets.

How does it Work?

By introducing GHO, the Aave Protocol would not only make stablecoin borrowing more competitive, but it would also offer more flexibility for users of stablecoins, and it would increase revenue for the Aave DAO as 100% of interest payments on GHO borrowing would be collected by the DAO.

It is important to note that GHO will be created by users on the Ethereum Mainnet as a decentralized stablecoin. To be able to mint GHO, a user will need to provide collateral, just like they would for all borrowing on the Aave Protocol. Likewise, the GHO protocol burns a user’s GHO when he or she repays a borrow position (or is liquidated in the case of a borrow position).

There would be direct payments to the AaveDAO treasury of all interest payments accrued by minters of GHO rather than the standard reserve factor collected from each borrower when they borrow other assets under AaveDAO.

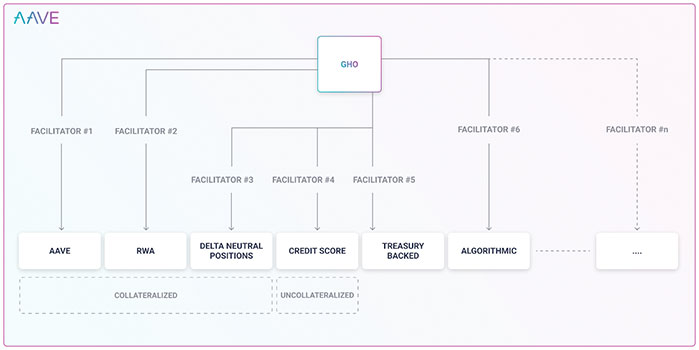

Facilitators are a concept introduced by GHO as a way to facilitate the process. Facilitators are capable of generating GHO tokens in an anonymous and trustless manner. It is also necessary that Governance approves what is called a bucket for each Facilitator in order for them to become effective. An upward limit on the amount of GHO that a facilitator can generate within a bucket is known as a bucket limit.

As with any other asset listed on the Aave Protocol, the integration between Aave and GHO will be implemented using the same mechanisms – a specific GHO token and a specific GHO Debt Token will be created. If the proposal is approved, the tokens will be available for registration on the Aave Ethereum marketplace for the GHO token upon approval of the proposal.

In light of the low transaction fees on L2s, as well as the fact that they are growing in adoption, AaveCompanies believes that GHO has the potential of becoming used on L2.

There is also the possibility to use grants and hackathons for the purpose of developing and integrating payment methods that can be used by both crypto-natives and more mainstream users in order to make GHO more accessible and usable.