The Ethereum price is solid, outperforming the greenback and BTC on the last trading day.

ETH is up seven percent versus the USD and trading at new all-time highs backed by several fundamentals tied to NFTs and the disruptive DeFi scene.

Ethereum, reading from the fees generated and channeled to miners in the last 24 hours, is several folds more active than Bitcoin.

The legacy blockchain even trails the level of activity of Uniswap and some Ethereum-tied NFT marketplaces like OpenSea.

According to data generated revealing the most intense dApps contributing to ETH burns, OpenSea tops the chart. Meanwhile, Uniswap—the DEX—dominates and is a significant fixture in Ethereum.

Ethereum On-Chain Fundamentals Stronger

Recent data now shows that more ETH coins are destroyed than released to miners, effectively making it deflationary.

Ethereum analysts are convinced at this pace that ETH would be the bona fide ultra-sound money that’s better than Bitcoin.

Even so, the high demand for Ethereum block space is pushing up Gas prices to unsustainable levels, a fact that’s keeping most retail users away.

yo i think I'm done with ETH. pic.twitter.com/1ZZM7NNSAg

— 🅿️AIN (@DeepFreakinPain) November 2, 2021

While Layer-2 platforms like Arbitrum may offer reprieve, the confidence of transacting on the battle-tested Ethereum mainnet is more appealing. Nonetheless, more platforms are intending to launch on Layer-2, relieving the base layer.

These stronger on-chain factors are why, according to Willy Woo, there are more upsides for the coin.

While BTC is building up strength for ATH escape velocity, ETH is quietly building even stronger on-chain fundamentals not yet reflected in price. pic.twitter.com/V8Irs8z7Qb

— Willy Woo (@woonomic) November 2, 2021

Per his analysis, ETH may soar even higher, levels supporters maintain will be nothing short of five figures.

Ethereum Technical Analysis

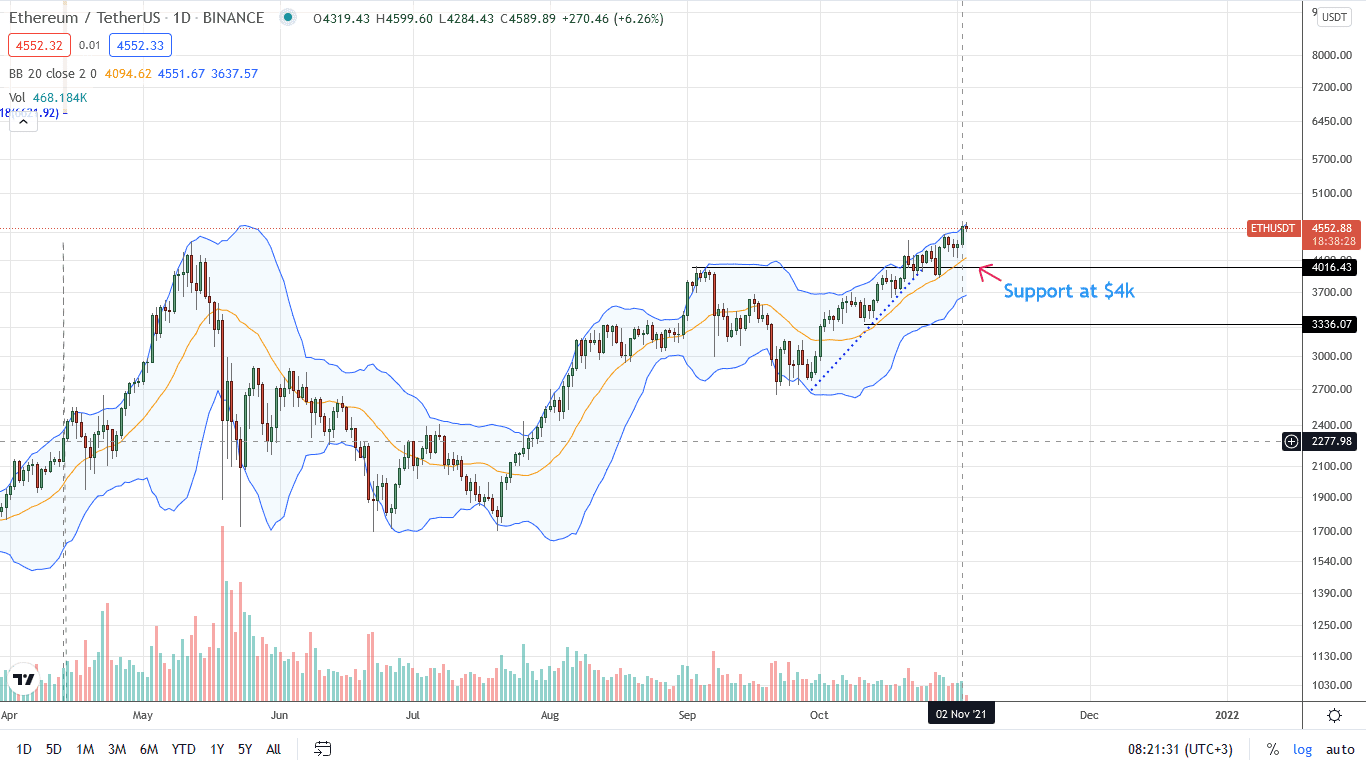

At the time of writing, ETH is at new all-time highs above $4.4k. From the daily chart, the confidence of traders in ETH is evident. The middle BB continues to act as the primary support level, anchoring upbeat bulls.

Besides, after a brief consolidation over the weekend, ETH/USDT prices are swinging in favor of buyers, rewinding losses.

Accordingly, reading from the way ETH/USDT candlesticks are arranged, every low may provide a loading opportunity for traders targeting $6.6k, the 1.618 Fibonacci extension level of the H1 2021 trade range, or even $10k.

Such a move, at spot levels, will confirm the surge of early Q3 2021 from a top-down view and October 28 bar for intra-day traders. This will further help narrow the gap with Bitcoin, making the crypto base stronger.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News