TL;DR

- Aave will progressively shut down the Family iOS wallet and retire the Avara brand, unifying all products and operations under Labs.

- Family will stop onboarding new users on April 1, with access available until April 2027, limited to account access and withdrawals.

- Family Accounts technology will continue operating as internal infrastructure, while.

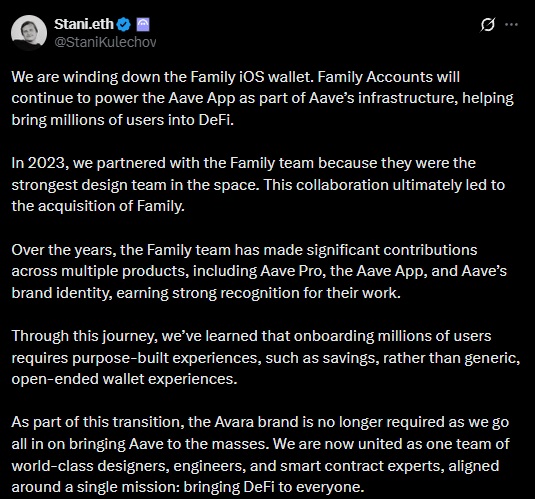

Aave decided to progressively shut down the Family iOS wallet and retire the Avara brand, concentrating all operations and products under the Labs division. The announcement was made by protocol founder Stani Kulechov. The protocol is carrying out a reduction in the scope of products aimed at end users.

Family will stop accepting new users starting on April 1. Existing users will be able to access the app until April 2027, after which they will need to operate through Aave’s infrastructure. During this period, the app’s functionality will be gradually limited to account access and fund withdrawals.

Family Accounts Will Not Be Discontinued

Family’s core technology, known as Family Accounts, will not be discontinued. That system will continue operating as part of Aave’s internal infrastructure, providing authentication and embedded wallets for the protocol’s products. The Family team was acquired by Avara in 2023 and contributed to the development of Aave Pro, the mobile app, and the ecosystem’s visual identity.

The wallet shutdown comes weeks after Aave transferred stewardship of the Lens Protocol to Mask Network. Mask assumed the intellectual property, onchain infrastructure, and accounts associated with the project. Lens continues to operate as permissionless infrastructure, but remains outside the direct control of Aave Labs.

Controversial Vote at Aave

The brand unification follows several months of internal tensions linked to protocol governance. In December, Kulechov purchased approximately $10 million worth of AAVE tokens shortly before a controversial vote. Part of the community questioned the move due to its impact on voting power. During the same period, Labs pushed forward a proposal regarding the ownership of brand assets without notifying the original author of the text.

Snapshot data showed that three wallets controlled more than 58% of voting power, with a single wallet exceeding 27%. Objections were also raised over product decisions that may have redirected close to $10 million annually in fees away from the DAO treasury.

In parallel with the internal disputes, Aave secured highly significant regulatory outcomes. The SEC closed a multi-year investigation without recommending enforcement action, and the protocol obtained authorization under the MiCA framework in Europe.