The Ethereum price is now trading above $3k. It was expected; nothing new. The trigger for this was the activation of EIP-1559 and the coin burning that came with it.

Thus far, millions worth of ETH have been taken out of circulation.

Ethereum Gas Rising

But here’s the bummer: Gas prices are beginning to rise.

#ethereum fees are going insane with the #nft markets pumping like crazy!

We are now seeing spikes in gas fees that make ETH basically unusable for all but the richest users.

Thread pic.twitter.com/bKRLUijdGD

— Lark Davis (@TheCryptoLark) August 10, 2021

As of writing, an ordinary transaction would offset a user roughly $20, more than triple the figure it was at some point in June.

EIP-1559 was meant to bring about order. Predictability was the word, and user experience was the reason.

Indeed this might have been achieved, failing to tame rising fees.

The reason why Gas is rising is pinned on the expanding NFTs market. While this could be a hindrance, it demonstrates the level of activity in Ethereum.

Evidently, without a doubt, the best liquidity, NFTs marketplaces, and DeFi protocols reside in Ethereum.

Therefore, the resulting demand bids up Gas prices as the network can only process a given number of transactions every 14 seconds at spot rates.

Poly Network Hacked

Meanwhile, a hacker attacked the cross-chain DeFi platform Poly Network dApp on its three chains—Ethereum, Polygon, and the Binance Smart Chain (BSC), cumulatively siphoning around $600 million of crypto assets.

Important Notice:

We are sorry to announce that #PolyNetwork was attacked on @BinanceChain @ethereum and @0xPolygon Assets had been transferred to hacker's following addresses:

ETH: 0xC8a65Fadf0e0dDAf421F28FEAb69Bf6E2E589963

BSC: 0x0D6e286A7cfD25E0c01fEe9756765D8033B32C71— Poly Network (@PolyNetwork2) August 10, 2021

Tether Limited has intervened, freezing $33 million of USDT.

. @Tether_to just froze ~33M $USDt on 0xC8a65Fadf0e0dDAf421F28FEAb69Bf6E2E589963 as part of the #PolyNetwork hack https://t.co/EviPTAkQJD

— Paolo Ardoino 🍐 (@paoloardoino) August 10, 2021

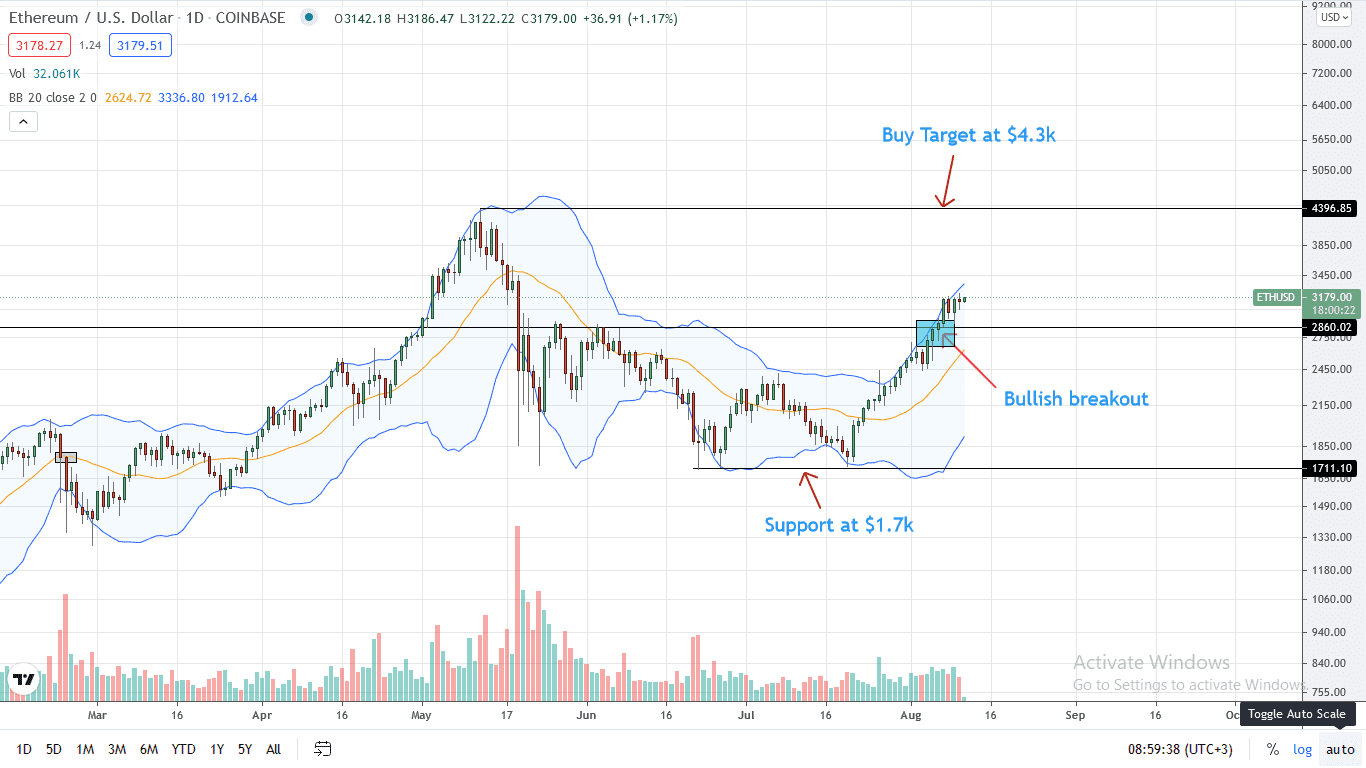

Ethereum Price Analysis

The Ethereum price is stable at the time of writing, adding 27 percent week-to-date.

Presently, ETH/USD prices are trading within a bullish breakout pattern, clearing $2.9k and $3k to the upside. ETH bull bars are tracking the upper BB, indicating strong underlying momentum as prices bottom-up after losses of May through June 2021.

Although prices are consolidating within a $200 range above $3k, every low may offer a loading opportunity for aggressive traders seeking to buy the dips, targeting $4.3k in the medium term.

Provided prices are solid above $2.9k—June 2021 highs, Ethereum buyers have the upper end, supporting the uptrend.

On the reverse side, a dump below $2.9k could see ETH/USD contract back to $2.6k in a retest.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News