TL;DR

- The U.S. Department of the Treasury has officially lifted the sanctions against Tornado Cash, reversing its 2022 decision.

- The move follows a court ruling that determined Tornado Cash’s smart contracts do not qualify as sanctionable “foreign property.”

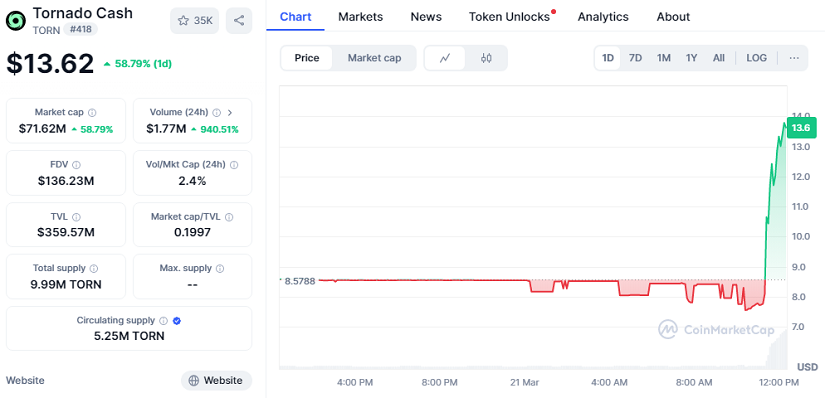

- The TORN token surged over 58% after the announcement, marking what many see as a major win for privacy and decentralization in the crypto ecosystem.

In a decision that has sparked excitement throughout the crypto world, the United States Department of the Treasury has announced the removal of Tornado Cash from its list of sanctioned entities. Tornado Cash, a decentralized tool designed to protect financial privacy by mixing cryptocurrencies, had been sanctioned in 2022 under accusations of facilitating money laundering by the Lazarus Group, which is linked to North Korea. However, a recent legal review concluded that the smart contracts used by Tornado Cash cannot be considered property controlled by any foreign person or entity.

This resolution marks a pivotal moment in the ongoing debate surrounding digital privacy and the legitimate use of decentralized technologies. The court ruling that preceded this decision was issued last November by a U.S. federal court of appeals, setting a significant legal precedent: smart contracts, as they are not directly controlled by humans, fall outside the traditional framework of sanctions enforced by the Office of Foreign Assets Control (OFAC).

Tornado Cash: Between Innovation and Controversy

While the lifting of sanctions is seen as a positive development, not all legal issues have been resolved. Roman Storm, co-founder of the protocol, still faces a criminal trial scheduled for July of this year. Additionally, another developer linked to the project remains a fugitive. Despite these individual legal challenges, the removal of more than 100 Ethereum addresses from the blacklist sends a clear signal that the government is beginning to acknowledge the legal and technical complexities of decentralized finance.

The TORN token surged 58.79% in the last 24 hours, currently trading around $13.62.

Treasury Secretary Scott Bessent emphasized in a public statement that protecting the crypto ecosystem from malicious actors remains a top priority. However, he also acknowledged the transformative potential of digital assets to drive financial inclusion and technological innovation.

A Step Toward the Recognition of Decentralization

This episode represents a major victory for advocates of privacy and decentralization. From the beginning, many experts argued that sanctioning an open-source code with no ownership set a dangerous precedent. Now, with the sanctions officially lifted, a more nuanced dialogue can begin between regulators and developers on how to strike a balance between security and freedom within the new digital paradigm.