Cryptocurrency investors seem to have become interested in non-fungible tokens (NFT) as yield farming rewards have been severely reduced. As 2020’s yield farming craze appears to have come to an end, investors are looking for a new target. This time, DeFi’s latest craze is artwork published in the form of NFTs on Rarible.

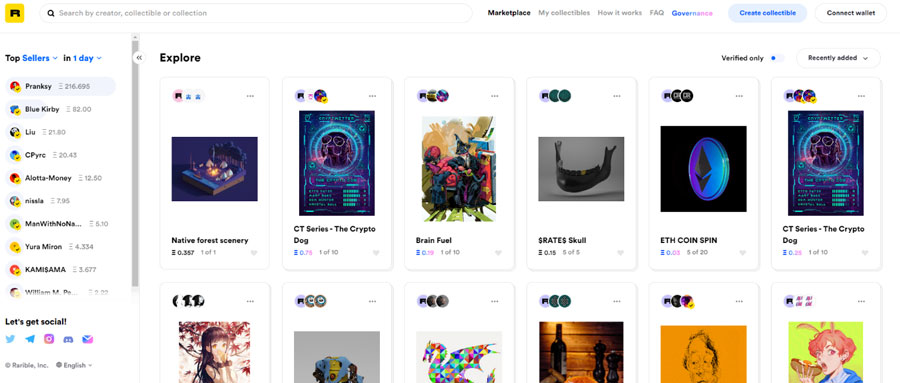

Rarible is a new platform and marketplace where users can purchase and sell digital collectibles in the form of NFTs. As a reminder, NFTs are simply put a unique type of token that are limited in their quantity.

Remember how kids in the 90s and 00s used to collect Pokémon cards, Yugioh cards, football stickers, and a multitude of other collectibles? Today, the same kids who collected these are grown up and a part of the decentralized finance industry. Their goal? To popularize collectibles, this time in a decentralized fashion.

However, this is only the narrative that investors are holding on to. In the past few weeks, my Twitter timeline showed me an interest in NFTs that can only be regarded as forced or orchestrated. The truth is that most people are pushing the narrative for their financial interests.

Rarible is still a young platform and at the moment it seems silly to spend multiple Ether tokens for a picture that someone downloaded from the internet and uploaded it as his own work. What is even crazier is that some individuals started uploading selfies on Rarible to sell them as NFTs. Naturally, this led to the community asking itself if NFTs may even live up to investor expectations.

The Pros

As you may see, NFTs are neither good nor bad. They propose a value that is very specific. In the past decades, niches have always profited with the rise of the internet. On the other hand, interest and demand for NFTs almost seem unnatural. It is almost as if the people who own the platforms and publish NFTs are the only ones in the community that push NFTs.

For you to have a better perspective on how NFTs might play out and what their future might be, it would be good to list some pros and cons. So, let’s start with the pros first.

As I mentioned before, NFTs are just modern-day collectibles. In the past, we have seen how kids and adults alike became interested in owning a collection of stickers, cards, and other items. Even now, there is a vibrant community within the gaming industry that collects in-game collectibles, statues, stickers, and toys. Of course, not everything from this list can be digitalized and decentralized. Nevertheless, based on the interest we can see that NFTs have a significant market.

Moreover, the community behind blockchain technology and cryptocurrencies do not have a corporate undertone. While future technologies remind us of boring dystopias, the crypto community works entirely opposite. The community is filled with creative and young investors who are ready to take over the world. Similarly, they are interested in artwork, memes, and internet culture.

On Rarible, we have seen that the most popular collectibles are literally memes and references to the modern internet culture. All in all, it is hard to not expect NFTs to gain traction in the future. Perhaps they will not be popular today, but in a few years, these platforms and tokens might enjoy significant popularity.

The Cons

We have explained what NFTs are and what market they cater to. However, how likely is it that they reach adoption within the crypto community? In September 2020, only a handful of users on Crypto Twitter discuss NFTs and trade them. In fact, there are more people who discuss the subsector than those who actively use the platforms.

It is hard to imagine digital collectibles being used by retail investors if not even hardcore crypto experts are interested. But we can speculate all day on how likely it is for NFTs to grow beyond ‘hyped’ products. What are the cons of NFTs?

First, it is clear that at their current state, NFTs for the purpose of collectibles serve absolutely no purpose. You buy it and then what? You own a highly unique token that only five more people have. What else can you do? Well, you either own it because you like the NFT or because you want to speculate on its price. Therefore, we head to the same conclusion we previously discussed. Users are financially incentivized to own NFTs.

Secondly, NFTs kind of have zero value. As I previously stated, I argue this point only based on what we can see on platforms now. How do you create an NFT? Well, you download an image and convert it into an NFT on Rarible. You can already guess where this leads to.

How does a rare and unique NFT continue having these properties if another person can copy the artwork and make the exact same version and sell it? Yes, they may be entirely different in terms of code, but visually they can be a 100% copy.

You have probably already remembered at this point how people used to make fake collectibles such as stickers and sell them as real ones. While authenticity is completely solved with NFTs, we still have a problem. Unless an NFT is specially produced by a protocol or company it will not be special.

If an anonymous user lists an NFT someone can instantly copy it and it will not matter at all if you bought the NFT from person A or person B. Unless the protocol itself disables NFT replicates and spams, this will most likely be a serious issue.

If you found this article interesting, here you can find more Opinion News